Vermont Data Entry Employment Contract - Self-Employed Independent Contractor

Description

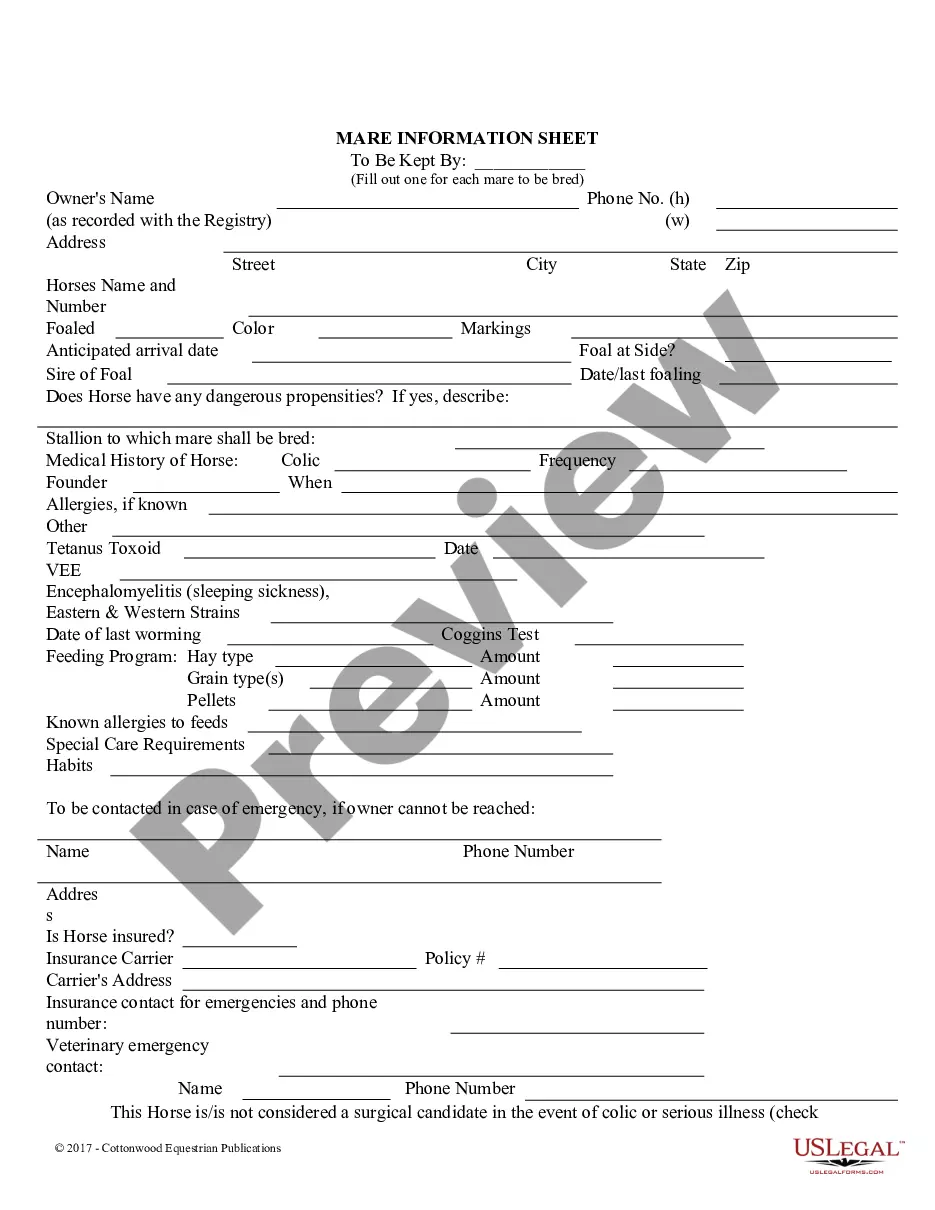

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Are you in a location where you find yourself needing documents for both business or personal purposes almost daily.

There are numerous legal document templates available online, but locating forms you can trust isn't easy.

