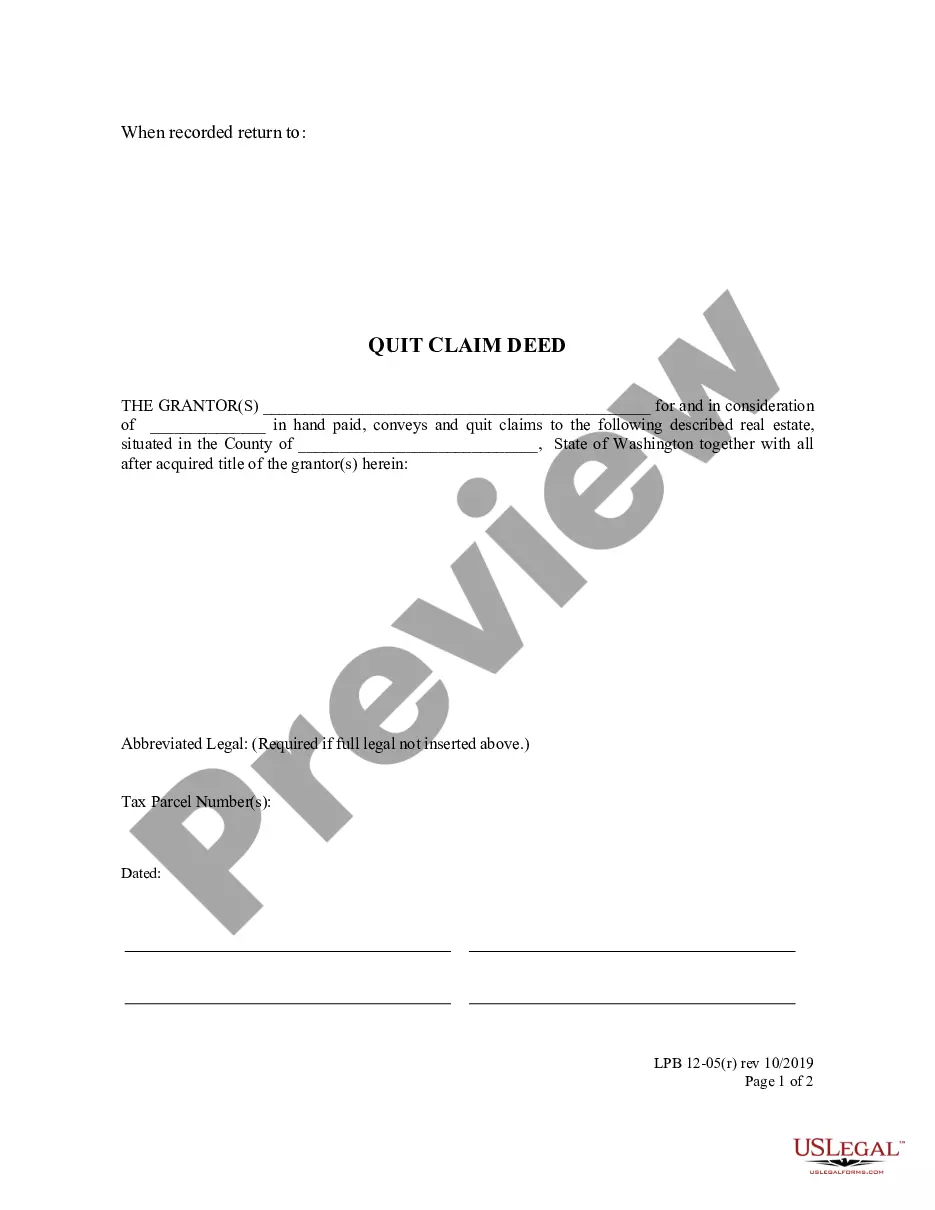

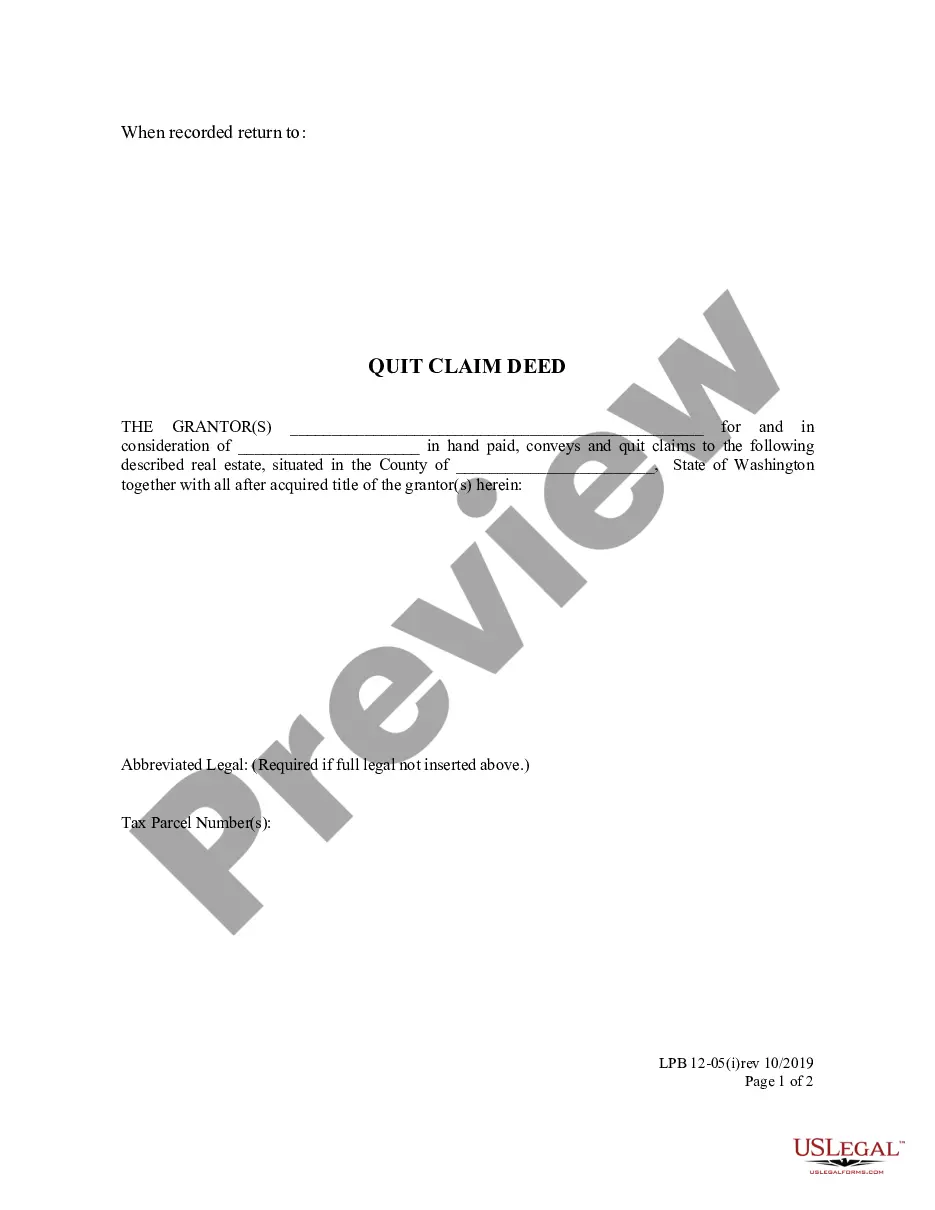

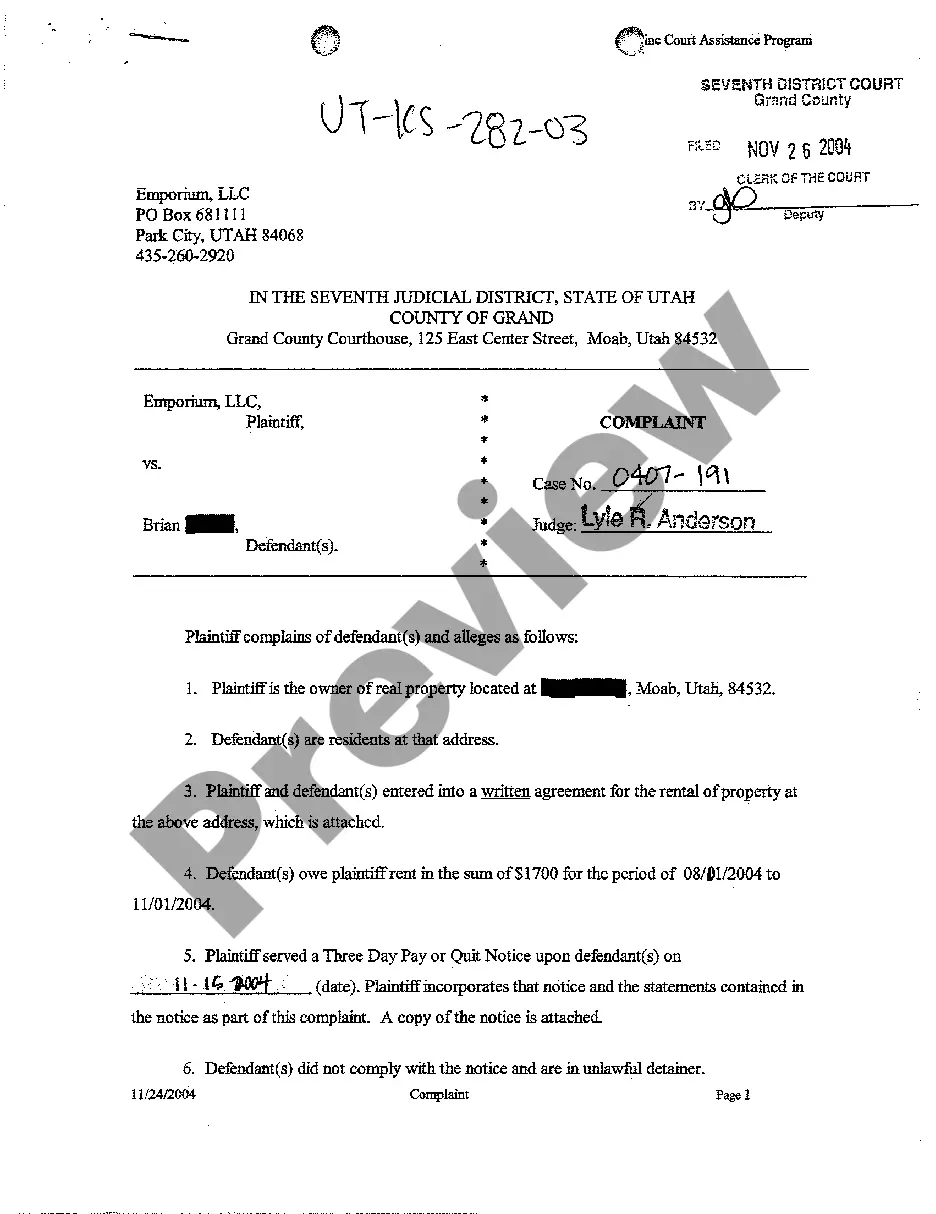

This is an official Washington form for use in land transactions, a Quitclaim Deed (with representative acknowledgment).

Washington Quitclaim Deed - with representative acknowledgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Quitclaim Deed - With Representative Acknowledgment?

Out of the large number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms prior to buying them. Its extensive library of 85,000 templates is grouped by state and use for efficiency. All the forms available on the service have already been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, press Download and get access to your Form name from the My Forms; the My Forms tab holds all of your downloaded documents.

