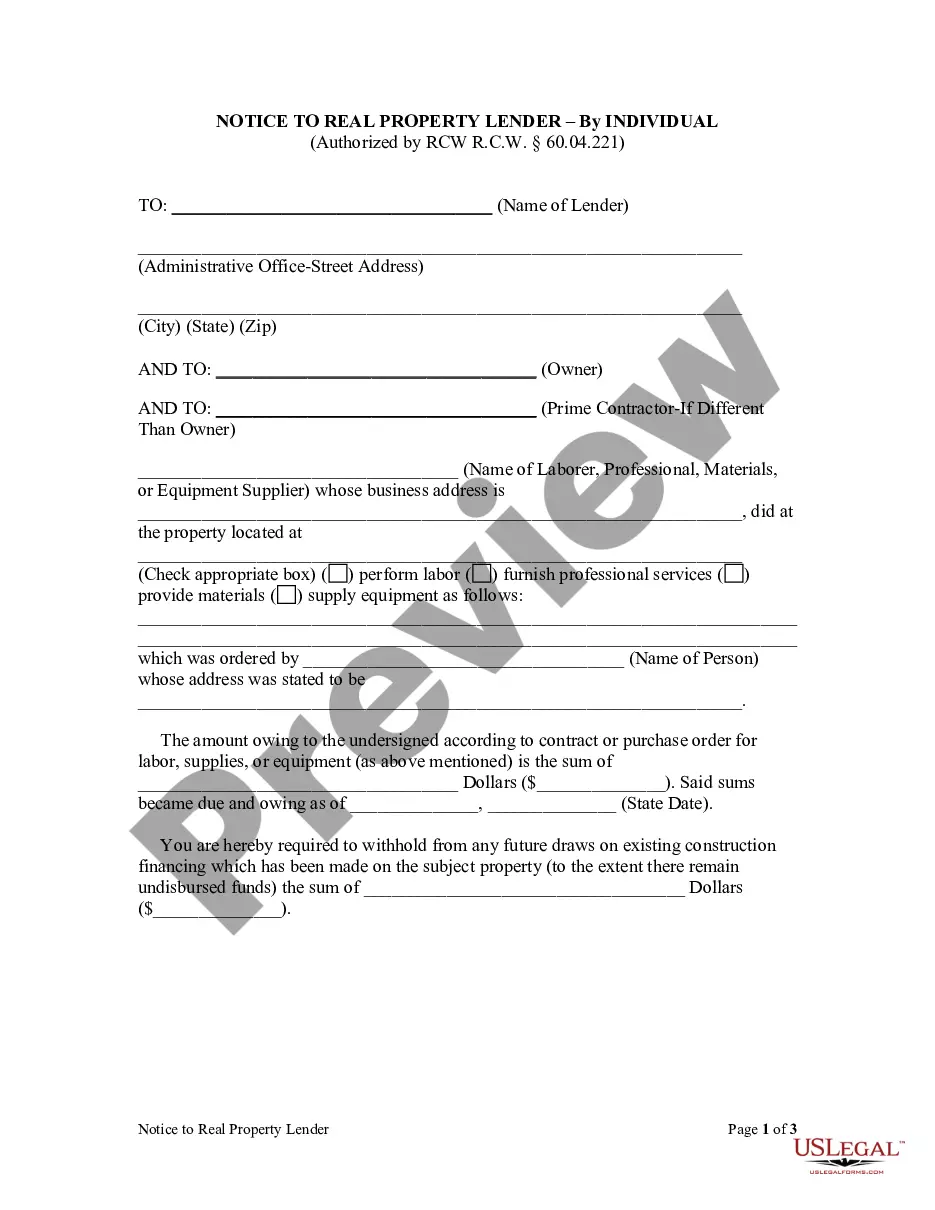

Notice to Real Property Lender - Individual

Note: This summary is not intended to be an all

inclusive summary of the law of construction liens in Washington, but does

contain basic and other information.

