The following form is a general form for a declaration of a gift of property.

Washington Declaration of Gift

Description

How to fill out Declaration Of Gift?

Are you currently situated in a location where you need documents for either business or personal purposes each time.

There are numerous legal document templates available online, but locating ones you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, such as the Washington Declaration of Gift, designed to adhere to state and federal standards.

Once you have the correct form, click Get now.

Choose the payment plan you prefer, enter the necessary information to establish your account, and complete the purchase using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Washington Declaration of Gift at any time, if needed. Just click on the desired form to download or print the template. Utilize US Legal Forms, the most extensive collection of legal templates, to save time and eliminate mistakes. The service offers precisely crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Washington Declaration of Gift template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/region.

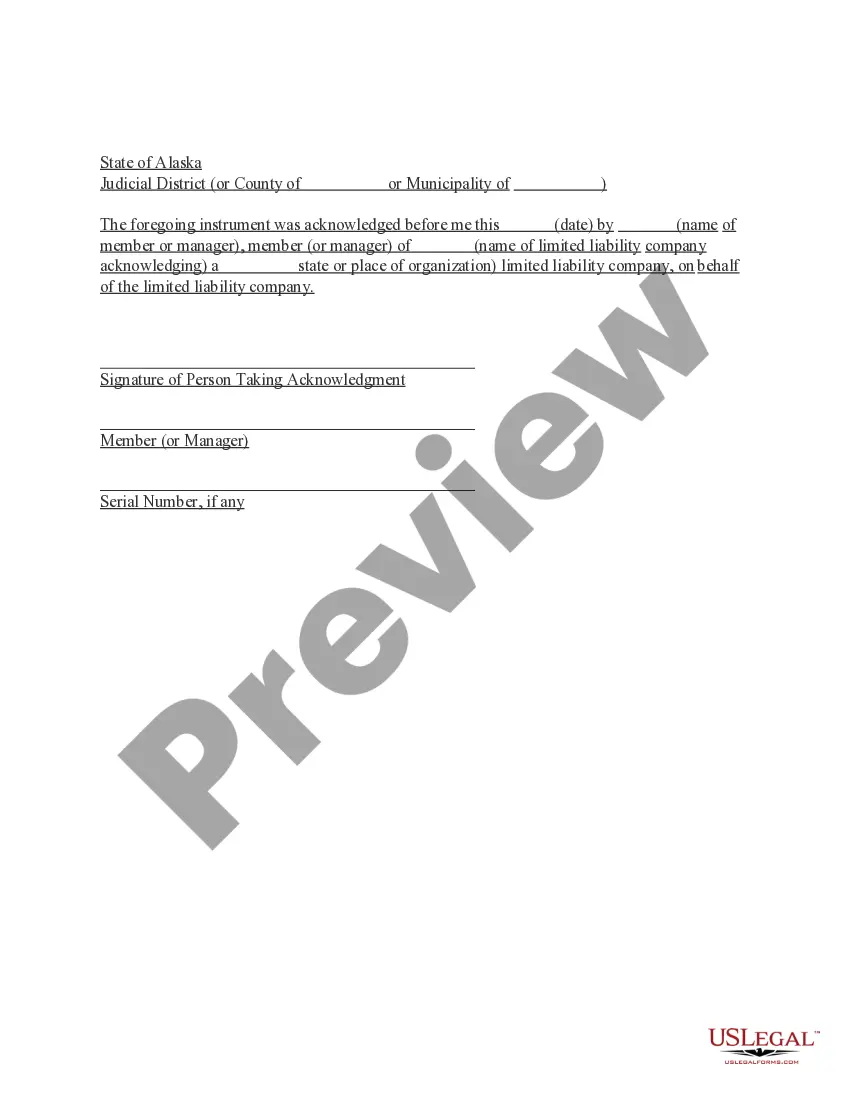

- Use the Review button to inspect the form.

- Read the description to confirm you have chosen the correct form.

- If the form isn't what you're seeking, utilize the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

You can gift your son $30,000 without any legal issues, but it is important to consider tax implications. In the U.S., gifts over a certain amount may require filing a gift tax return. However, the Washington Declaration of Gift can simplify this process by documenting your intent and the amount. This can help you manage any legal requirements and ensure a smooth gift experience.

Yes, you can gift a car in Washington state. To do this, you will need to complete a Washington Declaration of Gift, which legally transfers ownership without the need for a sale. This document ensures that the transaction is recognized by the Department of Licensing. By using a Declaration of Gift, you can avoid taxes typically associated with vehicle sales.

In Washington state, you can initiate a title transfer online through the Department of Licensing if all parties involved meet specific guidelines. However, keep in mind that the Washington Declaration of Gift may still need to be physically signed and submitted in some cases. It helps to check the online system for any additional requirements or options. This feature provides convenience and a streamlined approach for various transactions.

Yes, you can transfer a car to a family member in Washington. You will need to complete the title transfer process through the Department of Licensing, and using the Washington Declaration of Gift can facilitate this process by documenting the nature of the transfer. It’s important to ensure all forms are completed accurately and submitted on time. This will prevent any potential disputes related to ownership.

To gift property in Washington state, begin by preparing a property deed that states your intent to gift. A Washington Declaration of Gift can reinforce this intention, making the legal process clear. You may also need to file the deed with your local county office to ensure it’s recorded properly. This process helps protect your rights as the giver and formalizes the transfer for the recipient.

The best way to transfer a car title to a family member is to fill out the appropriate title transfer form from the Department of Licensing in Washington. Utilizing the Washington Declaration of Gift can simplify this process by documenting the intent to gift the vehicle. Both parties should sign the title, and it may also be helpful to keep a copy for your records. This ensures a smooth transition of ownership.

Gifting a title in Washington state generally involves completing the title transfer form and submitting it to the Department of Licensing. The Washington Declaration of Gift can be utilized to formalize the transaction, providing essential documentation for both parties. Be sure to check for any fees associated with the title transfer. It is a straightforward process that can benefit both the giver and receiver.

To declare a foreign gift, you will need to document the gift's source and its value. It is important to use the Washington Declaration of Gift for proper reporting, especially to comply with federal and state tax regulations. You should also consult with a tax professional for guidance on any applicable limits or requirements. Ensuring you declare the gift correctly will help prevent future complications.

Gifting a car can be beneficial in Washington state, especially for tax purposes. If you use a Washington Declaration of Gift, it simplifies the ownership transfer process without tax complications. Selling a car for $1 may raise questions from tax authorities and could lead to misunderstandings. Consider your specific situation when deciding the best option for transferring vehicle ownership.

In Washington State, the annual gift exclusion limit is $17,000 per recipient. If your gift exceeds this amount, it's necessary to file a Washington Declaration of Gift to comply with tax laws. This declaration helps in documenting the gift, ensuring transparency in the transfer process. Knowing the limits can help you plan your gifting strategy effectively and avoid unexpected tax implications.