Keep to the tips listed below to get the form:

- Once you discover a Form name, ensure it is the one for the state you really need it to file in.

- Preview the template and read the document description just before downloading the template.

- Search for a new template using the Search field in case the one you’ve already found is not appropriate.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

When you have downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains the most updated version in your state. Our service provides fast and easy access to templates that suit both attorneys and their clients.

Form popularity

FAQ

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

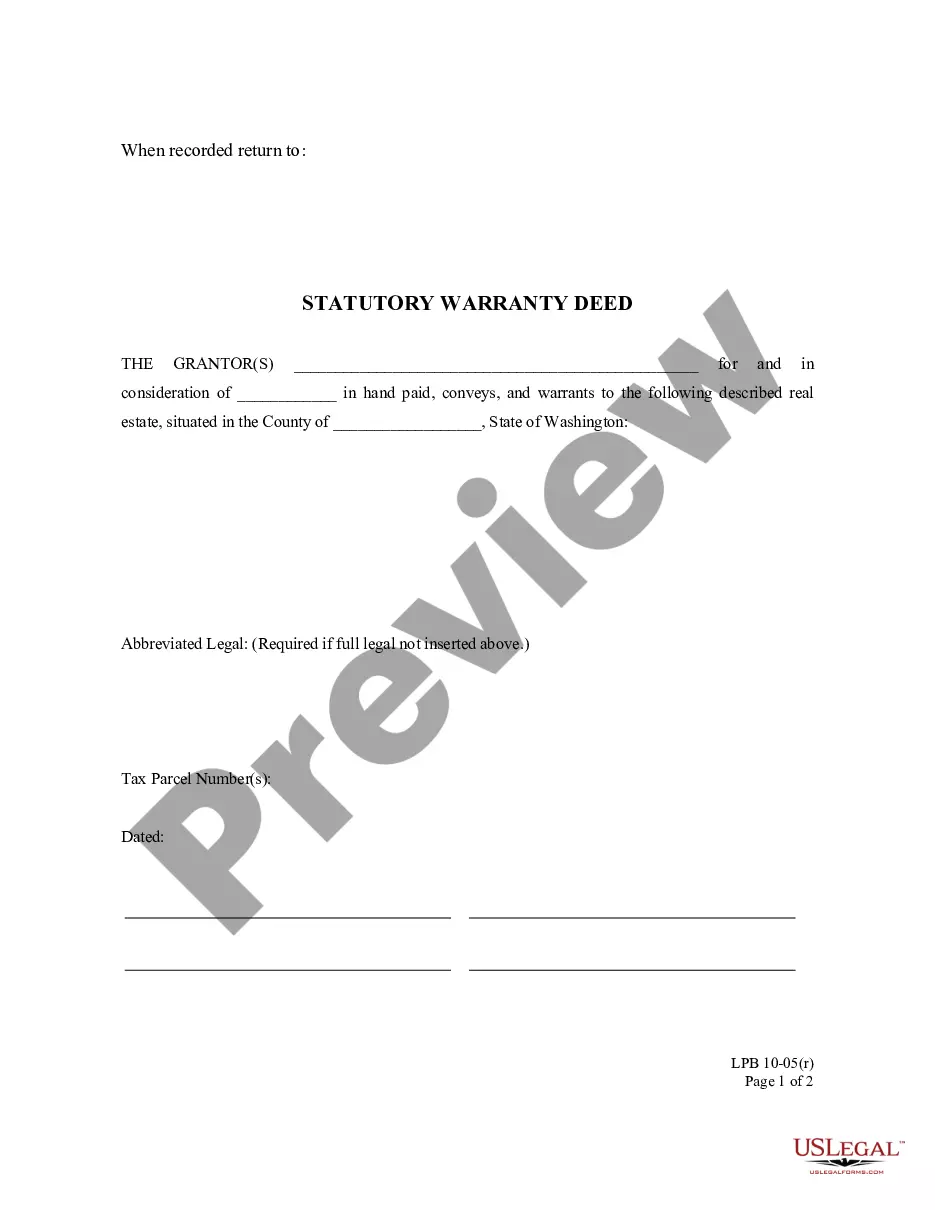

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

No, in most states, the Grantee is not required to sign the Quitclaim Deed. However, some counties do require that the Quitclaim Deed be signed by the Grantee in addition to the Grantor.Whether or not you need witnesses in addition to a notary public for your Quitclaim Deed depends on your location.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