Definitions.

Unless the context requires otherwise, the definitions in this section

apply throughout this chapter.

(1) "Construction agent" means any registered or licensed contractor,

registered or licensed subcontractor, architect, engineer, or other person

having charge of any improvement to real property, who shall be deemed

the agent of the owner for the limited purpose of establishing the lien

created by this chapter.

(2) "Contract price" means the amount agreed upon by the contracting

parties, or if no amount is agreed upon, then the customary and reasonable

charge therefor.

(3) "Draws" means periodic disbursements of interim or construction

financing by a lender.

(4) "Furnishing labor, professional services, materials, or equipment"

means the performance of any labor or professional services, the contribution

owed to any employee benefit plan on account of any labor, the provision

of any supplies or materials, and the renting, leasing, or otherwise supplying

of equipment for the improvement of real property.

(5) "Improvement" means: (a) Constructing, altering, repairing, remodeling,

demolishing, clearing, grading, or filling in, of, to, or upon any real

property or street or road in front of or adjoining the same; (b) planting

of trees, vines, shrubs, plants, hedges, or lawns, or providing other landscaping

materials on any real property; and (c) providing professional services

upon real property or in preparation for or in conjunction with the intended

activities in (a) or (b) of this subsection.

(6) "Interim or construction financing" means that portion of money

secured by a mortgage, deed of trust, or other encumbrance to finance improvement

of, or to real property, but does not include:

(b) Funds to pay interest, insurance premiums, lease deposits, taxes,

assessments, or prior encumbrances;

(c) Funds to pay loan, commitment, title, legal, closing, recording,

or appraisal fees;

(d) Funds to pay other customary fees, which pursuant to agreement

with the owner or borrower are to be paid by the lender from time to time;

(e) Funds to acquire personal property for which the potential lien

claimant may not claim a lien pursuant to this chapter.

(7) "Labor" means exertion of the powers of body or mind performed

at the site for compensation. "Labor" includes amounts due and owed

to any employee benefit plan on account of such labor performed.

(8) "Mortgagee" means a person who has a valid mortgage of record or

deed of trust of record securing a loan.

(9) "Owner-occupied" means a single-family residence occupied by the

owner as his or her principal residence.

(10) "Payment bond" means a surety bond issued by a surety licensed

to issue surety bonds in the state of Washington that confers upon potential

claimants the rights of third party beneficiaries.

(11) "Potential lien claimant" means any person or entity entitled

to assert lien rights under this chapter who has otherwise complied with

the provisions of this chapter and is registered or licensed if required

to be licensed or registered by the provisions of the laws of the state

of Washington.

(12) "Prime contractor" includes all contractors, general contractors,

and specialty contractors, as defined by chapter 18.27 or 19.28 RCW, or

who are otherwise required to be registered or licensed by law, who contract

directly with a property owner or their common law agent to assume primary

responsibility for the creation of an improvement to real property, and

includes property owners or their common law agents who are contractors,

general contractors, or specialty contractors as defined in chapter 18.27

or 19.28 RCW, or who are otherwise required to be registered or licensed

by law, who offer to sell their property without occupying or using the

structures, projects, developments, or improvements for more than one year.

(13) "Professional services" means surveying, establishing or marking

the boundaries of, preparing maps, plans, or specifications for, or inspecting,

testing, or otherwise performing any other architectural or engineering

services for the improvement of real property.

(14) "Real property lender" means a bank, savings bank, savings and

loan association, credit union, mortgage company, or other corporation,

association, partnership, trust, or individual that makes loans secured

by real property located in the state of Washington.

(15) "Site" means the real property which is or is to be improved.

(16) "Subcontractor" means a general contractor or specialty contractor

as defined by chapter 18.27 or 19.28 RCW, or who is otherwise required

to be registered or licensed by law, who contracts for the improvement

of real property with someone other than the owner of the property or their

common law agent. RCW 60.04.011

Lien authorized.

