Washington Agreement to Assign Lease to Incorporators Forming Corporation

Description

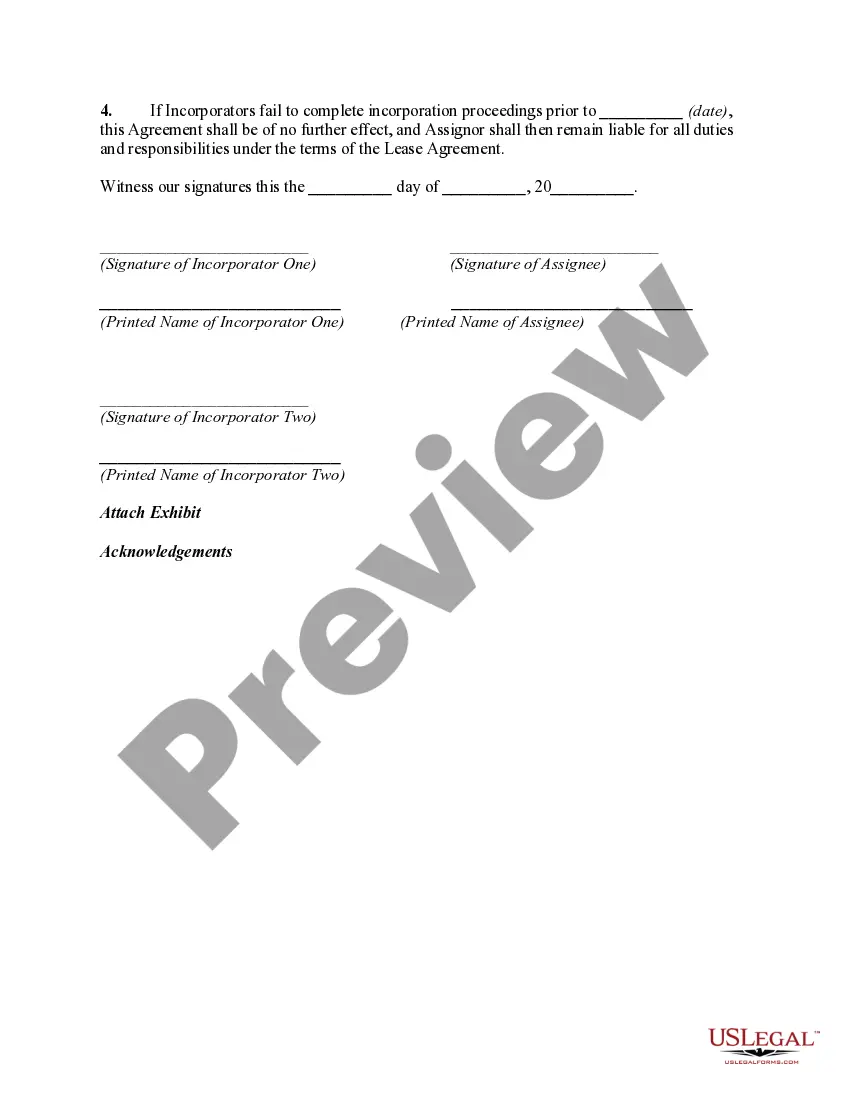

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

If you need to compile, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s convenient and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your details to sign up for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Washington Agreement to Assign Lease to Incorporators Forming Corporation.

- Use US Legal Forms to find the Washington Agreement to Assign Lease to Incorporators Forming Corporation in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and then click the Download button to obtain the Washington Agreement to Assign Lease to Incorporators Forming Corporation.

- You can also access forms you previously purchased in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s contents. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A social purpose corporation in Washington state is a hybrid business structure that combines profit goals with social or environmental missions. This type of corporation allows you to pursue broader objectives beyond just financial gain. With the Washington Agreement to Assign Lease to Incorporators Forming Corporation, you can easily navigate the unique needs of establishing such a corporation, ensuring that both your social aims and business interests are addressed.

In Washington state, a business license is typically required for any business operation, regardless of structure. While forming a Limited Liability Company (LLC) is beneficial, it is not mandatory for all businesses. However, if you choose to establish an LLC, using the Washington Agreement to Assign Lease to Incorporators Forming Corporation will help manage lease assignments and incorporate your requirements efficiently.

To elect S Corporation status in Washington state, your corporation must first meet specific eligibility criteria. You will need to file IRS Form 2553 with the federal government after forming your corporation. Ensure that you keep the Washington Agreement to Assign Lease to Incorporators Forming Corporation in mind, as having the right documentation will help streamline the process of establishing your business structure.

To transfer real property in Washington state, you generally need to create a deed that identifies the buyer and seller and details the property being transferred. This deed must then be signed, notarized, and recorded with the county auditor. Utilizing legal resources, like the Washington Agreement to Assign Lease to Incorporators Forming Corporation, can provide clarity and assistance during this process.

To start an S Corp in Washington state, begin by filing the Articles of Incorporation with the Washington Secretary of State. Once established, submit the election form to the IRS for S Corp status. Implementing the Washington Agreement to Assign Lease to Incorporators Forming Corporation during this phase helps secure any leases needed for your business location, ensuring a smoother start.

There is no specific minimum income requirement to maintain S Corp status in Washington. However, it is essential to ensure the corporation generates enough income to cover operational expenses and comply with tax regulations. The Washington Agreement to Assign Lease to Incorporators Forming Corporation could help you manage your leases effectively while pursuing profitability.

To start an S Corp in Washington, you must first create a corporation by filing Articles of Incorporation. After that, you need to file Form 2553 with the IRS to elect S Corp status. During this process, think about the Washington Agreement to Assign Lease to Incorporators Forming Corporation, as it can provide guidance on handling leases when forming your corporation.

Forming an LLC in Washington state involves selecting a unique name and filing the Articles of Organization with the state. You may also need to create an operating agreement to establish the rules for your business. Incorporating the Washington Agreement to Assign Lease to Incorporators Forming Corporation into your strategy can clarify leasing arrangements as you establish your LLC.

Washington does not impose a state income tax on S Corps, but it does levy a business and occupation tax on revenue. It is essential to consult a tax professional to understand your tax obligations fully. Utilizing the Washington Agreement to Assign Lease to Incorporators Forming Corporation can streamline your business activities and clarify lease-related tax considerations.

To start your own business in Washington state, you will need a registered business name, a business structure, and necessary licenses or permits. Additionally, consider filing the Washington Agreement to Assign Lease to Incorporators Forming Corporation to protect your business interests regarding leasing property. This document can simplify the leasing process as you establish your business.