Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees

Description

How to fill out Classification Of Employees For Personnel Manual Or Employee Handbook Regarding Full Time, Part Time, Temporary, Leased, Exempt, And Nonexempt Employees?

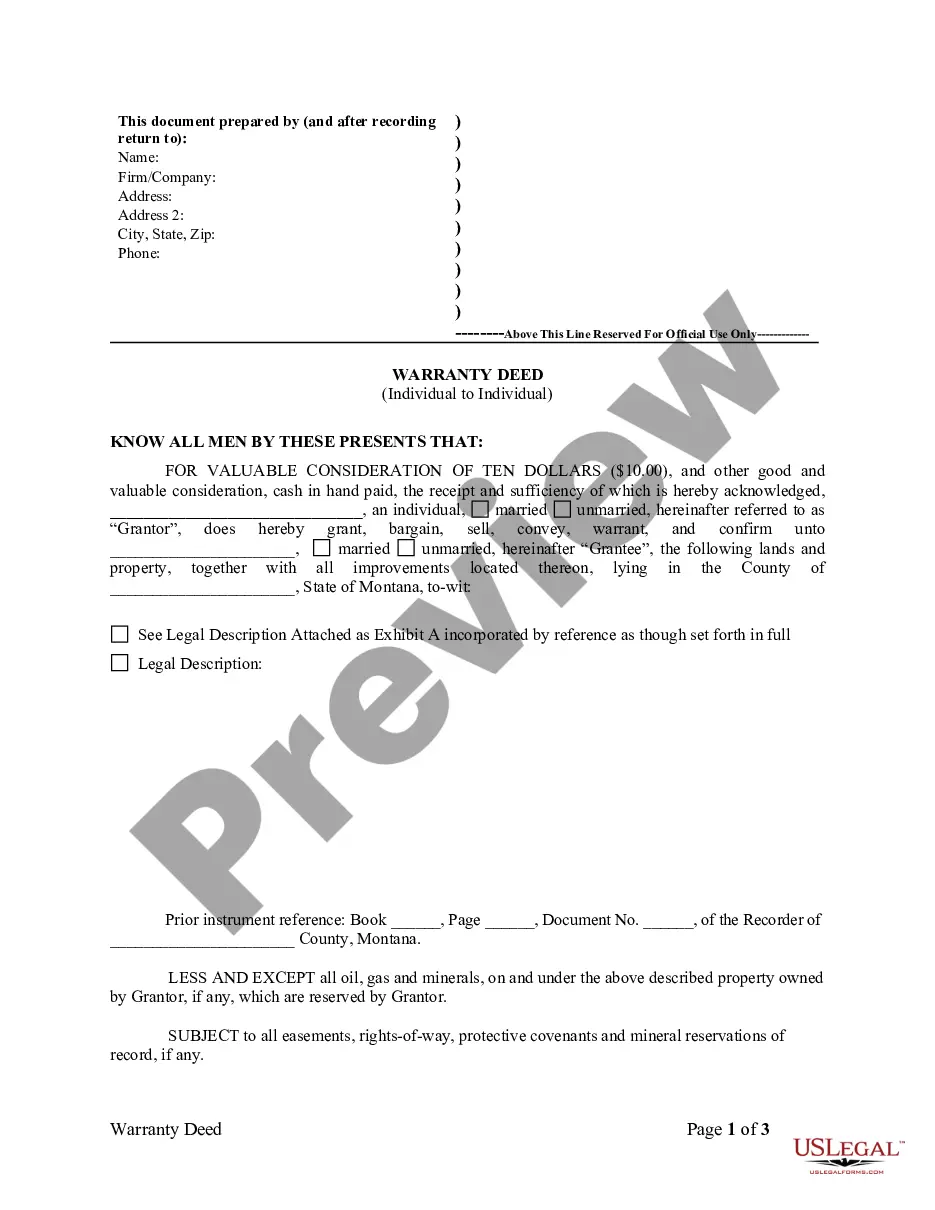

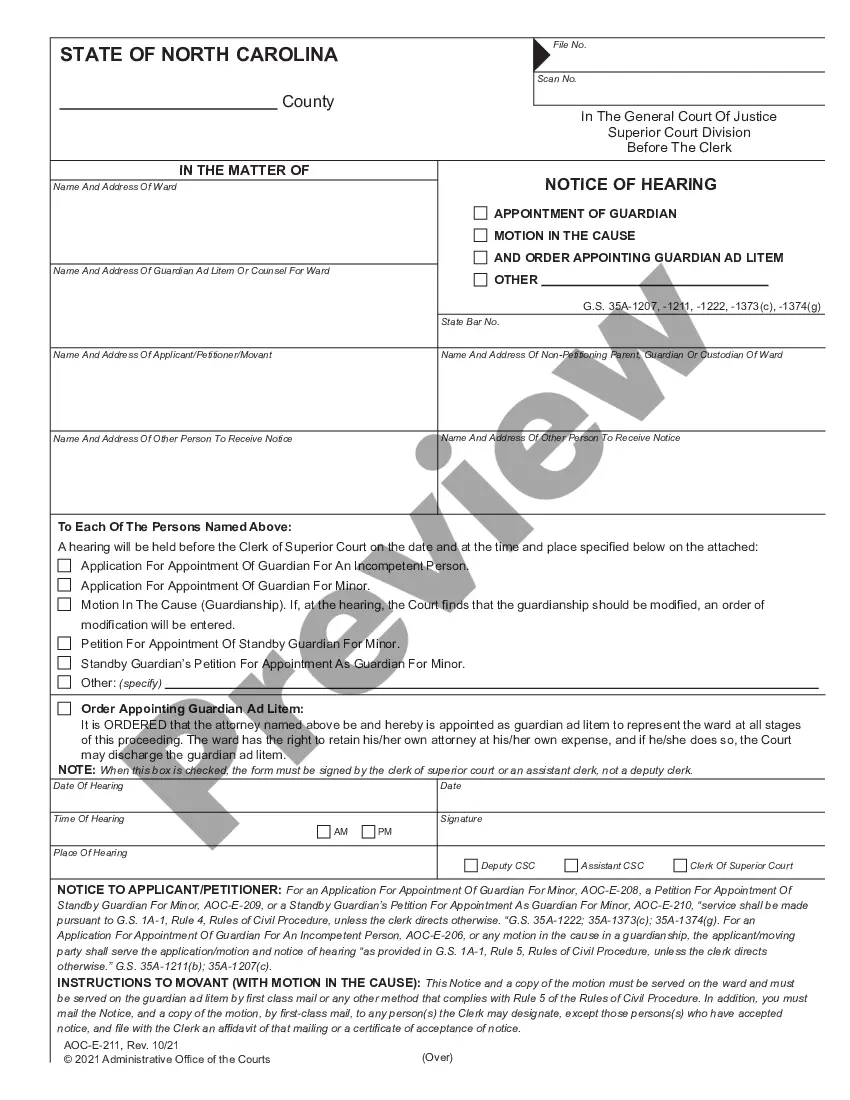

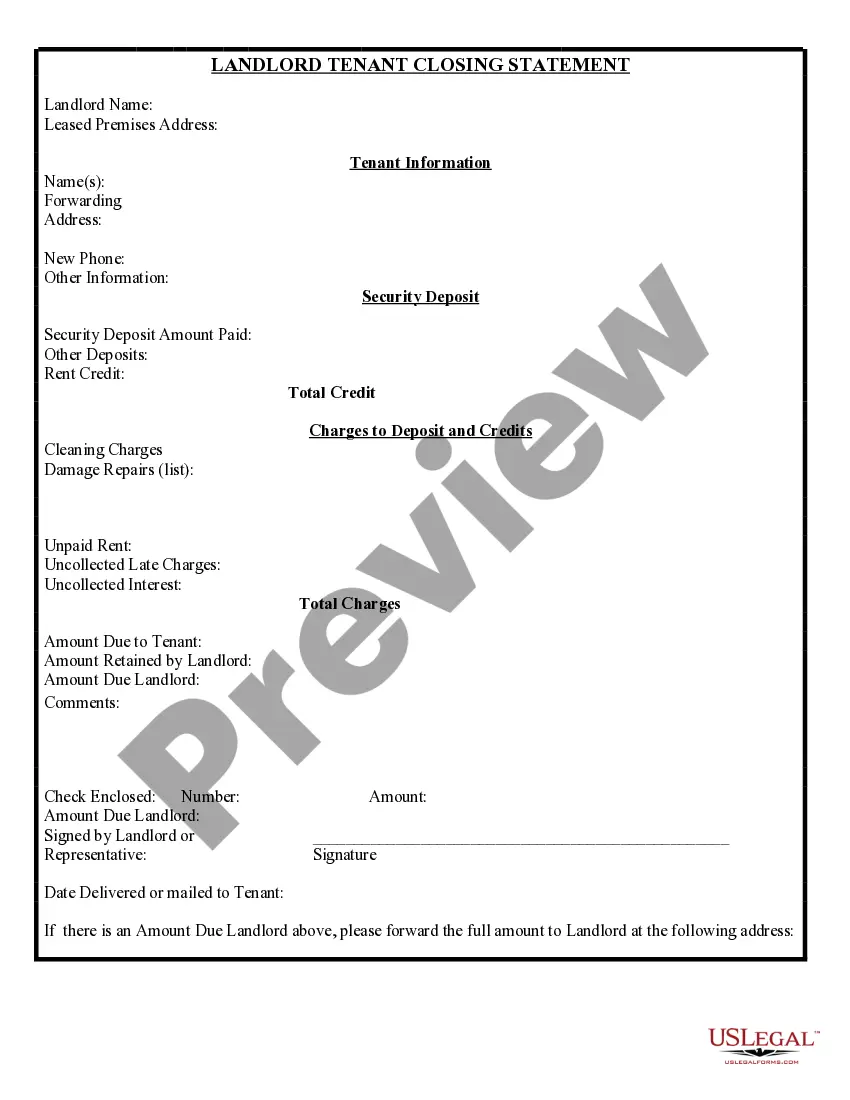

If you wish to be thorough, download, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's simple and user-friendly search feature to find the documents you need.

A range of templates for business and personal use are categorized by types and state, or keywords.

Step 4. Once you have found the form you require, click the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction. Step 6. Choose the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Washington Classification of Employees for Personnel Manual or Employee Handbook for Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees.

- Utilize US Legal Forms to obtain the Washington Classification of Employees for Personnel Manual or Employee Handbook concerning Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Washington Classification of Employees for Personnel Manual or Employee Handbook for Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees.

- You can also retrieve forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Use the Review option to examine the content of the form. Don’t forget to read through the overview.

- Step 3. If you are unhappy with the form, use the Research field at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

Full-time employment in Washington state typically refers to a schedule of 40 hours per week. However, standards may vary by industry and employer, so it's important to clearly define what full-time means within your specific organization. This clarity can enhance your Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees.