Except as provided in RCW 60.04.031, any person furnishing labor, professional

services, materials, or equipment for the improvement of real property

shall have a lien upon the improvement for the contract price of labor,

professional services, materials, or equipment furnished at the instance

of the owner, or the agent or construction agent of the owner. RCW 60.04.021

Notices -- Exceptions.

(1) Except as otherwise provided in this section, every person furnishing

professional services, materials, or equipment for the improvement of real

property shall give the owner or reputed owner notice in writing of the

right to claim a lien. If the prime contractor is in compliance with

the requirements of RCW 19.27.095, 60.04.230, and 60.04.261, this notice

shall also be given to the prime contractor as described in this subsection

unless the potential lien claimant has contracted directly with the prime

contractor. The notice may be given at any time but only protects

the right to claim a lien for professional services, materials, or equipment

supplied after the date which is sixty days before:

(b) Delivering or serving the notice personally upon the owner or reputed

owner and obtaining evidence of delivery in the form of a receipt or other

acknowledgement signed by the owner or reputed owner or an affidavit of

service.

In the case of new construction of a single-family residence, the notice

of a right to claim a lien may be given at any time but only protects the

right to claim a lien for professional services, materials, or equipment

supplied after a date which is ten days before the notice is given as described

in this subsection.

(2) Notices of a right to claim a lien shall not be required of:

(b) Laborers whose claim of lien is based solely on performing labor;

or,

(c) Subcontractors who contract for the improvement of real property

directly with the prime contractor, except as provided in subsection (3)(b)

of this section.

(3) Persons who furnish professional services, materials, or equipment

in connection with the repair, alteration, or remodel of an existing owner-occupied

single-family residence or appurtenant garage:

(a) Who contract directly with the owner-occupier or their common law

agent shall not be required to send a written notice of the right to claim

a lien and shall have a lien for the full amount due under their contract,

as provided in RCW 60.04.021; or

(b) Who do not contract directly with the owner-occupier or their common

law agent shall give notice of the right to claim a lien to the owner-occupier.

Liens of persons furnishing professional services, materials, or equipment

who do not contract directly with the owner-occupier or their common law

agent may only be satisfied from amounts not yet paid to the prime contractor

by the owner at the time the notice described in this section is received,

regardless of whether amounts not yet paid to the prime contractor are

due. For the purposes of this subsection "received" means actual receipt of notice by personal service, or registered

or certified mail, or three days after mailing by registered or certified

mail, excluding Saturdays, Sundays, or legal holidays.

(4) The notice of right to claim a lien described in subsection (1)

of this section, shall include but not be limited to the following information

and shall substantially be in the following form, using lower-case and

upper-case ten-point type where appropriate. See Form WA-01-09 or WA-01A-09.

(5) Every potential lien claimant providing professional services where

no improvement as defined in RCW 60.04.011(5) (a) or (b) has been commenced,

and the professional services provided are not visible from an inspection

of the real property may record in the real property records of the county

where the property is located a notice which shall contain the professional

service provider's name, address, telephone number, legal description of

the property, the owner or reputed owner's name, and the general nature

of the professional services provided. If such notice is not recorded,

the lien claimed shall be subordinate to the interest of any subsequent

mortgagee and invalid as to the interest of any subsequent purchaser if

the mortgagee or purchaser acts in good faith and for a valuable consideration

acquires an interest in the property prior to the commencement of an improvement

as defined in RCW 60.04.011(5) (a) or (b) without notice of the professional

services being provided. The notice described in this subsection

shall be substantially in the following form: See Form WA-02-09 or WA-02A-09.

(6) A lien authorized by this chapter shall not be enforced unless the

lien claimant has complied with the applicable provisions of this section.

Acts of coercion -- Application of chapter 19.86 RCW.

