Washington Amendment to Living Trust

What this document covers

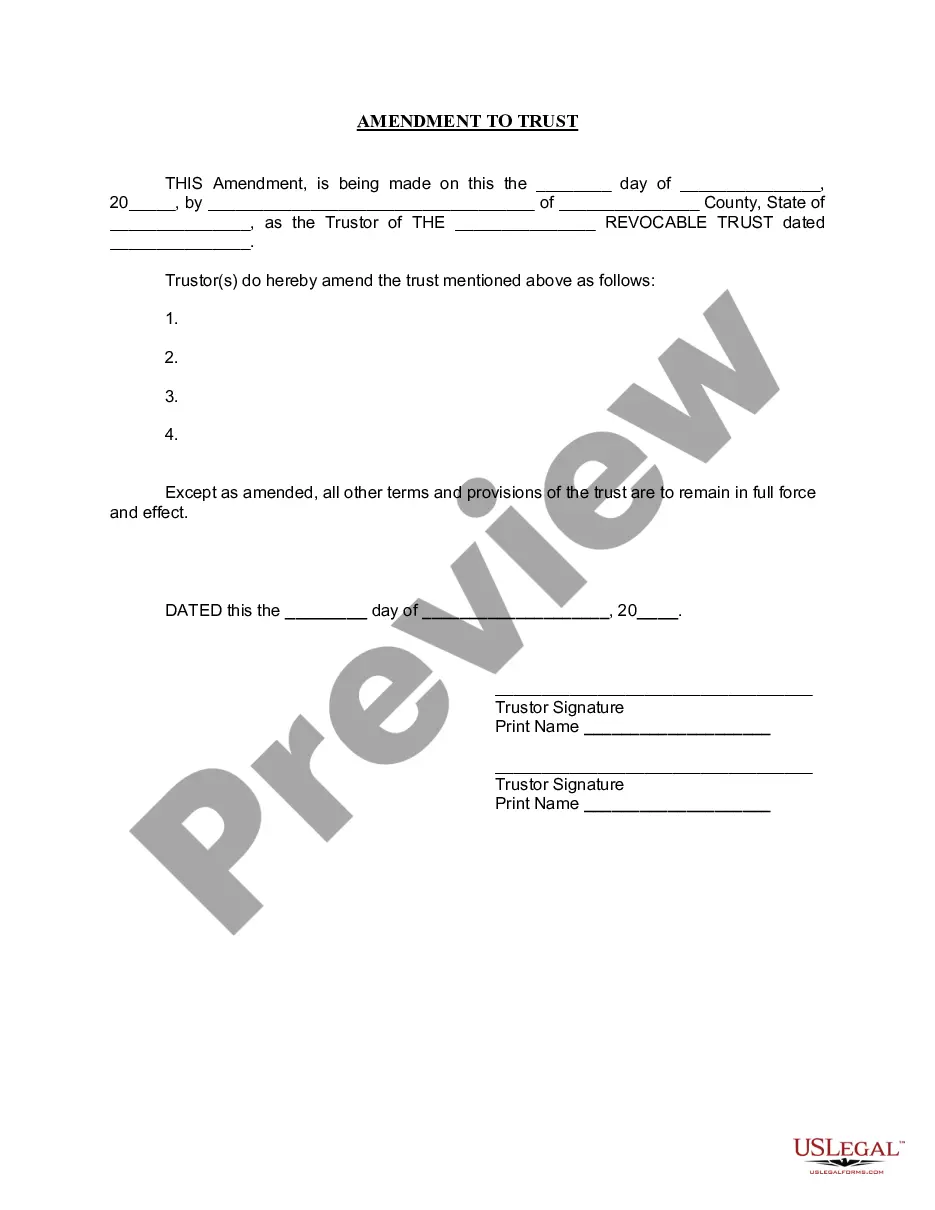

The Amendment to Living Trust form allows the Trustor to make changes to a living trust while maintaining the overall purpose and structure of the trust. A living trust is created to hold a person's assets during their lifetime, typically for estate planning purposes. This specific form enables the Trustor to modify certain provisions without invalidating the remaining components of the trust, ensuring continuity in estate management.

Key parts of this document

- Date of amendment: The date when the amendment is made.

- Trustor details: Information about the individual making the amendment.

- Trust name: Identification of the trust being amended.

- Amendment details: Description of the specific changes to be made.

- Trustor signatures: Signatures of the Trustor(s) to validate the amendment.

- Notary section: Space for a notary public to authenticate the signatures.

When to use this form

This form is appropriate to use when a Trustor wishes to change specific provisions of an existing living trust. For example, if the Trustor wants to add or remove beneficiaries, update asset allocations, or change trustees. It is essential to have this form for any significant changes that may impact the management or distribution of the trust assets while ensuring that the trust remains legally intact.