US Legal Forms provides thousands of form templates, including the Vermont Data Entry Employment Contract - Self-Employed Independent Contractor, which can be tailored to meet federal and state regulations.

Once you find the appropriate form, click Acquire now.

Select the payment plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Vermont Data Entry Employment Contract - Self-Employed Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you require and verify it is for your correct city/state.

- Use the Preview button to review the document.

- Check the description to ensure you have selected the right form.

- If the form isn't what you are looking for, use the Search field to locate a form that meets your specifications.

Form popularity

FAQ

Yes, a Vermont Data Entry Employment Contract - Self-Employed Independent Contractor is essential for protecting both parties involved. A contract outlines the terms of your agreement, clarifies responsibilities, and helps prevent misunderstandings. Without a contract, you might face disputes over payment, project scope, or deadlines. Using US Legal Forms, you can create a comprehensive contract that secures your interests and establishes clear communication.

To write a Vermont Data Entry Employment Contract - Self-Employed Independent Contractor, start by clearly defining the scope of work and the payment terms. Include the duration of the contract and any specific obligations or deliverables expected from both parties. Make sure to address issues such as confidentiality, termination, and dispute resolution. Utilizing a platform like US Legal Forms can simplify this process by providing templates that ensure you include all necessary elements.

The new federal rule on independent contractors emphasizes the criteria used to identify who qualifies as an independent contractor versus an employee. This rule affects how businesses hire and engage workers, potentially impacting the compensation and benefits independent contractors receive. When working under these new guidelines, a Vermont Data Entry Employment Contract - Self-Employed Independent Contractor can ensure that your classification is clear and compliant with the latest laws. Staying informed about these changes can safeguard your work arrangements and enhance your business opportunities.

The terms self-employed and independent contractor often refer to similar work situations, but they have subtle differences. Typically, an independent contractor operates under a specific contract, while self-employed individuals may manage their own business without formal agreements. Having a Vermont Data Entry Employment Contract - Self-Employed Independent Contractor can formalize your status and offer clear guidelines on expectations and compensation. Understanding these terms can enhance your professional reputation and help you navigate your work arrangements more effectively.

Freelance data entry jobs involve working on a project basis to input, update, or manage data for clients. These roles can be very flexible, allowing you to choose your hours and clients. When taking on such jobs, using a Vermont Data Entry Employment Contract - Self-Employed Independent Contractor can help clarify your responsibilities and protect your rights as a contractor. This contract ensures that both you and your client understand the terms of your engagement clearly.

Yes, being a contractor is classified as self-employment. When you operate under a Vermont Data Entry Employment Contract - Self-Employed Independent Contractor, you manage your business activities independently. This means you have the autonomy to choose your clients and the flexibility to set your hours. Embracing this status provides unique opportunities to thrive in your career.

Yes, independent contractors are subject to self-employment tax on their earnings. This tax covers Social Security and Medicare contributions, which you would typically see deducted from a regular paycheck. When working under a Vermont Data Entry Employment Contract - Self-Employed Independent Contractor, set aside funds to meet these tax obligations. Understanding this responsibility is crucial for financial planning.

Recent changes in regulations for the self-employed may affect tax obligations and benefits. It's essential to stay informed about any updates related to the Vermont Data Entry Employment Contract - Self-Employed Independent Contractor. New rules may introduce additional reporting requirements or alter how deductions work. Consulting a tax advisor can help you navigate these changes effectively.

Absolutely, having a contract while being self-employed is common and highly beneficial. A Vermont Data Entry Employment Contract - Self-Employed Independent Contractor ensures that both you and your client understand the work expectations, payment terms, and project deadlines. This not only fosters professional relationships but also safeguards your rights and responsibilities as a contractor.

Yes, you can be self-employed and still work under a contract. A Vermont Data Entry Employment Contract - Self-Employed Independent Contractor clearly outlines the terms of your relationship with clients. It provides structure and clarity, allowing you to manage multiple contracts while maintaining your independence. Contracts protect both parties and define the obligations and expectations.