Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor

Description

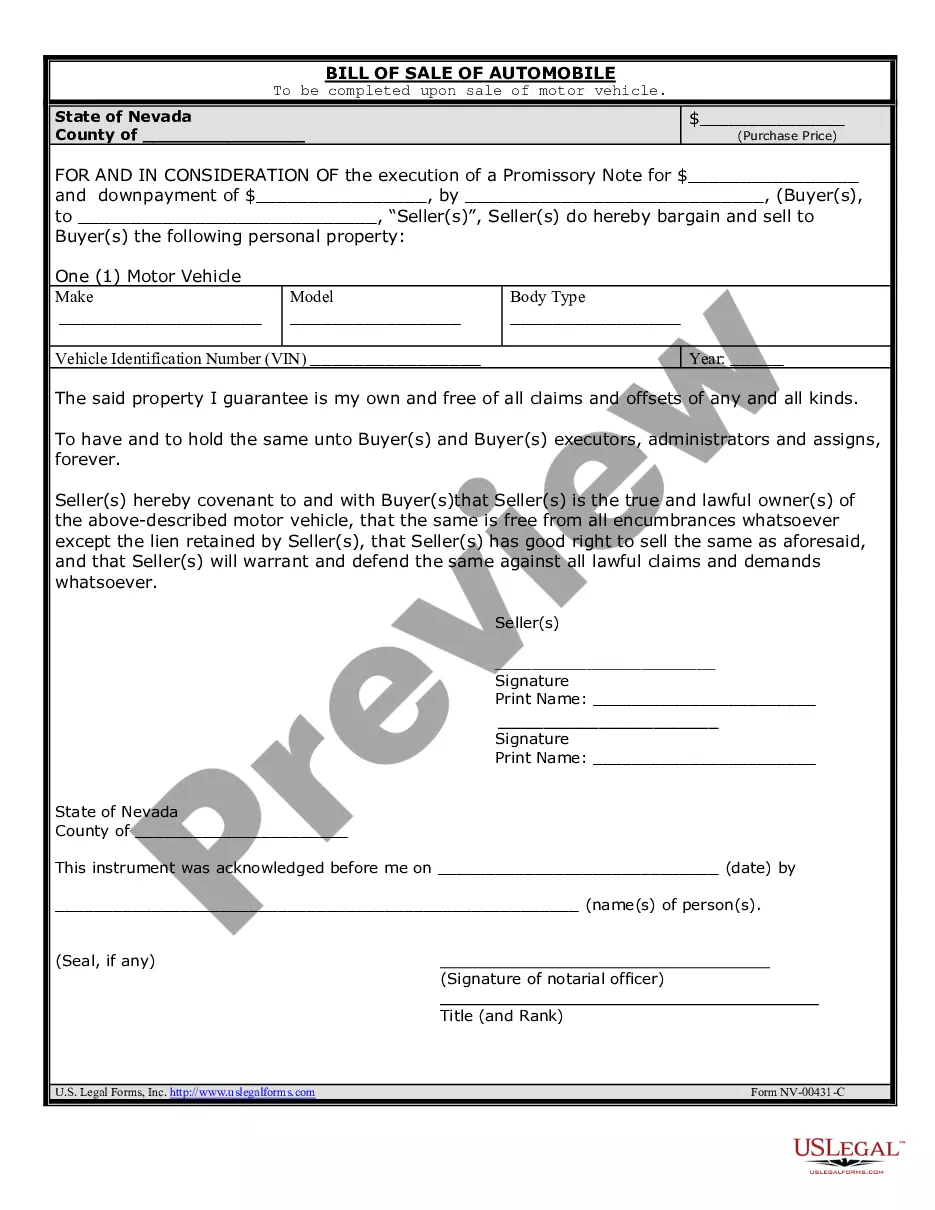

How to fill out Agreement By Accounting Firm To Employ Auditor As Self-Employed Independent Contractor?

Selecting the appropriate official document template can be a challenge.

Naturally, there are numerous designs accessible online, but how will you locate the official form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward instructions you should follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and examine the form's details to confirm it meets your needs. If the form does not satisfy your requirements, use the Search field to find the suitable form. When you are confident that the form is appropriate, choose the Purchase now button to acquire the form. Select the pricing plan you need, provide the required details, create your account, and pay for the order using your PayPal account or Visa or Mastercard. Choose the document format and download the official document template to your device. Finally, complete, modify, print, and sign the acquired Washington Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor. US Legal Forms is the premier repository of official forms where you can discover various document templates. Make use of the service to download professionally-crafted paperwork that comply with state regulations.

- The service provides a multitude of designs, including the Washington Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor, which can be utilized for corporate and personal purposes.

- All of the forms are reviewed by experts and meet state and federal requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Washington Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor.

- Use your account to browse the official forms you have previously purchased.

- Go to the My documents section of your account and retrieve another copy of the document you need.

Form popularity

FAQ

To write a simple contract agreement, focus on clarity and brevity. Begin with the date and names of the parties involved, followed by a description of the services provided. Include payment terms, deadlines, and any conditions for termination. A Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor can help establish these elements in a straightforward and effective manner.

The agreement between a company and a contractor typically outlines the terms of the work to be performed, payment expectations, and the duration of the engagement. It serves as a legal document to protect both parties and clearly states their rights and obligations. Utilizing a well-defined Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor can streamline this process and ensure both parties are aligned.

Yes, you need a business license to operate as an independent contractor in Washington. This license legitimizes your business and allows you to conduct your work legally. Depending on your specific industry, additional permits or registrations might also be necessary. Consider consulting a Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor to ensure compliance with local regulations.

The best contract for contractors typically includes detailed work descriptions, payment structures, and timelines. It should also address rights and responsibilities of both parties clearly to avoid misunderstandings. Furthermore, a Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor provides a robust framework for setting expectations and protecting interests.

To write a contract for a contractor, start by clearly defining the scope of work, including specific tasks and expectations. Next, outline the payment terms, deadlines, and any penalties for late delivery or non-compliance. Additionally, include clauses regarding confidentiality, termination, and dispute resolution. Utilizing a Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor can ensure all necessary elements are covered.

You need a business license in Washington state when you start engaging in business activities, which includes signing a Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor. It's important to secure this license prior to commencing work to ensure compliance with state regulations. Waiting too long to obtain your license can lead to penalties and delays in your operations. Thus, proactively addressing this requirement will provide you peace of mind and a smooth start.

In Washington state, you generally need a business license to operate as a contractor. If you are working under a Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, this requirement still applies. Be sure to register your business with the appropriate government agencies. Additionally, obtaining specialized permits may also be necessary, depending on your specific services.

As an independent contractor in Washington, you typically need to complete and submit a W-9 form to provide your taxpayer identification information. You should also keep detailed records of your income and expenses for tax purposes. Additionally, when you draft your Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, ensure it outlines your responsibilities and payment terms clearly. Using platforms like uslegalforms can help streamline this process.

In Washington state, you generally do not need a specific business license to work as an independent contractor. However, if your work falls under certain categories, you might need specific permits or licenses. A Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor may also require compliance with local regulations. It's advisable to check with local authorities to ensure you meet all legal requirements.

Yes, you can be your own contractor in Washington state, especially if you engage in self-employment arrangements. Under a Washington Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, you have the freedom to control your work schedule and business practices. It's essential to ensure proper registration and compliance with relevant laws to operate successfully.