Vermont Complex Will - Income Trust for Spouse

Description

How to fill out Complex Will - Income Trust For Spouse?

If you wish to total, down load, or printing authorized record web templates, use US Legal Forms, the greatest assortment of authorized varieties, which can be found on the web. Take advantage of the site`s easy and handy research to find the papers you will need. Numerous web templates for enterprise and person reasons are categorized by categories and states, or keywords and phrases. Use US Legal Forms to find the Vermont Complex Will - Income Trust for Spouse in a handful of mouse clicks.

If you are previously a US Legal Forms customer, log in to the account and click on the Download key to get the Vermont Complex Will - Income Trust for Spouse. Also you can accessibility varieties you in the past saved inside the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for the right city/nation.

- Step 2. Use the Review option to check out the form`s articles. Don`t neglect to learn the outline.

- Step 3. If you are not happy with all the develop, make use of the Look for field near the top of the display screen to discover other models of the authorized develop design.

- Step 4. After you have identified the shape you will need, select the Acquire now key. Select the pricing program you choose and include your qualifications to register for the account.

- Step 5. Procedure the purchase. You may use your bank card or PayPal account to complete the purchase.

- Step 6. Pick the formatting of the authorized develop and down load it in your gadget.

- Step 7. Full, edit and printing or indicator the Vermont Complex Will - Income Trust for Spouse.

Each authorized record design you buy is yours permanently. You may have acces to each develop you saved with your acccount. Click on the My Forms segment and choose a develop to printing or down load again.

Contend and down load, and printing the Vermont Complex Will - Income Trust for Spouse with US Legal Forms. There are thousands of specialist and condition-distinct varieties you may use for your enterprise or person requirements.

Form popularity

FAQ

Washington has the highest estate tax at 20%, which is applied to the portion of an estate's value greater than $11,193,000. Inheritance tax rates depend on the beneficiary's relation to the deceased, and, in each state, certain types of relationships are exempt from inheritance tax.

Vermont Estate Tax Exemption If your estate is worth less than $5 million, it will not be subject to estate tax in Vermont. Even if your estate happens to be more than $5 million, only the amount over $5 million will be subject to the estate tax, which is applied at a flat rate of 16%.

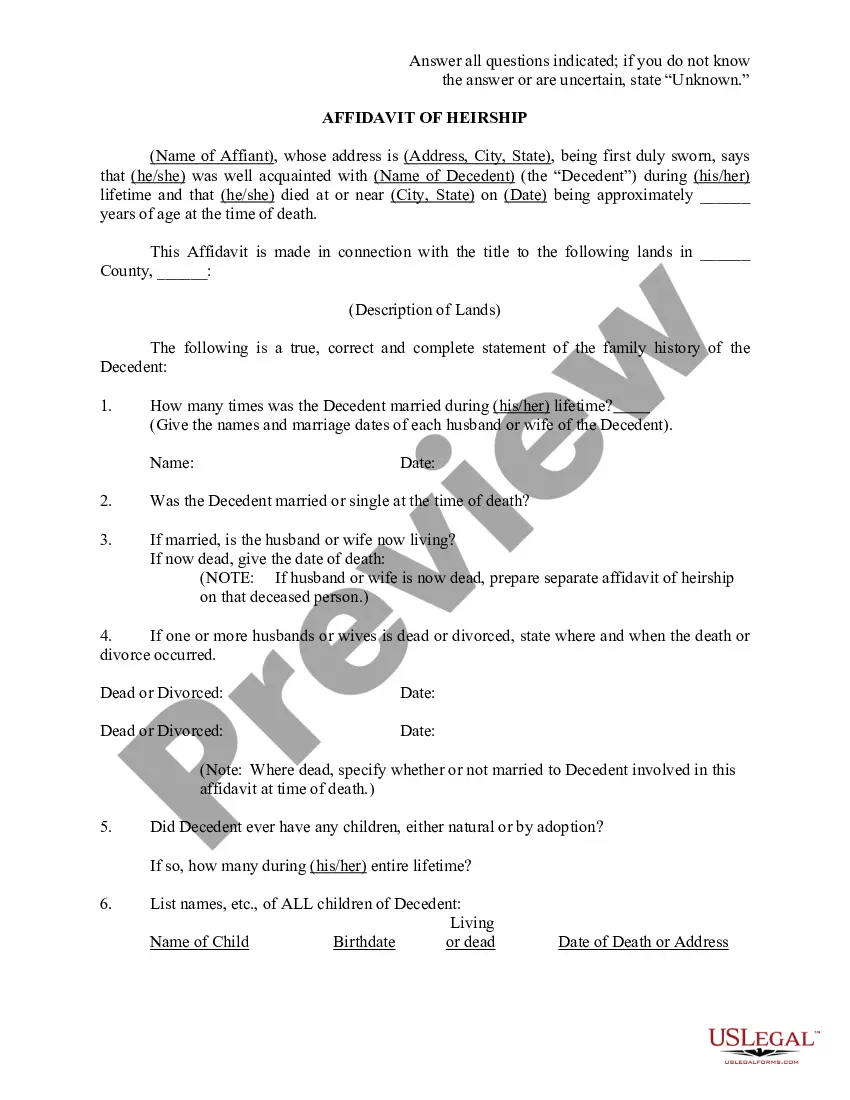

A marital trust is a legal entity established to pass assets to a surviving spouse or children/grandchildren. When a spouse dies, their assets are moved into the trust. A general power of appointment, an estate trust, and a QTIP trust are three types of marital trusts.

A marital trust (also known as an A trust) is a type of trust that is used by married couples, usually in conjunction with a bypass trust, to minimize federal estate tax, allow the surviving spouse to benefit from family wealth during his or her continuing life and to ensure assets ultimately pass to individuals ...

In order to qualify for the marital deduction, the property must pass from the decedent to the surviving spouse, and be included in the decedent's gross estate. They then discussed each requirement and added that the property must also not be a nondeductible terminable interest.

Here are 4 ways to protect your inheritance from taxes: See if the alternate valuation date will help. For tax purposes, the estates are evaluated based on their fair market value at the time of the decedent's death. ... Transfer your assets into a trust. ... Minimize IRA distributions. ... Make charitable gifts. ... Next steps for you.

Here are ten common methods to minimize estate taxes for your estate upon your death. Marital Transfers. ... Lifetime Gifts to Children and Grandchildren. ... Gifting to Minors. ... Marital Trusts (AB Trusts and QTIP Trusts) ... Irrevocable Life Insurance Trust (ILIT) ... Family Limited Partnership. ... Private Annuity.

Charitable remainder trusts (CRTs) are often used for highly appreciated assets, because they help divert capital gains taxes as well as estate taxes. They may be a good choice for real estate, stocks, mutual funds or other assets that have been in a portfolio for some time.