Vermont Adjustments in the event of reorganization or changes in the capital structure

Description

How to fill out Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

US Legal Forms - one of many most significant libraries of authorized kinds in the States - provides a wide array of authorized papers templates you can down load or produce. Utilizing the internet site, you may get thousands of kinds for enterprise and individual reasons, sorted by categories, states, or key phrases.You can get the latest versions of kinds just like the Vermont Adjustments in the event of reorganization or changes in the capital structure in seconds.

If you have a subscription, log in and down load Vermont Adjustments in the event of reorganization or changes in the capital structure through the US Legal Forms collection. The Down load button will show up on each develop you perspective. You have accessibility to all in the past saved kinds within the My Forms tab of your account.

If you want to use US Legal Forms initially, allow me to share simple recommendations to obtain started off:

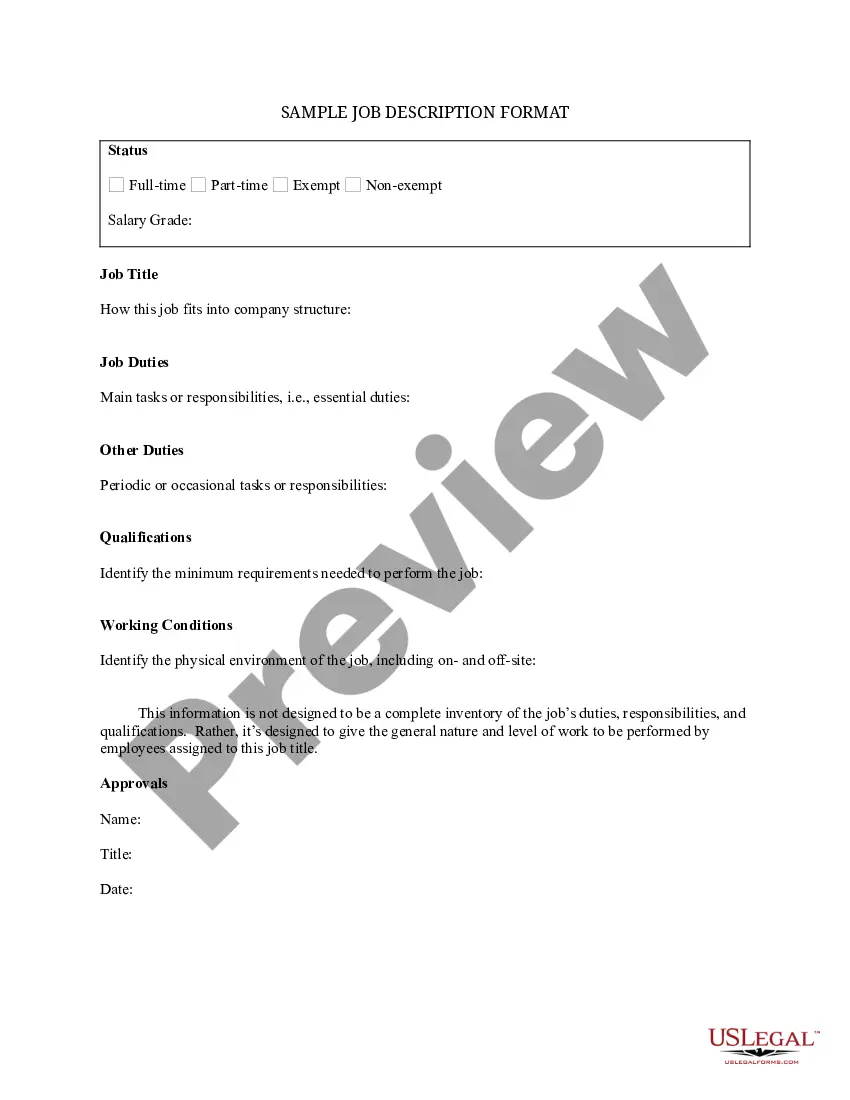

- Be sure you have chosen the right develop for your personal town/state. Select the Review button to check the form`s information. Read the develop information to actually have selected the correct develop.

- In the event the develop does not suit your requirements, use the Lookup field near the top of the screen to obtain the one which does.

- Should you be pleased with the shape, confirm your option by visiting the Acquire now button. Then, opt for the costs program you want and give your qualifications to sign up to have an account.

- Process the deal. Make use of your charge card or PayPal account to perform the deal.

- Pick the structure and down load the shape on your own gadget.

- Make adjustments. Fill up, change and produce and sign the saved Vermont Adjustments in the event of reorganization or changes in the capital structure.

Every design you included with your money does not have an expiration date and is also your own property permanently. So, if you would like down load or produce yet another duplicate, just proceed to the My Forms area and click on the develop you will need.

Get access to the Vermont Adjustments in the event of reorganization or changes in the capital structure with US Legal Forms, the most considerable collection of authorized papers templates. Use thousands of specialist and status-certain templates that meet up with your company or individual demands and requirements.

Form popularity

FAQ

No Vermont exclusion is available when a net capital loss is reported, even if the sale of farm or standing timber resulted in a capital gain. The general exclusion amount for tax year 2021 is $5,000 or the actual amount of net adjusted capital gains, whichever is less.

Vermont taxes capital gains, just as the federal government does. The gain is due on the sale of real estate here, whether or not the seller is a resident of Vermont, but there is a substantial exclusion if the property being sold was the primary residence of the seller.

The Percentage Exclusion for capital gains is capped at $350,000. This means that any gain above $875,000 will be taxed at standard income tax rates. The Flat Exclusion remains at $5,000. The amount excluded cannot exceed 40% of federal taxable income.

Land Use Change Tax Calculation The Land Use Change Tax (LUCT) is imposed at a rate of 10% of the full fair market value of land that is developed. LUCT is also due when land is withdrawn from the Current Use Program and the owner removes the lien.

Second, capital gains taxes on accrued capital gains are forgiven if the asset holder dies?the so-called ?Angel of Death? loophole. The basis of an asset left to an heir is ?stepped up? to the asset's current value.

Bonus Depreciation Allowed Under Federal Law Depreciation Vermont does not recognize the bonus depreciation allowed under federal law. Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property.

How to File Tax YearMaximum Household Income2022$134,8002021$136,9002020$138,5002019$138,2504 more rows

Key Takeaways You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly.