This office lease form states that the tenant shall exercise its option to renew this lease upon written notice given to the landlord no less than eighteen (18) months before the end of the lease term.

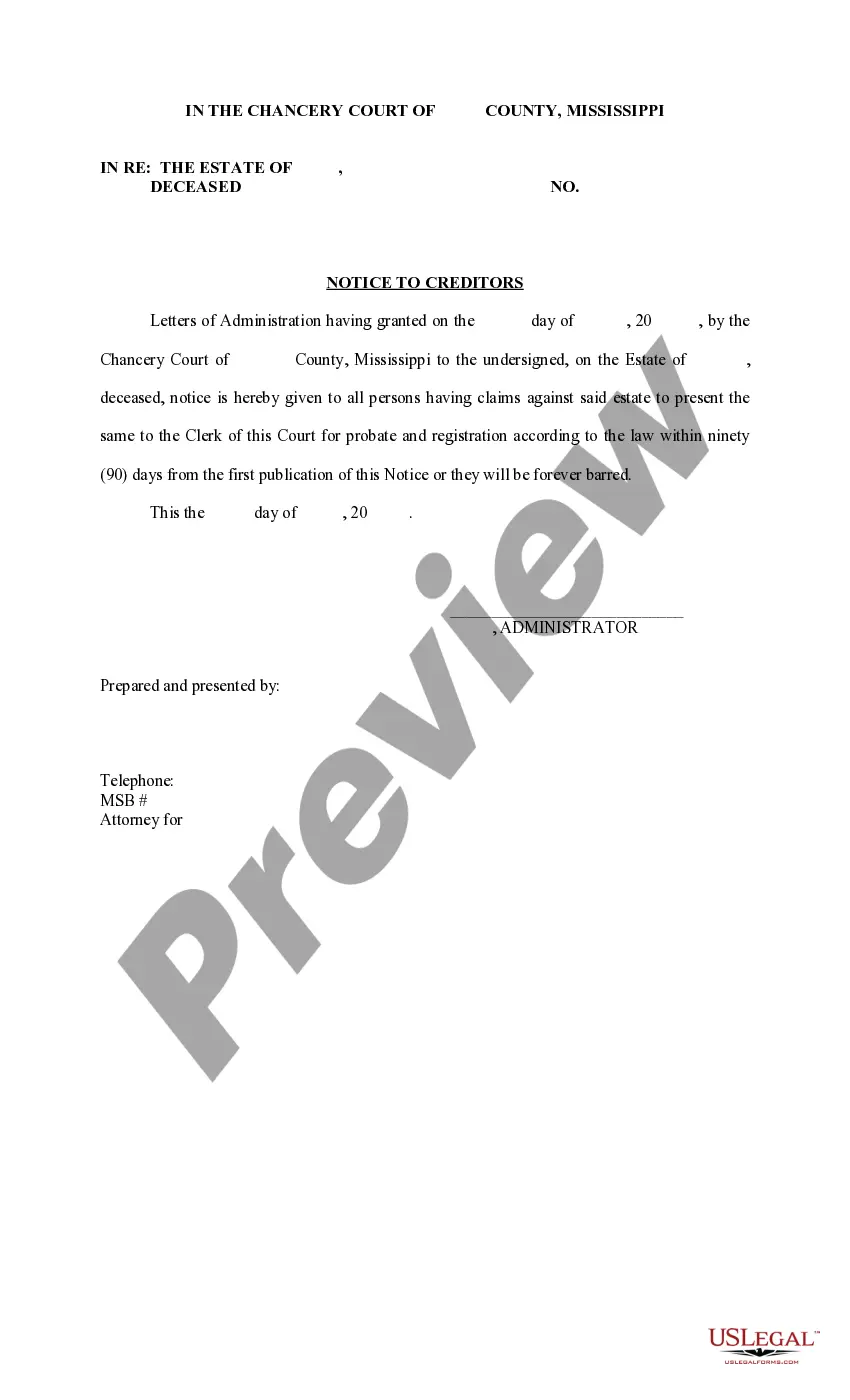

Vermont Notice of Intention to Exercise Option

Description

How to fill out Notice Of Intention To Exercise Option?

Choosing the best legitimate document template can be quite a struggle. Obviously, there are a variety of layouts accessible on the Internet, but how will you obtain the legitimate form you want? Utilize the US Legal Forms internet site. The assistance delivers a huge number of layouts, including the Vermont Notice of Intention to Exercise Option, which can be used for business and private requirements. Each of the varieties are examined by specialists and satisfy federal and state needs.

In case you are already authorized, log in for your account and click on the Download switch to obtain the Vermont Notice of Intention to Exercise Option. Use your account to search through the legitimate varieties you possess bought formerly. Go to the My Forms tab of the account and get an additional version from the document you want.

In case you are a new consumer of US Legal Forms, listed below are basic guidelines that you can comply with:

- Initial, ensure you have chosen the proper form for the metropolis/state. You are able to look over the shape using the Review switch and study the shape outline to guarantee it is the right one for you.

- In case the form will not satisfy your expectations, utilize the Seach area to get the right form.

- When you are sure that the shape would work, click on the Purchase now switch to obtain the form.

- Opt for the prices prepare you would like and type in the required info. Create your account and buy an order using your PayPal account or charge card.

- Pick the data file structure and down load the legitimate document template for your device.

- Full, revise and print and sign the attained Vermont Notice of Intention to Exercise Option.

US Legal Forms will be the biggest collection of legitimate varieties that you can find different document layouts. Utilize the company to down load appropriately-manufactured documents that comply with status needs.

Form popularity

FAQ

To exercise an option, you simply advise your broker that you wish to exercise the option in your contract. Your broker will initiate an exercise notice, which informs the seller or writer of the contract that you are exercising the option.

If you don't exercise your options before they expire, you'll lose them. That means you may miss an opportunity to build wealth if your company stock is trading above your exercise price. Sadly, it's not uncommon for stock options holders to leave their options unexercised.

Exercising stock options means you're purchasing shares of a company's stock at a set price. If you decide to exercise your stock options, you'll own a piece of the company. Owning stock options is not the same as owning shares outright.

A type of employee stock option is given to startup employees as part of their equity compensation. It allows them to purchase company stock at a discounted price and provides tax benefits when the options are exercised.

For example, a call option with a strike price of $50 would be in-the-money if the market price is $55. The investor who is exercising the call option would have the opportunity to purchase the stock at $50 and therefore earn $5. An in-the-money put option is when the exercise price is above the market price.