The legislature finds that acts of coercion or attempted coercion, including

threats to withhold future contracts, made by a contractor or developer

to discourage a contractor, subcontractor, or material or equipment supplier

from giving an owner the notice of right to claim a lien required by RCW

60.04.031, or from filing a claim of lien under this chapter are matters

vitally affecting the public interest for the purpose of applying the consumer

protection act, chapter 19.86 RCW. These acts of coercion are not

reasonable in relation to the development and preservation of business.

These acts of coercion shall constitute an unfair or deceptive act or practice

in trade or commerce for the purpose of applying the consumer protection

act, chapter 19.86 RCW. RCW 60.04.035

Contractor registration.

A contractor or subcontractor required to be registered under chapter

18.27 RCW or licensed under chapter 19.28 RCW, or otherwise required to

be registered or licensed by law, shall be deemed the construction agent

of the owner for the purposes of establishing the lien created by this

chapter only if so registered or licensed. Persons dealing with contractors

or subcontractors may rely, for the purposes of this section, upon a certificate

of registration issued pursuant to chapter 18.27 RCW or license issued

pursuant to chapter 19.28 RCW, or other certificate or license issued pursuant

to law, covering the period when the labor, professional services, material,

or equipment shall be furnished, and the lien rights shall not be lost

by suspension or revocation of registration or license without their knowledge.

No lien rights described in this chapter shall be lost or denied by virtue

of the absence, suspension, or revocation of such registration or license

with respect to any contractor or subcontractor not in immediate contractual

privity with the lien claimant. RCW 60.04.041

Property subject to lien.

The lot, tract, or parcel of land which is improved is subject to a

lien to the extent of the interest of the owner at whose instance, directly

or through a common law or construction agent the labor, professional services,

equipment, or materials were furnished, as the court deems appropriate

for satisfaction of the lien. If, for any reason, the title or interest

in the land upon which the improvement is situated cannot be subjected

to the lien, the court in order to satisfy the lien may order the sale

and removal of the improvement from the land which is subject to the lien.

RCW 60.04.051

Priority of lien.

The claim of lien created by this chapter upon any lot or parcel of

land shall be prior to any lien, mortgage, deed of trust, or other encumbrance

which attached to the land after or was unrecorded at the time of commencement

of labor or professional services or first delivery of materials or equipment

by the lien claimant. RCW 60.04.061

Release of lien rights.

Upon payment and acceptance of the amount due to the lien claimant and

upon demand of the owner or the person making payment, the lien claimant

shall immediately prepare and execute a release of all lien rights for

which payment has been made, and deliver the release to the person making

payment. In any suit to compel deliverance of the release thereafter

in which the court determines the delay was unjustified, the court shall,

in addition to ordering the deliverance of the release, award the costs

of the action including reasonable attorneys' fees and any damages. RCW

60.04.071

Frivolous claim -- Procedure.

(1) Any owner of real property subject to a recorded claim of lien under

this chapter, or contractor, subcontractor, lender, or lien claimant who

believes the claim of lien to be frivolous and made without reasonable

cause, or clearly excessive may apply by motion to the superior court for

the county where the property, or some part thereof is located, for an

order directing the lien claimant to appear before the court at a time

no earlier than six nor later than fifteen days following the date of service

of the application and order on the lien claimant, and show cause, if any

he or she has, why the relief requested should not be granted. The

motion shall state the grounds upon which relief is asked, and shall be

supported by the affidavit of the applicant or his or her attorney setting

forth a concise statement of the facts upon which the motion is based.

(2) The order shall clearly state that if the lien claimant fails to

appear at the time and place noted, the lien shall be released, with prejudice,

and that the lien claimant shall be ordered to pay the costs requested

by the applicant including reasonable attorneys' fees.

(3) If no action to foreclose the lien claim has been filed, the clerk

of the court shall assign a cause number to the application and obtain

from the applicant a filing fee of thirty-five dollars. If an action has been filed to foreclose the lien claim, the application

shall be made a part of that action.

