Vermont Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

If you require to summarize, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the site’s user-friendly and convenient search feature to locate the documents you need.

Various templates for business and personal purposes are classified by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the Vermont Qualified Written RESPA Request to Dispute or Validate Debt in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Vermont Qualified Written RESPA Request to Dispute or Validate Debt.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

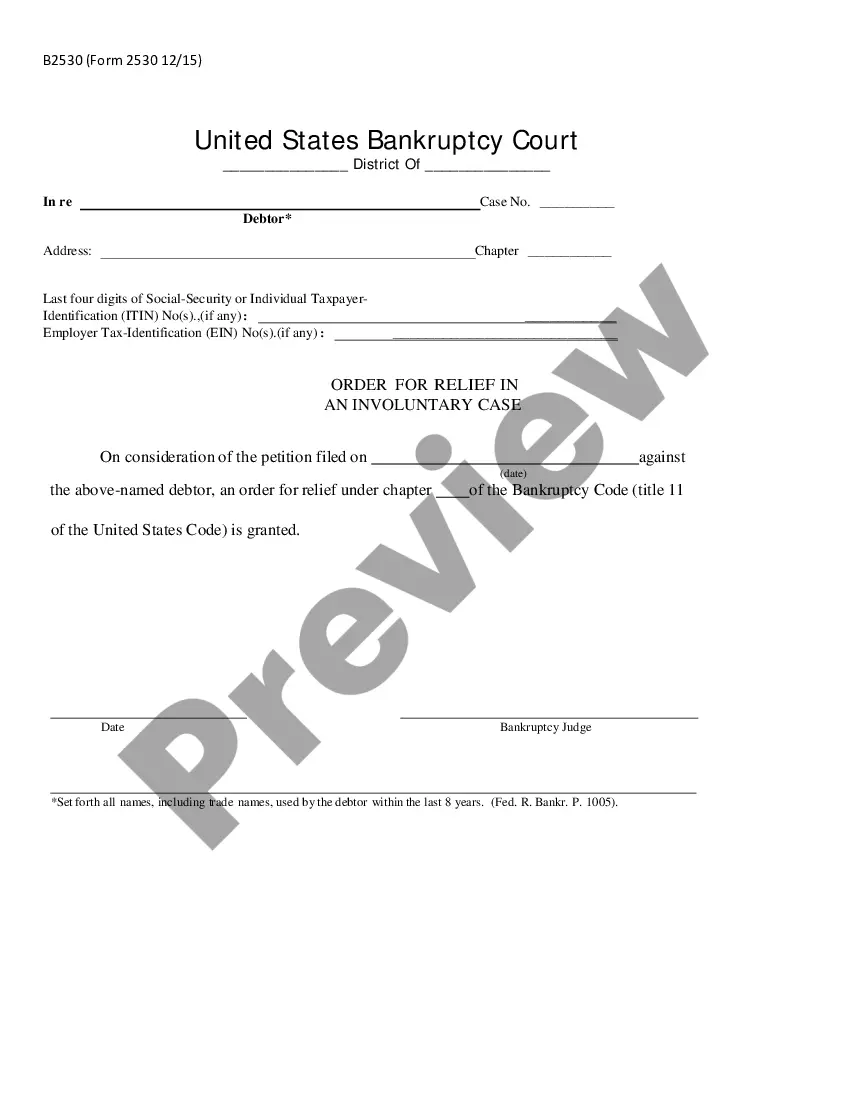

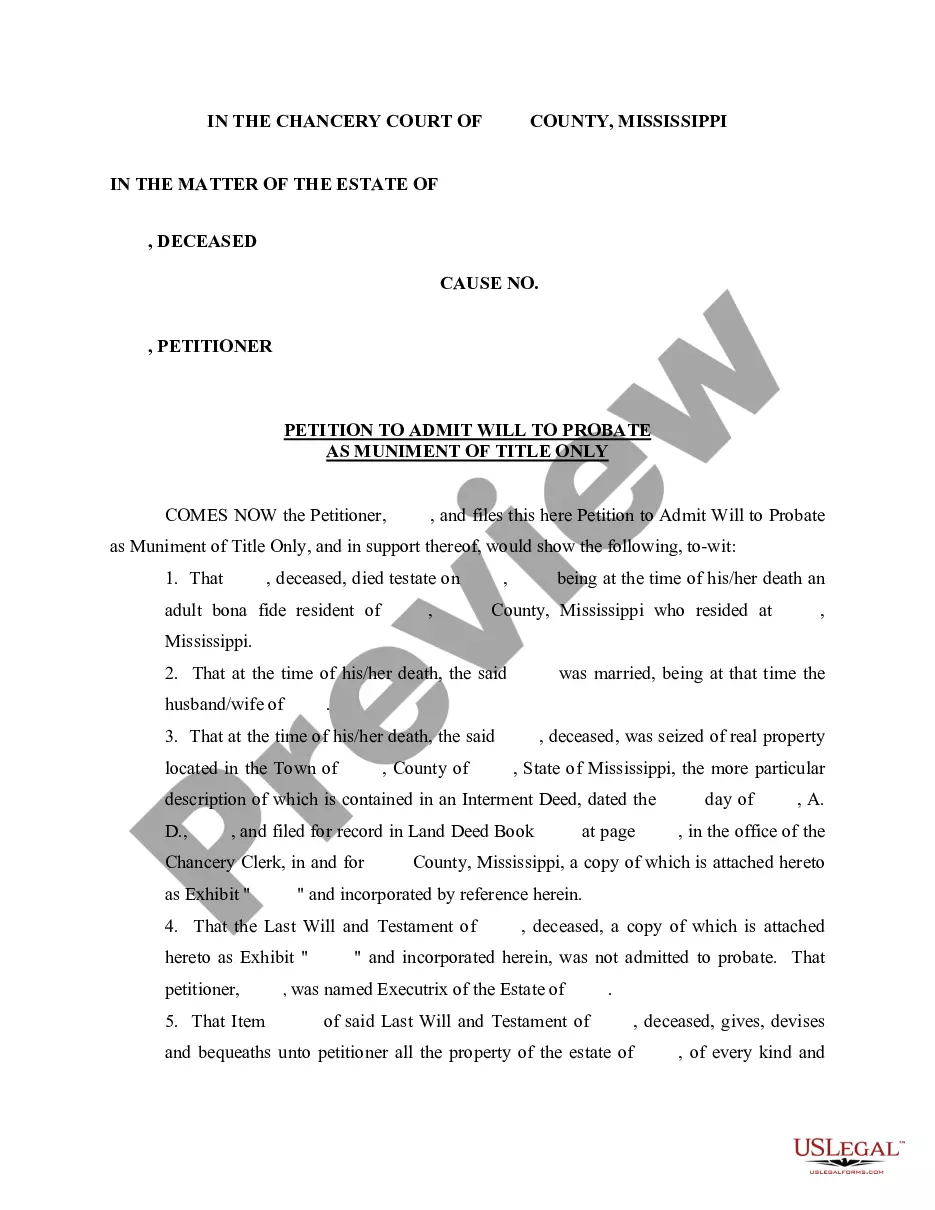

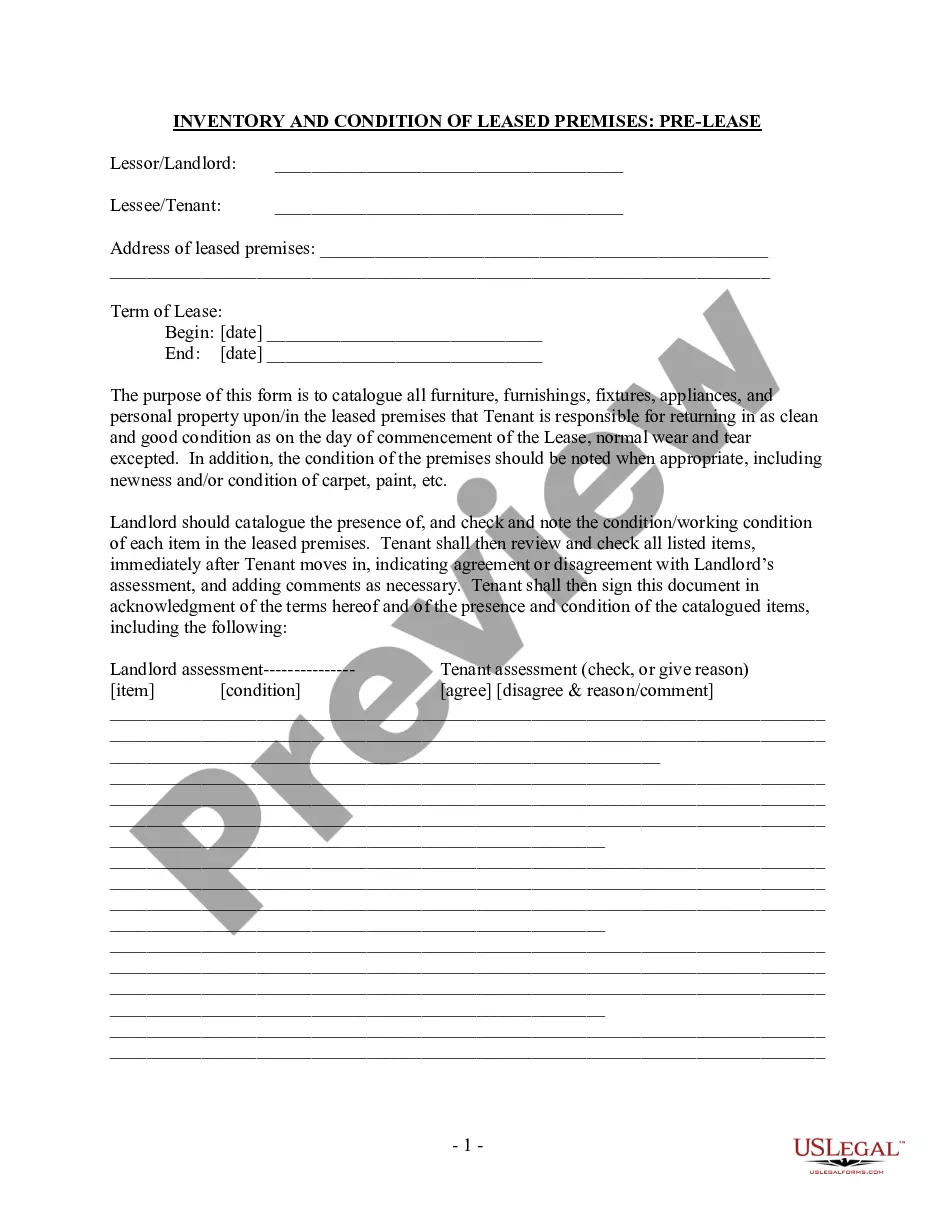

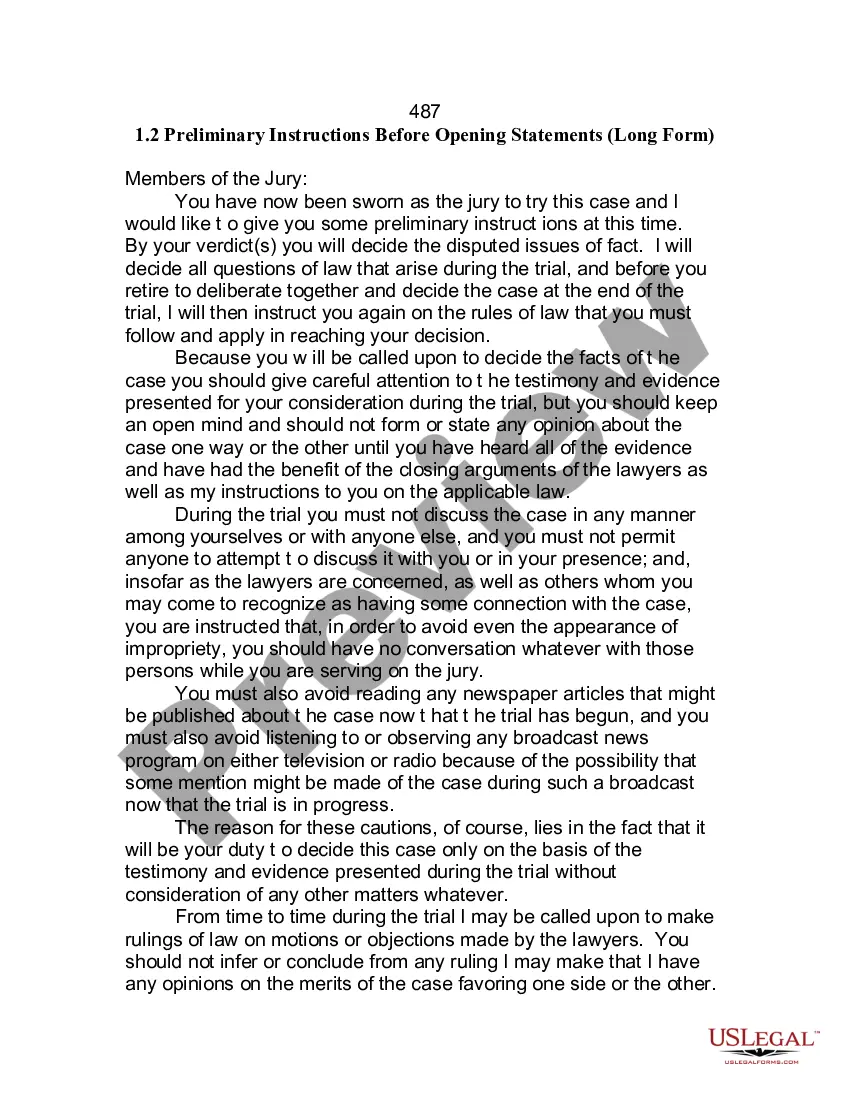

