This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal template documents that you can access or create.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly obtain the latest versions of forms such as the Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

If you are already a member, Log In and download the Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children from the US Legal Forms library. The Obtain option will be available on every form you view.

Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select your preferred payment plan and provide your credentials to register for an account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device.

- Access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the correct form for your city/state.

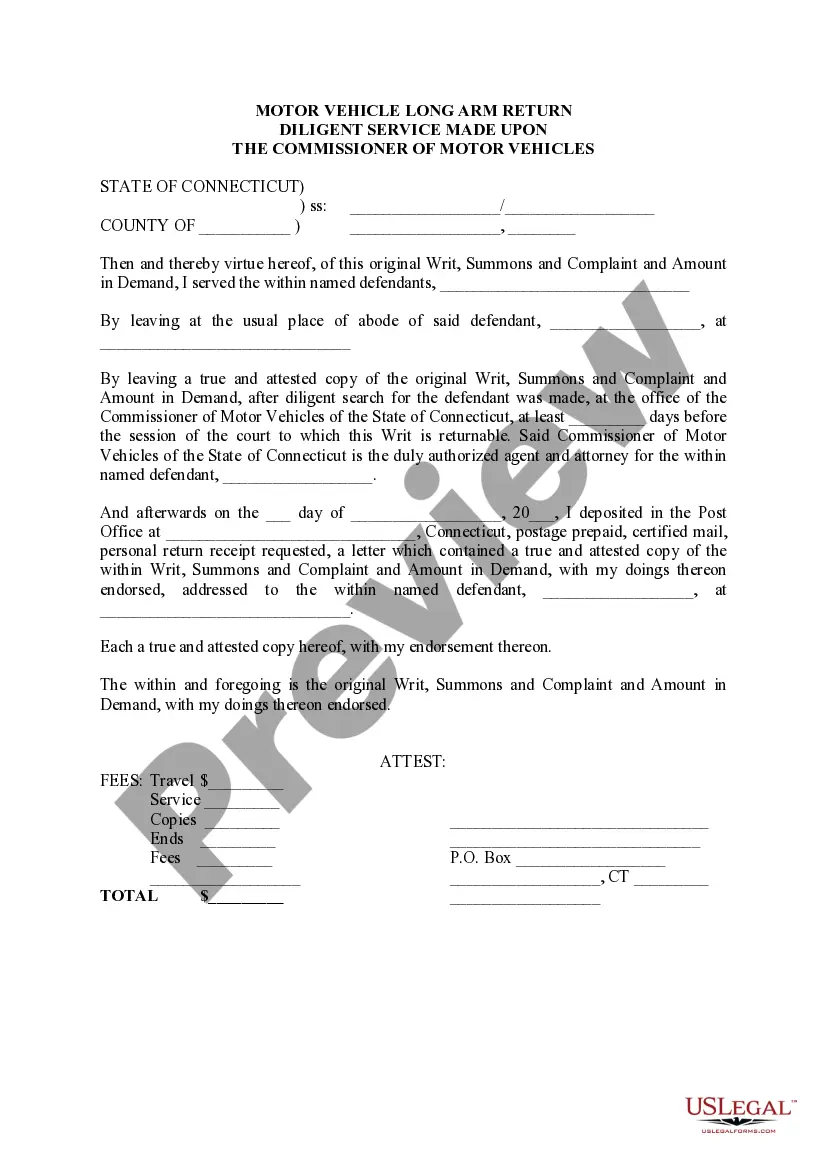

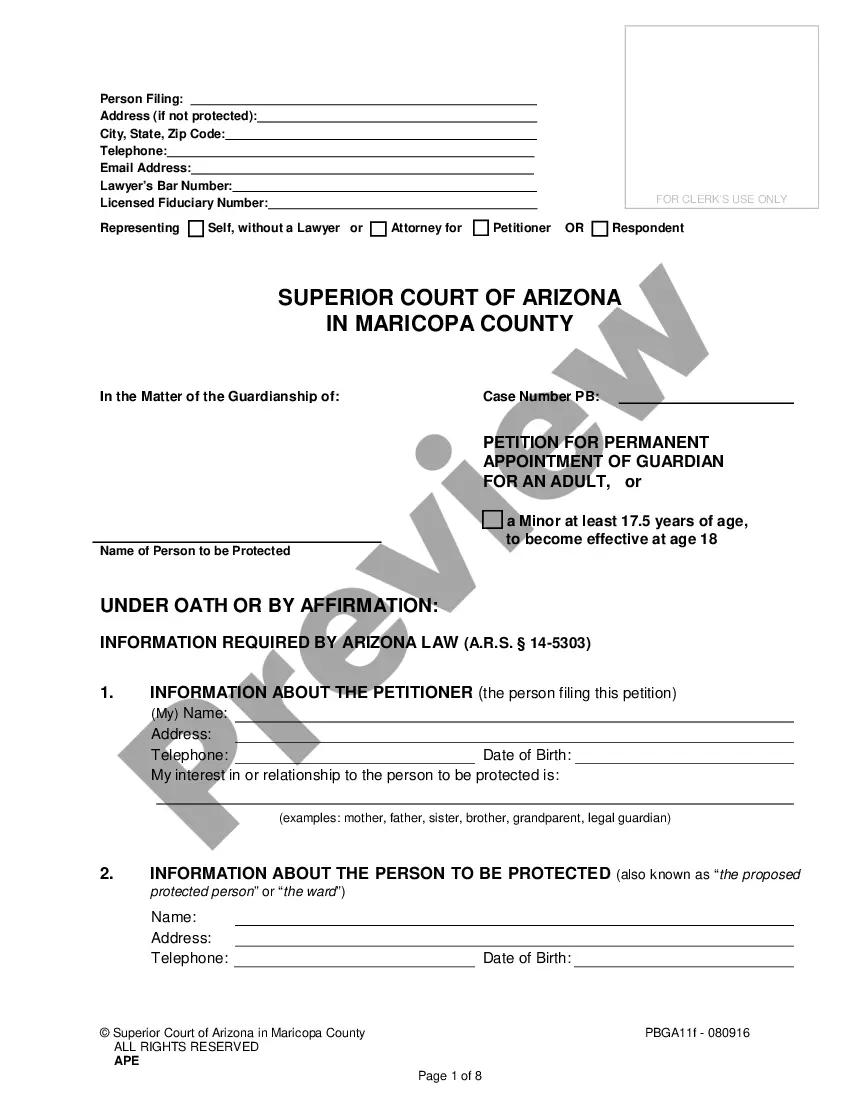

- Choose the Preview option to examine the details of the form.

- Read the form description to confirm that you have selected the right document.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

Form popularity

FAQ

If you make a $100,000 gift and do not file a gift tax return, you could be subject to penalties and interest on any unpaid tax. The IRS can enforce penalties for not reporting such substantial gifts, even with a Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children in place. Always file the necessary forms to protect yourself and your beneficiaries.

Forgetfulness can lead to penalties when it comes to filing gift tax returns. If you forget to file your return, the IRS may assess penalties and interest on any tax due. Utilizing a Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can help streamline this process, ensuring you meet your responsibilities.

Form 706 is used to report estate taxes after a person passes away, while Form 709 is specifically for gift taxes. When considering a Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, Form 709 typically comes into play for any gifts made during your lifetime. Understanding the differences ensures you utilize the correct forms and comply with tax laws effectively.