(4) If, following a hearing on the matter, the court determines that

the lien is frivolous and made without reasonable cause, or clearly excessive,

the court shall issue an order releasing the lien if frivolous and made

without reasonable cause, or reducing the lien if clearly excessive, and

awarding costs and reasonable attorneys' fees to the applicant to be paid

by the lien claimant. If the court determines that the lien is not frivolous and was made with reasonable cause, and

is not clearly excessive, the court shall issue an order so stating and

awarding costs and reasonable attorneys' fees to the lien claimant to be

paid by the applicant.

(5) Proceedings under this section shall not affect other rights and

remedies available to the parties under this chapter or otherwise. RCW

60.04.081

Recording--Time--Contents of lien.

Every person claiming a lien under RCW 60.04.021 shall file for recording,

in the county where the subject property is located, a notice of claim

of lien not later than ninety days after the person has ceased to furnish

labor, professional services, materials, or equipment or the last date

on which employee benefit contributions were due. The notice of claim of

lien:

(b) The first and last date on which the labor, professional services,

materials, or equipment was furnished or employee benefit contributions

were due;

(d) The street address, legal description, or other description reasonably

calculated to identify, for a person familiar with the area, the location

of the real property to be charged with the lien;

(e) The name of the owner or reputed owner of the property, if known,

and, if not known, that fact shall be stated; and

(2) Shall be signed by the claimant or some person authorized to act

on his or her behalf who shall affirmatively state they have read the notice

of claim of lien and believe the notice of claim of lien to be true and

correct under penalty of perjury, and shall be acknowledged pursuant to

chapter 64.08 RCW. If the lien has been assigned, the name of the assignee

shall be stated. Where an action to foreclose the lien has been commenced

such notice of claim of lien may be amended as pleadings may be by order

of the court insofar as the interests of third parties are not adversely

affected by such amendment. A claim of lien substantially in the following

form shall be sufficient: See form WA-05-09 or WA-05A-09.

The period provided for recording the claim of lien is a period of

limitation and no action to foreclose a lien shall be maintained unless

the claim of lien is filed for recording within the ninety-day period stated.

The lien claimant shall give a copy of the claim of lien to the owner or

reputed owner by mailing it by certified or registered mail or by personal

service within fourteen days of the time the claim of lien is filed for

recording. Failure to do so results in a forfeiture of any right the claimant

may have to attorneys' fees and costs against the owner under RCW 60.04.181.

Separate residential units -- Time for filing.

When furnishing labor, professional services, materials, or equipment

for the construction of two or more separate residential units, the time

for filing claims of lien against each separate residential unit shall

commence to run upon the cessation of the furnishing of labor, professional

services, materials, or equipment on each residential unit, as provided

in this chapter. For the purposes of this section a separate residential

unit is defined as consisting of one residential structure together with

any garages or other outbuildings appurtenant thereto. RCW 60.04.101

Recording -- Fees.

The county auditor shall record the notice of claim of lien in the same

manner as deeds and other instruments of title are recorded under chapter

65.08 RCW. Notices of claim of lien for registered land need not

be recorded in the Torrens register. The county auditor shall charge

no higher fee for recording notices of claim of lien than other documents.

RCW

60.04.111

Lien -- Assignment.

Any lien or right of lien created by this chapter and the right of action

to recover therefor, shall be assignable so as to vest in the assignee

all rights and remedies of the assignor, subject to all defenses thereto

that might be made. RCW 60.04.121

Claims -- Designation of amount due.

In every case in which the notice of claim of lien is recorded against

two or more separate pieces of property owned by the same person or owned

by two or more persons jointly or otherwise, who contracted for the labor,

professional services, material, or equipment for which the notice of claim

of lien is recorded, the person recording the notice of claim of lien shall

designate in the notice of claim of lien the amount due on each piece of

property. Otherwise, the lien is subordinated to other liens that may be

established under this chapter. The lien of such claim does not extend

beyond the amount designated as against other creditors having liens upon

any of such pieces of property. RCW 60.04.131

Lien -- Duration -- Procedural limitations.

