Vermont Change in control of Camera Platforms International, Inc.

Description

How to fill out Change In Control Of Camera Platforms International, Inc.?

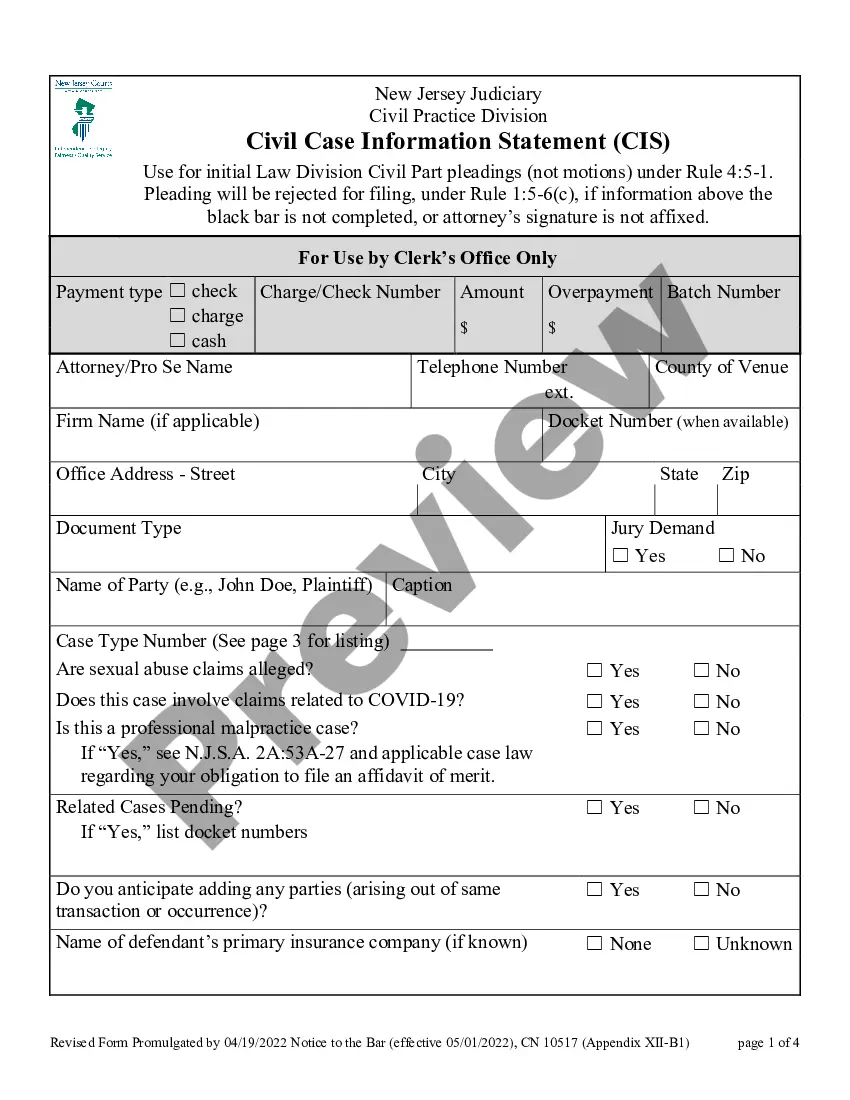

Finding the right authorized document web template could be a battle. Naturally, there are tons of templates accessible on the Internet, but how would you obtain the authorized kind you will need? Use the US Legal Forms internet site. The support gives a large number of templates, including the Vermont Change in control of Camera Platforms International, Inc., which you can use for company and personal requires. Each of the varieties are checked out by experts and satisfy federal and state needs.

In case you are previously authorized, log in for your profile and click on the Down load option to find the Vermont Change in control of Camera Platforms International, Inc.. Use your profile to look with the authorized varieties you possess bought in the past. Proceed to the My Forms tab of the profile and get one more copy from the document you will need.

In case you are a brand new user of US Legal Forms, listed below are simple recommendations so that you can adhere to:

- Initial, make certain you have selected the appropriate kind for the city/region. You are able to check out the shape while using Review option and look at the shape information to ensure this is the best for you.

- When the kind fails to satisfy your requirements, take advantage of the Seach discipline to find the proper kind.

- Once you are certain the shape would work, click on the Buy now option to find the kind.

- Choose the costs program you want and enter the essential details. Design your profile and buy the transaction utilizing your PayPal profile or Visa or Mastercard.

- Select the data file structure and obtain the authorized document web template for your gadget.

- Comprehensive, modify and produce and sign the acquired Vermont Change in control of Camera Platforms International, Inc..

US Legal Forms is definitely the greatest local library of authorized varieties where you will find various document templates. Use the company to obtain skillfully-created files that adhere to condition needs.

Form popularity

FAQ

Of the entirety of the states and territories, Washington D.C. has the most traffic cameras in the country, and they are collected very densely within the metro area.

Nebraska. There are no statewide laws regulating red light or speed cameras in Nebraska.

In 2023, Russia led the ranking of European countries with the most permanently installed speed cameras, at 18,413 cameras. Italy followed with 11,098 cameras, and Great Britain concluded the top three.

In 139 locales, video can be used to bust speeders or other moving violators. Vermont is among the 27 states that do not stipulate how traffic cameras are used.

Live traffic cam locations in Vermont are indicated on the map above. Click on the camera icon on the map to view each live camera location in VT. Links to all Vermont state traffic cams are also on the left side navigation.