If you file your gift tax return late, you may face a penalty of 5% of the unpaid tax for each month the return is delayed, up to a maximum of 25%. This penalty applies even if you have a valid Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Timely filing is essential to minimize penalties and maintain compliance.

Failing to declare a gift can lead to significant complications, especially concerning your Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. The IRS may impose penalties if they discover the undeclared gift during an audit or review. It is crucial to keep accurate records and report any gifts to avoid potential liabilities.

The best type of trust for children often depends on specific goals, but many opt for 2503 B or C trusts due to their straightforward benefits. These trusts allow for annual contributions and tax efficiency. By choosing the Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, families can ensure their children's financial futures while minimizing tax implications.

A trust for minor children functions as a legal arrangement that holds and manages assets until the child reaches a specified age. Trustees administer the trust, distributing funds according to the trust's terms. Utilizing a Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children ensures that the minor receives maximum benefits while adhering to gift tax regulations.

The gift tax exclusion for minors aligns with the annual exclusion limit, which stands at $17,000 per recipient in 2023. This means parents can gift this amount without triggering gift tax liabilities. Establishing a Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children allows families to maximize this benefit effectively.

One of the biggest mistakes parents make is not considering the long-term impact of their trust fund decisions. Failing to outline clear terms or appoint a trustworthy trustee can lead to complications. By using a Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, parents can avoid such pitfalls and ensure a well-structured trust fund process.

The maximum gift tax that can apply depends on the value of gifts exceeding the annual exclusion limit. If gifts are above the exclusion threshold, the excess may be subject to tax, which can be significant. To avoid these issues, parents can implement the Washington Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, enabling efficient gift planning.