No lien created by this chapter binds the property subject to the lien

for a longer period than eight calendar months after the claim of lien

has been recorded unless an action is filed by the lien claimant within

that time in the superior court in the county where the subject property

is located to enforce the lien, and service is made upon the owner of the

subject property within ninety days of the date of filing the action; or,

if credit is given and the terms thereof are stated in the claim of lien,

then eight calendar months after the expiration of such credit; and in

case the action is not prosecuted to judgment within two years after the

commencement thereof, the court, in its discretion, may dismiss the action

for want of prosecution, and the dismissal of the action or a judgment

rendered thereon that no lien exists shall constitute a cancellation of

the lien. This is a period of limitation, which shall be tolled by

the filing of any petition seeking protection under Title Eleven, United

States Code by an owner of any property subject to the lien established

by this chapter. RCW 60.04.141

Rights of owner -- Recovery options.

The lien claimant shall be entitled to recover upon the claim recorded

the contract price after deducting all claims of other lien claimants to

whom the claimant is liable, for furnishing labor, professional services,

materials, or equipment; and in all cases where a claim of lien shall be

recorded under this chapter for labor, professional services, materials,

or equipment supplied to any lien claimant, he or she shall defend any

action brought thereupon at his or her own expense.

During the pendency of the action, the owner may withhold from the prime

contractor the amount of money for which a claim is recorded by any subcontractor,

supplier, or laborer. In case of judgment against the owner or the

owner's property, upon the lien, the owner shall be entitled to deduct

from sums due to the prime contractor the principal amount of the judgment

from any amount due or to become due from the owner to the prime contractor

plus such costs, including interest and attorneys' fees, as the court deems

just and equitable, and the owner shall be entitled to recover back from

the prime contractor the amount for which a lien or liens are established

in excess of any sum that may remain due from the owner to the prime contractor. RCW

60.04.151

Bond in lieu of claim.

Any owner of real property subject to a recorded claim of lien under

this chapter, or contractor, subcontractor, lender, or lien claimant who

disputes the correctness or validity of the claim of lien may record, either

before or after the commencement of an action to enforce the lien, in the

office of the county recorder or auditor in the county where the claim

of lien was recorded, a bond issued by a surety company authorized to issue

surety bonds in the state. The surety shall be listed in the latest

federal department of the treasury list of surety companies acceptable

on federal bonds, published in the Federal Register, as authorized to issue

bonds on United States government projects with an underwriting limitation,

including applicable reinsurance, equal to or greater than the amount of

the bond to be recorded. The bond shall contain a description of

the claim of lien and real property involved, and be in an amount equal

to the greater of five thousand dollars or two times the amount of the

lien claimed if it is ten thousand dollars or less, and in an amount equal

to or greater than one and one-half times the amount of the lien if it

is in excess of ten thousand dollars. If the claim of lien affects more than one parcel of real property and is

segregated to each parcel, the bond may be segregated the same as in the

claim of lien. A separate bond shall be required for each claim of

lien made by separate claimants. However, a single bond may be used

to guarantee payment of amounts claimed by more than one claim of lien

by a single claimant so long as the amount of the bond meets the requirements

of this section as applied to the aggregate sum of all claims by such claimant.

The condition of the bond shall be to guarantee payment of any judgment

upon the lien in favor of the lien claimant entered in any action to recover

the amount claimed in a claim of lien, or on the claim asserted in the

claim of lien. The effect of recording a bond shall be to release

the real property described in the notice of claim of lien from the lien

and any action brought to recover the amount claimed. Unless otherwise

prohibited by law, if no action is commenced to recover on a lien within

the time specified in RCW 60.04.141, the surety shall be discharged from

liability under the bond. If an action is timely commenced, then

on payment of any judgment entered in the action or on payment of the full

amount of the bond to the holder of the judgment, whichever is less, the

surety shall be discharged from liability under the bond.

