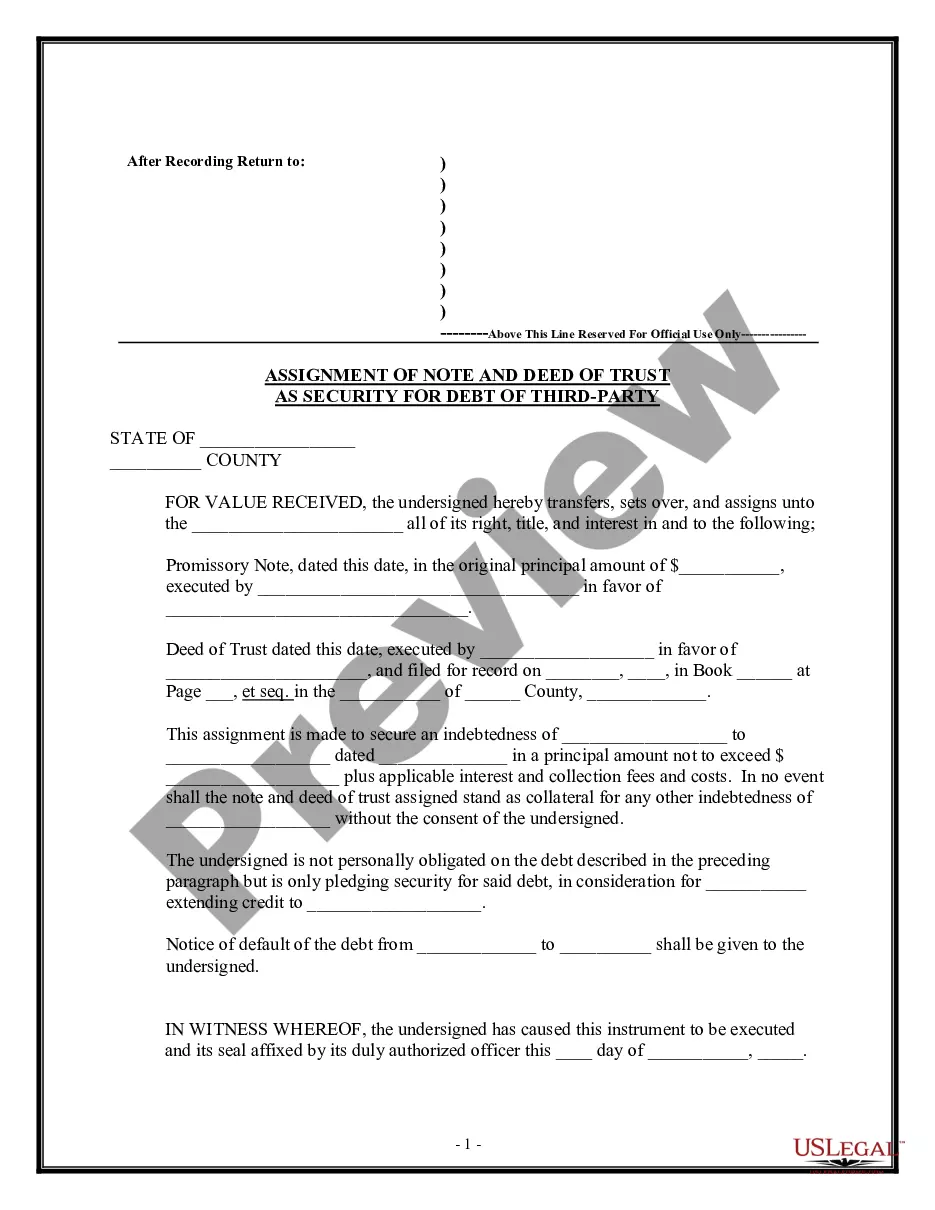

Vermont Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

You are able to devote hours on the web searching for the legitimate file format which fits the state and federal specifications you require. US Legal Forms gives thousands of legitimate varieties which are examined by specialists. It is simple to down load or print out the Vermont Assignment of Note and Deed of Trust as Security for Debt of Third Party from your support.

If you have a US Legal Forms bank account, you may log in and click the Obtain button. Next, you may full, change, print out, or indication the Vermont Assignment of Note and Deed of Trust as Security for Debt of Third Party. Each and every legitimate file format you get is your own property for a long time. To get yet another version associated with a bought type, proceed to the My Forms tab and click the related button.

If you work with the US Legal Forms website the very first time, follow the easy guidelines beneath:

- Initial, be sure that you have selected the best file format for that region/area of your liking. Look at the type explanation to ensure you have chosen the appropriate type. If accessible, use the Preview button to look from the file format at the same time.

- If you wish to locate yet another variation from the type, use the Search discipline to find the format that meets your requirements and specifications.

- Upon having identified the format you would like, click on Acquire now to continue.

- Pick the rates plan you would like, enter your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your Visa or Mastercard or PayPal bank account to purchase the legitimate type.

- Pick the structure from the file and down load it to your device.

- Make adjustments to your file if necessary. You are able to full, change and indication and print out Vermont Assignment of Note and Deed of Trust as Security for Debt of Third Party.

Obtain and print out thousands of file layouts while using US Legal Forms website, that provides the greatest selection of legitimate varieties. Use professional and state-distinct layouts to handle your small business or specific requires.

Form popularity

FAQ

A deed of trust is satisfied when the debt it secures is paid or when the obligation it secures is fulfilled. A deed of trust is no longer a lien on the property if the debt or obligation it secures has been satisfied but it will remain a cloud on title until removed from the chain of title.

A deed of trust, or security deed, as it is known in some jurisdictions, is a form of mortgage. A borrower of money signs a promissory note demonstrating the debt owed to the lender. The promissory note will generally recite the purpose of the loan and indicate that it is secured by real property.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

But how will the Trust Deed have affected your credit rating, and what can you do to improve the situation? A Trust Deed remains on your credit file for six years from its start date, alongside previous default notices, and before you're discharged you won't be able to obtain credit.

The good news is that it's possible to obtain a mortgage after a Trust Deed, but it will take some time and planning.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

What is the Difference Between a Deed and a Deed of Trust? The primary difference between a deed and a deed of trust is the purpose of each document. A deed transfers ownership of a property from one party to another, while a deed of trust secures a loan on a property.

At the end of the trust deed, your trustee will decide if you can be discharged from the trust deed. To be discharged you must have met all the agreed conditions, such as making payments on time.