Vermont Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

Finding the correct official document template can be a challenge.

Of course, there are numerous designs available online, but how do you locate the official form you require.

Utilize the US Legal Forms website. The service offers a vast selection of templates, such as the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee, which can serve both business and personal purposes.

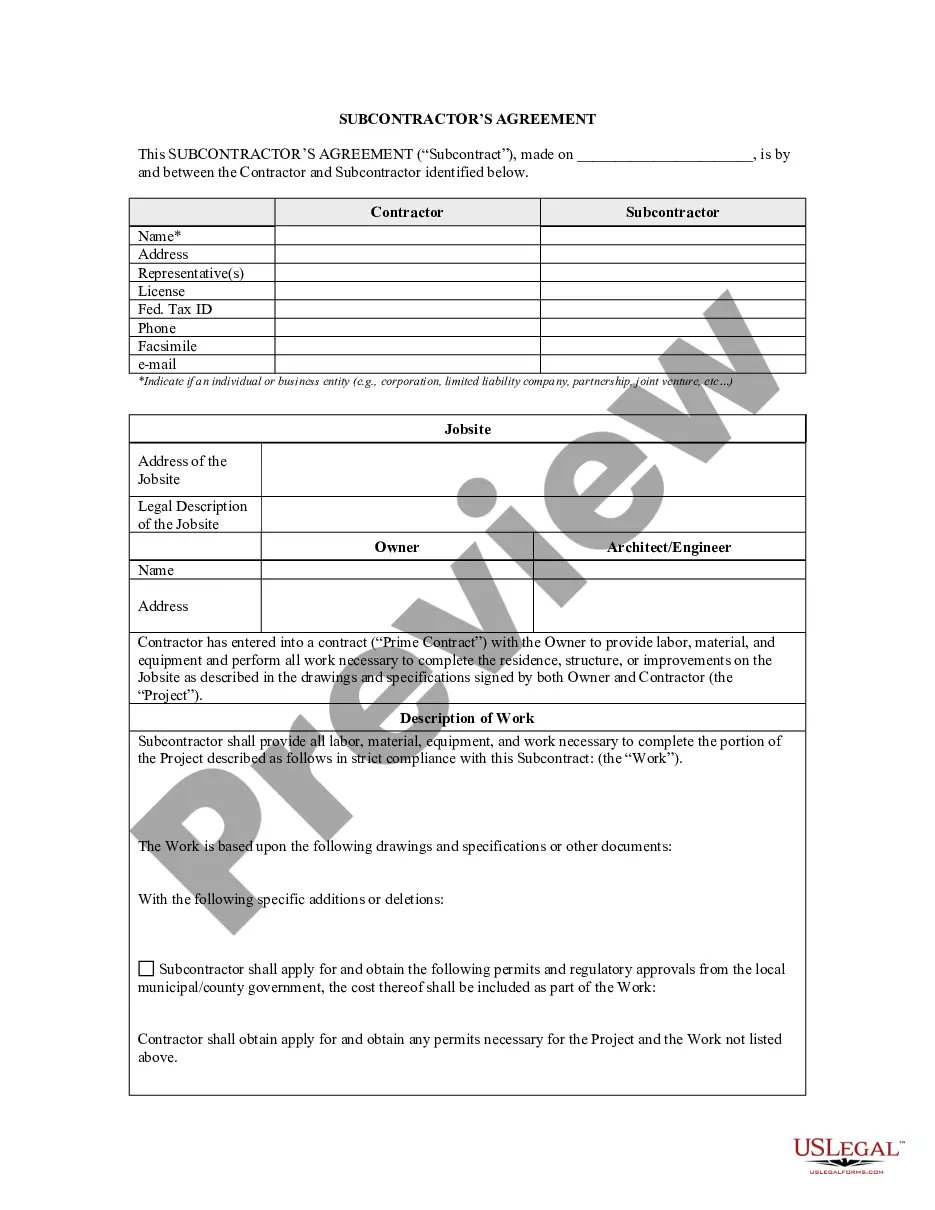

You can view the form using the Preview button and examine the form details to confirm it suits your needs.

- All templates are reviewed by experts and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee.

- Use your account to browse the official forms you have previously ordered.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your area/region.

Form popularity

FAQ

For payroll deductions, you should complete the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee. This form serves as a comprehensive guide for your employer to administer deductions related to taxes and other employee benefits. Properly filling out this form ensures that your deductions align with your financial goals and obligations.

The primary form for payroll deductions in Vermont is the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee. This form allows employees to specify various deductions, such as health insurance or retirement contributions, along with their tax withholdings. Completing this form accurately helps streamline payroll processes and supports proper tax withholding.

Employees typically fill out a W4, which is used for withholding tax calculations, rather than a W9. The W9 is primarily for independent contractors to provide their taxpayer identification information. If you are an employee, focus on completing the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee and the W4 to ensure correct tax treatment.

Yes, Vermont allows itemized deductions, similar to federal tax regulations. However, the state has specific rules and limitations regarding which deductions qualify. To maximize your deductions, refer to Vermont's tax guidelines and ensure your Vermont Payroll Deduction Authorization Form for Optional Matters - Employee accurately accounts for any itemized deductions you wish to claim.

The percentage of tax withholding depends on your income, number of dependents, and filing status. Use the IRS withholding calculator or consult a tax professional for personalized advice. It's important to choose a percentage that helps you manage your tax obligations and avoid surprises during tax season, ensuring that your Vermont Payroll Deduction Authorization Form for Optional Matters - Employee reflects your needs.

To fill out a W4 for deductions, first, provide your personal information, including your name and Social Security number. Next, use the worksheet included with the form to determine your allowances or deductions based on your financial situation. Finally, submit the completed W4 to your employer to ensure your Vermont Payroll Deduction Authorization Form for Optional Matters - Employee aligns with your tax withholding preferences.

All employees should complete the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee to ensure accurate tax withholding from their paychecks. This form allows employees to specify their desired deductions for state and federal taxes. By filling it out correctly, you help your employer process payroll efficiently and comply with tax laws.

Section 113 of the income tax Act outlines provisions for deductions related to employee payroll. It is crucial for employers to understand how to process the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee effectively. This section also explains how these deductions can impact an employee's taxable income, leading to potential tax savings. Utilizing this section correctly can streamline payroll management and enhance compliance.

VT Form 113 is used for reporting and authorizing payroll deductions in accordance with Section 113. This form is crucial for anyone who wants to specify optional payroll deductions from their paycheck. By using the Vermont Payroll Deduction Authorization Form for Optional Matters - Employee, you can ensure that your preferences are officially recorded and processed.

Failing to comply with Section 113 regulations can lead to penalties, including fines or increased taxation rates. Understanding the consequences of non-compliance is vital for you as an employee. The Vermont Payroll Deduction Authorization Form for Optional Matters - Employee helps you adhere to these rules, minimizing the risk of penalties.