- Step 2. Utilize the Preview feature to review the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A lender must provide the necessary RESPA information to a buyer within three business days of receiving a Vermont Qualified Written RESPA Request to Dispute or Validate Debt. This timely response is crucial for helping buyers understand their rights and obligations regarding their mortgage. It ensures that buyers receive the information needed to make informed decisions about their financial situations. If you need support with creating requests, consider utilizing the tools available on the US Legal Forms platform.

Mortgage servicers must provide a timely response to a Vermont Qualified Written RESPA Request to Dispute or Validate Debt. This requirement ensures that servicers address any inquiries or disputes regarding mortgage payments or servicing issues. By adhering to this standard, servicers help protect consumers' rights and promote transparency in the mortgage process. If you need assistance with navigating these requirements, US Legal Forms offers resources to guide you through the process.

When writing a dispute letter to a mortgage company, begin with your details and the lender's information. Clearly state the issue you want to address, provide supporting evidence, and ask for a specific action or resolution. A properly formatted Vermont Qualified Written RESPA Request to Dispute or Validate Debt will present your case effectively and ensures the lender treats your dispute seriously.

A Vermont Qualified Written RESPA Request to Dispute or Validate Debt can temporarily halt foreclosure proceedings. Once you submit this request, it prompts the lender to cease foreclosure actions until they address your concerns. This pause allows you to explore your options and seek resolution effectively without the pressure of losing your home.

Collectors are required by Fair Debt Collection Practices Act to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter. If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Within five days of first contacting you, debt collectors are required to send you a debt validation letter if they haven't already provided the information verbally. A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt.