Vermont Insurance Agents Stock option plan

Description

How to fill out Insurance Agents Stock Option Plan?

Have you been within a place that you require documents for sometimes organization or individual functions just about every working day? There are a variety of authorized document web templates accessible on the Internet, but getting kinds you can rely isn`t effortless. US Legal Forms delivers a large number of form web templates, like the Vermont Insurance Agents Stock option plan, which are composed in order to meet federal and state specifications.

When you are already knowledgeable about US Legal Forms website and have your account, merely log in. After that, it is possible to down load the Vermont Insurance Agents Stock option plan design.

Unless you provide an bank account and would like to start using US Legal Forms, abide by these steps:

- Discover the form you want and ensure it is for the right metropolis/state.

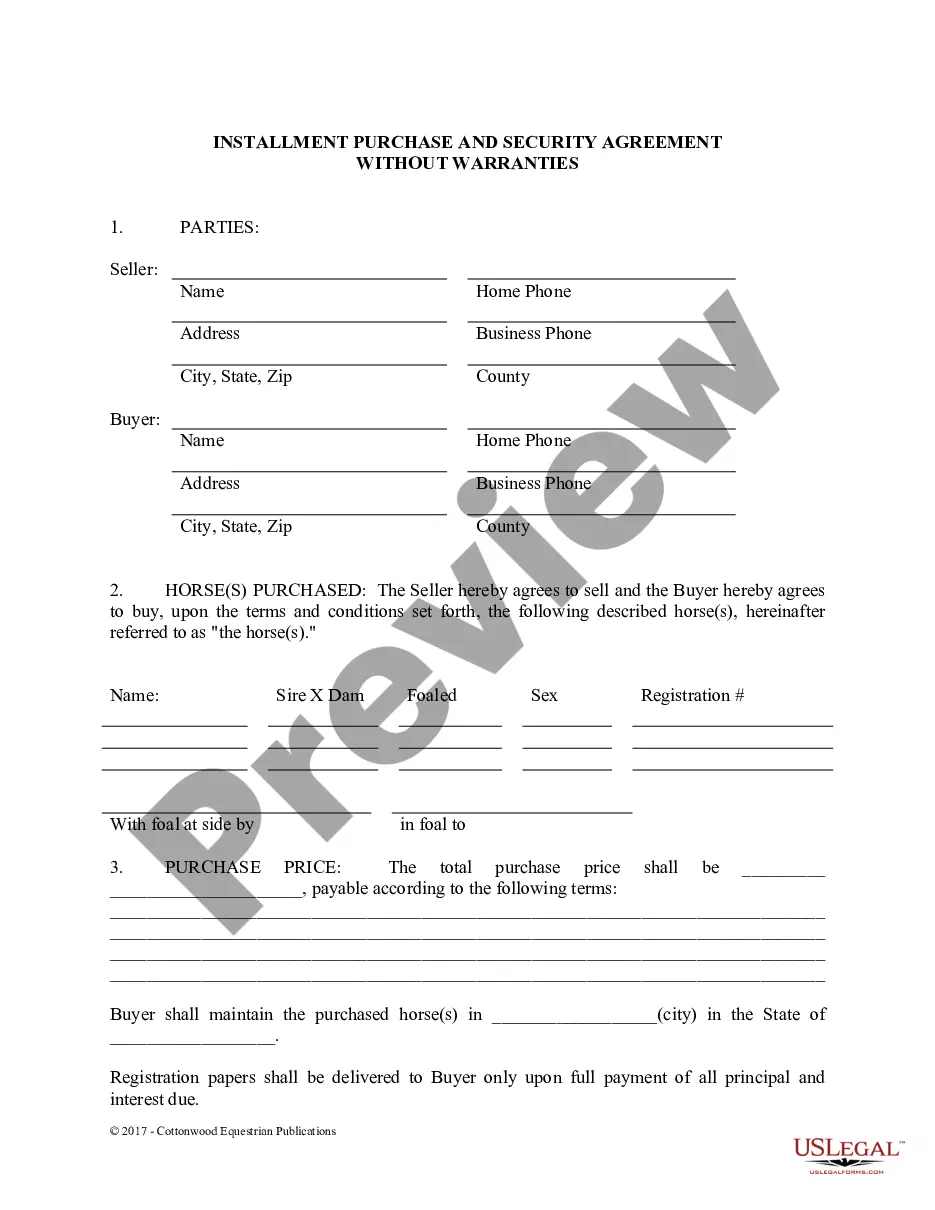

- Take advantage of the Review option to analyze the shape.

- Read the description to actually have selected the right form.

- In the event the form isn`t what you are seeking, use the Lookup field to discover the form that meets your requirements and specifications.

- Once you find the right form, just click Acquire now.

- Pick the costs strategy you desire, submit the required details to create your money, and pay for an order using your PayPal or Visa or Mastercard.

- Pick a handy document format and down load your copy.

Get each of the document web templates you possess bought in the My Forms menus. You can get a more copy of Vermont Insurance Agents Stock option plan any time, if possible. Just go through the essential form to down load or print out the document design.

Use US Legal Forms, the most considerable assortment of authorized types, to conserve time and prevent blunders. The assistance delivers professionally made authorized document web templates that can be used for an array of functions. Produce your account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Capital gains and losses are classified as long term if the asset was held for more than one year, and short term if held for a year or less. Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent.

Vermont's personal exemption allowed for each taxpayer and dependent is: $4,500 for 2022. $4,350 for 2020 and 2021. Vermont - Personal Exemptions - Explanations - CCH AnswerConnect cch.com ? document ? state ? pers... cch.com ? document ? state ? pers...

Capital gains are not taxed until they are realized, meaning that even if your Apple stock has increased 50x from the day you invested, you won't owe any capital gains taxes until you sell the stock. Of course, once you do sell the stock, you will face federal and state capital gains taxes.

The Vermont Standard Deduction increases an average of $267. For tax year 2022, it is $13,050 for Married/CU Filing Jointly or Qualifying Widow(er), $6,500 for Single or Married/CU Filing Separately, $9,800 for Head of Household, and an additional $1,050 for individuals 65 and older and/or blind.

Bonus Depreciation Allowed Under Federal Law Depreciation Vermont does not recognize the bonus depreciation allowed under federal law. Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property.