As of 2023, Washington's minimum salary threshold for exempt employees is $1,014 per week, which equals $52,728 annually. This salary must meet the criteria set forth in the state’s wage and hour laws to classify an employee as exempt. Including this threshold in your Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees is crucial for compliance.

In Washington, an employee is considered exempt based on their job duties and salary level. Typically, roles that involve executive, administrative, or professional tasks qualify for exempt status. This classification plays a vital role in determining the content of your Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees.

In Washington state, the primary distinction between part-time and full-time employment lies in the number of hours worked per week. Full-time employees usually work 40 hours or more, while part-time employees work fewer than that. This difference can greatly affect benefits eligibility and job expectations. When creating the Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees, you should clearly define these terms for your employees to establish transparency and accountability.

In Washington, the number of hours required to qualify for benefits varies depending on the employer's policies. Typically, many employers designate at least 20 to 30 hours per week as the threshold for eligibility for benefits, but this may differ across industries. It's crucial to include this information in the Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees to ensure employees understand their benefits. Additionally, employers should stay updated on state laws that may influence these thresholds.

Typically, full-time employment in Washington state is defined as working 40 hours a week; however, some employers may consider 32 hours as full-time depending on their company policies. When drafting the Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees, it’s essential to clarify your company's definition of full-time hours. This will help prevent confusion among employees and provide clear expectations. Be sure to align your policies with state guidelines and industry standards.

The 7 minute rule in Washington state refers to the guideline that employers should account for any small increments of time, such as the extra few minutes worked beyond a scheduled shift. In terms of the Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees, this could impact how you track work hours and determine overtime. Employers must ensure that they are compliant with accurate timekeeping to avoid disputes. This rule emphasizes fairness in compensating employees for their work.

In Washington state, a full-time employee is generally one who works at least 40 hours per week. This classification can vary depending on the employer's policies, but it commonly reflects the standard of full-time work. Clearly defining full-time positions in your Washington Classification of Employees for Personnel Manual can assist in managing expectations and benefits for employees.

Determining whether exempt or non-exempt status is better largely depends on your employment needs and preferences. Exempt employees enjoy a consistent paycheck without overtime considerations, whereas non-exempt employees benefit from the ability to earn overtime. Your choice may reflect job type, financial goals, or lifestyle, so it's important to assess both classifications in your Employee Handbook.

To classify employees accurately, start by reviewing their job descriptions and responsibilities against the criteria established by the Fair Labor Standards Act. Analyze their compensation structure and ensure alignment with legal requirements. Utilizing a comprehensive Washington Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees can support you in making informed decisions about each employee's classification.