Vermont Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

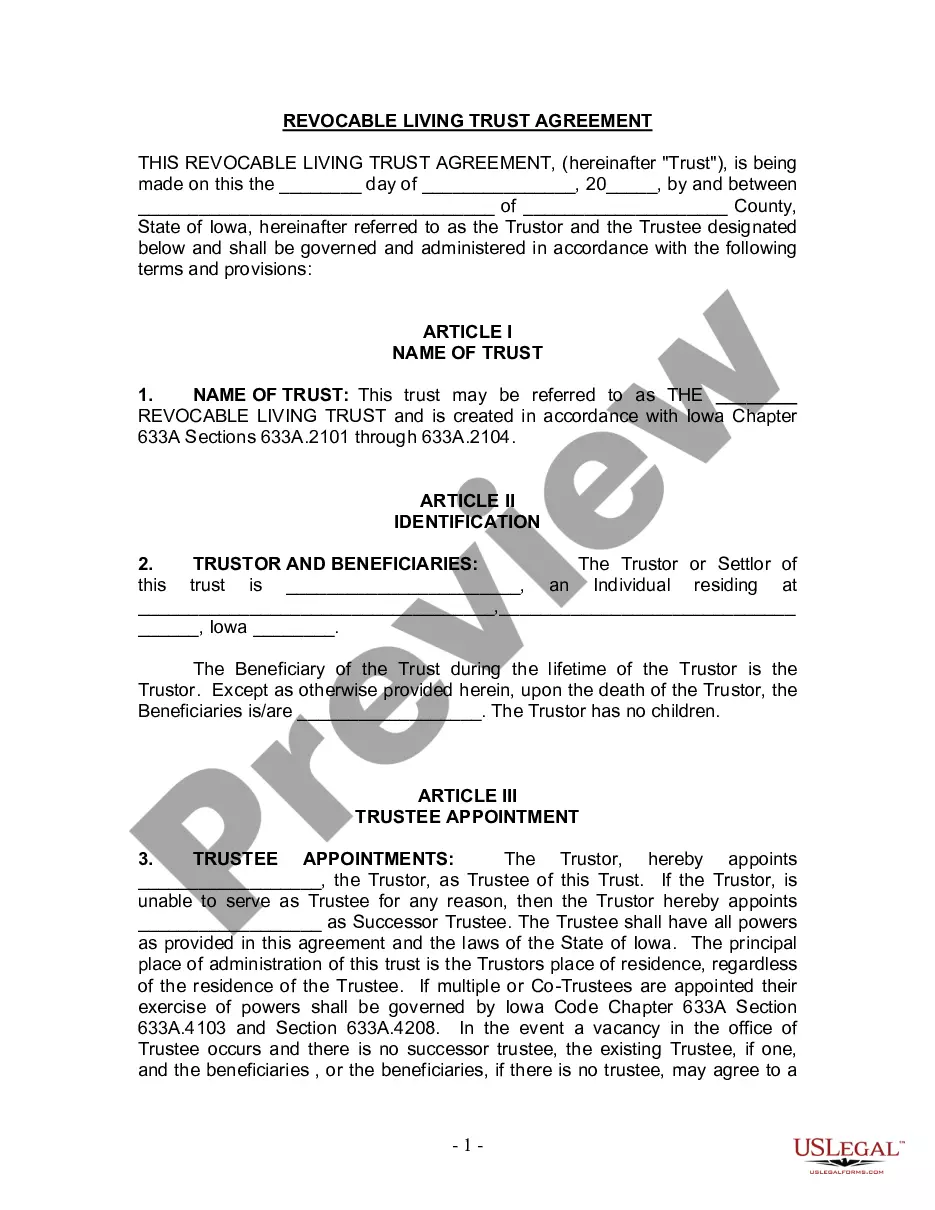

Are you currently in a placement where you will need files for either company or individual uses just about every day time? There are tons of authorized document templates available on the net, but getting versions you can depend on isn`t simple. US Legal Forms gives a huge number of type templates, just like the Vermont Gift Deed of Nonparticipating Royalty Interest with No Warranty, that are published in order to meet federal and state specifications.

In case you are already informed about US Legal Forms site and get a free account, merely log in. Following that, you can download the Vermont Gift Deed of Nonparticipating Royalty Interest with No Warranty format.

Unless you have an accounts and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you require and ensure it is for that right area/region.

- Make use of the Review button to examine the form.

- Browse the explanation to ensure that you have chosen the proper type.

- If the type isn`t what you`re searching for, utilize the Look for industry to obtain the type that suits you and specifications.

- Once you get the right type, simply click Purchase now.

- Choose the pricing strategy you need, complete the specified information and facts to generate your bank account, and buy your order utilizing your PayPal or charge card.

- Select a hassle-free file structure and download your copy.

Discover every one of the document templates you may have purchased in the My Forms food selection. You may get a extra copy of Vermont Gift Deed of Nonparticipating Royalty Interest with No Warranty anytime, if needed. Just click the necessary type to download or printing the document format.

Use US Legal Forms, probably the most comprehensive assortment of authorized forms, to save lots of time as well as avoid mistakes. The services gives professionally manufactured authorized document templates that can be used for a selection of uses. Produce a free account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

There is no gift tax in Vermont. The federal gift tax has a $16,000 exemption per year per recipient in 2022, increasing to $17,000 in 2023.

To properly convey a deed the deed must be signed in front of a notary and recorded in the county clerks office. If a survey is referenced in the deed, that survey should also be recorded. If a deed divides a parcel a survey should be recorded with the deed.

Good to know: Beware that a Gift Deed cannot be revoked. Once the property is given away, you cannot get it back unless the person who received it transfers it back.

In order for a gift deed to be valid they must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift.

You need to get a gift deed drafted by a lawyer then and then get that gift deed registered with the registrar or sub-registrar for making the gift deed valid and legal by paying the requisite stamp duty and registration charges.

Both parties should mention all relevant information like address, name, date of birth and signature. A gift deed should have two witnesses and their signatures. A gift deed should be printed on stamp paper once the amount is paid. Once that is done, it should be registered at the registrar's or sub-registrar's office.

A primary residence in Vermont pays at a varying rate ? 0.5% on the first $100,000 in value and then 1.45% (really 1.25% transfer tax and 0.2% clean water fee) on the remaining value. Properties other than a primary residence pay the 1.45% on all value.

Rate Schedule Type of PropertyValue Taxed1.25% Property Transfer TaxPrincipal ResidenceMarginal Value > $100,000?Principal Residence Purchased w/ VHFA, VCTF, or USDA Assistance$0-$110,000$110,000 - $200,000?Marginal Value > $200,000?2 more rows