Intended users of this form

- Individuals who are named as the Trustor of a living trust.

- Trustors who wish to amend the terms of their existing living trust.

- Beneficiaries or family members involved in estate planning who require adjustments to the trust provisions.

How to complete this form

- Enter the date when the amendment is executed.

- Fill in the Trustor's full name and county of residence.

- Specify the name of the living trust being amended.

- Clearly describe the amendments being made to the trust.

- Sign the document in front of a notary public.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to specify all amendments clearly, leading to ambiguity.

- Not obtaining a signature from all Trustors, if applicable.

- Overlooking state-specific notarization requirements.

- Not providing adequate witness signatures when required.

Benefits of completing this form online

- Convenience of downloading the form anytime, from anywhere.

- Editability allows users to customize the document according to their needs.

- Access to forms that are drafted by licensed attorneys, ensuring legal reliability.

Looking for another form?

Form popularity

FAQ

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

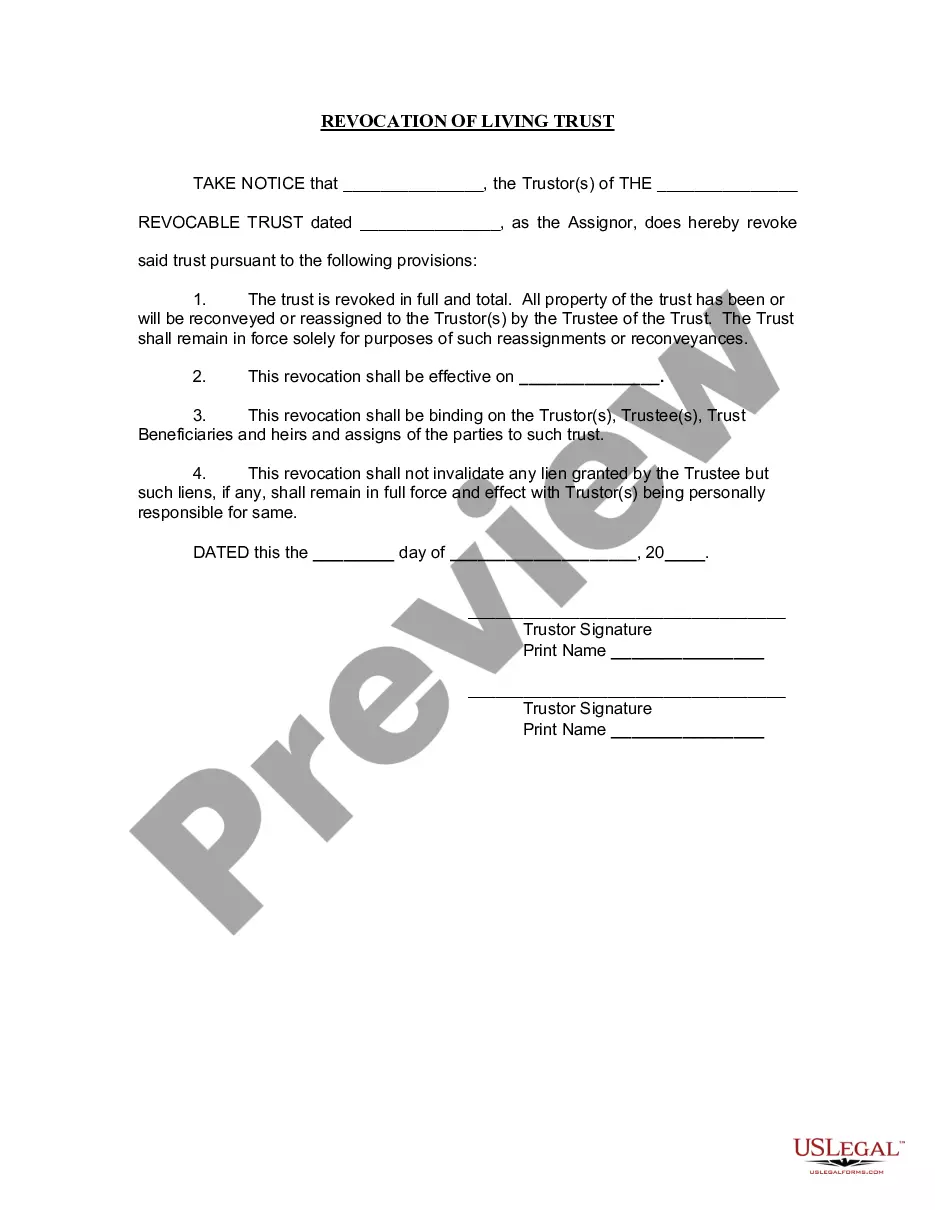

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.