Nothing in this section shall in any way prohibit or limit the use of

other methods, devised by the affected parties to secure the obligation

underlying a claim of lien and to obtain a release of real property from

a claim of lien. RCW 60.04.161

Foreclosure -- Parties.

The lien provided by this chapter, for which claims of lien have been

recorded, may be foreclosed and enforced by a civil action in the court

having jurisdiction in the manner prescribed for the judicial foreclosure

of a mortgage. The court shall have the power to order the sale of

the property. In any action brought to foreclose a lien, the owner

shall be joined as a party. The interest in the real property of

any person who, prior to the commencement of the action, has a recorded

interest in the property, or any part thereof, shall not be foreclosed

or affected unless they are joined as a party.

A person shall not begin an action to foreclose a lien upon any property

while a prior action begun to foreclose another lien on the same property

is pending, but if not made a party plaintiff or defendant to the prior

action, he or she may apply to the court to be joined as a party thereto,

and his or her lien may be foreclosed in the same action. The filing

of such application shall toll the running of the period of limitation

established by RCW 60.04.141 until disposition of the application or other

time set by the court. The court shall grant the application for

joinder unless to do so would create an undue delay or cause hardship which

cannot be cured by the imposition of costs or other conditions as the court

deems just. If a lien foreclosure action is filed during the pendency

of another such action, the court may, on its own motion or the motion

of any party, consolidate actions upon such terms and conditions as the

court deems just, unless to do so would create an undue delay or cause

hardship which cannot be cured by the imposition of costs or other conditions.

If consolidation of actions is not permissible under this section, the

lien foreclosure action filed during the pendency of another such action

shall not be dismissed if the filing was the result of mistake, inadvertence,

surprise, excusable neglect, or irregularity. An action to foreclose

a lien shall not be dismissed at the instance of a plaintiff therein to

the prejudice of another party to the suit who claims a lien. RCW 60.04.171

Rank of lien -- Application of proceeds -- Attorneys' fees.

(1) In every case in which different construction liens are claimed

against the same property, the court shall declare the rank of such lien

or class of liens, which liens shall be in the following order:

(2) The proceeds of the sale of property must be applied to each lien

or class of liens in order of its rank and, in an action brought to foreclose

a lien, pro rata among each claimant in each separate priority class.

A personal judgment may be rendered against any party personally liable

for any debt for which the lien is claimed. If the lien is established,

the judgment shall provide for the enforcement thereof upon the property

liable as in the case of foreclosure of judgment liens. The amount

realized by such enforcement of the lien shall be credited upon the proper

personal judgment. The deficiency, if any, remaining unsatisfied,

shall stand as a personal judgment, and may be collected by execution against

any party liable therefor.

(3) The court may allow the prevailing party in the action, whether

plaintiff or defendant, as part of the costs of the action, the moneys

paid for recording the claim of lien, costs of title report, bond costs,

and attorneys' fees and necessary expenses incurred by the attorney in

the superior court, court of appeals, supreme court, or arbitration, as

the court or arbitrator deems reasonable. Such costs shall have the

priority of the class of lien to which they are related, as established

by subsection (1) of this section.

(4) Real property against which a lien under this chapter is enforced

may be ordered sold by the court and the proceeds deposited into the registry

of the clerk of the court, pending further determination respecting distribution

of the proceeds of the sale. RCW 60.04.181

Lien -- Effect on community interest.

The claim of lien, when filed as required by this chapter, shall be

notice to the husband or wife of the person who appears of record to be

the owner of the property sought to be charged with the lien, and shall

subject all the community interest of both husband and wife to the lien. RCW

60.04.211

Liberal construction -- 1991 c 281.

RCW 19.27.095, 60.04.230, and 60.04.011 through 60.04.226 and 60.04.261

are to be liberally construed to provide security for all parties intended

to be protected by their provisions. RCW 60.04.900