A signed quit claim deed overrides a will, because the property covered by the deed is not part of the estate at your mother's death.The deed needed to be notarized to be valid.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

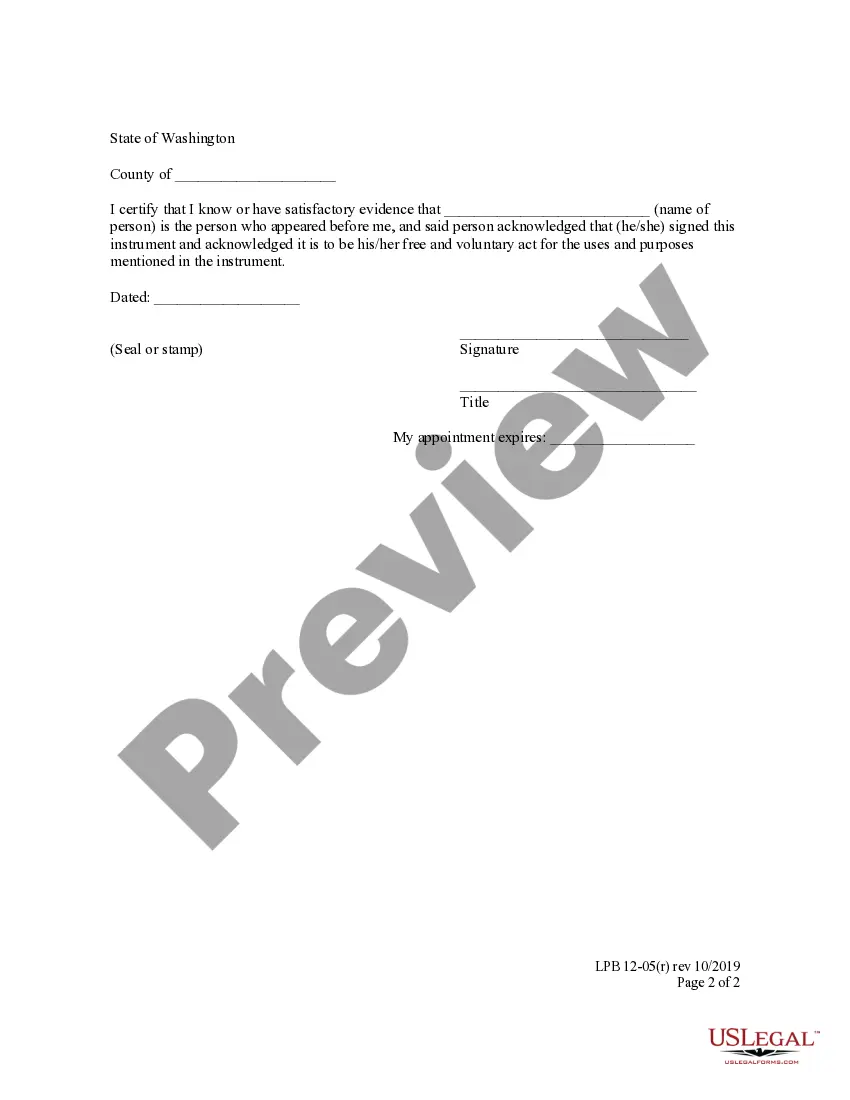

The grantor must sign the deed according to the law in every state and county. The grantor's signature finalizes the transfer of ownership, and quitclaim deeds aren't considered valid unless the grantor signs them. A certified notary public must typically be present as the grantor signs.

The Washington quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.