Vermont Stock Redemption Agreements with exhibits of Fair Lanes, Inc.

Description

How to fill out Stock Redemption Agreements With Exhibits Of Fair Lanes, Inc.?

Choosing the right lawful file design can be a have difficulties. Obviously, there are a lot of templates available on the net, but how do you find the lawful type you will need? Use the US Legal Forms internet site. The assistance gives a large number of templates, for example the Vermont Stock Redemption Agreements with exhibits of Fair Lanes, Inc., that can be used for company and private needs. Every one of the varieties are inspected by specialists and fulfill federal and state needs.

In case you are presently listed, log in to your account and then click the Obtain switch to get the Vermont Stock Redemption Agreements with exhibits of Fair Lanes, Inc.. Use your account to appear through the lawful varieties you might have bought in the past. Go to the My Forms tab of your account and acquire yet another copy in the file you will need.

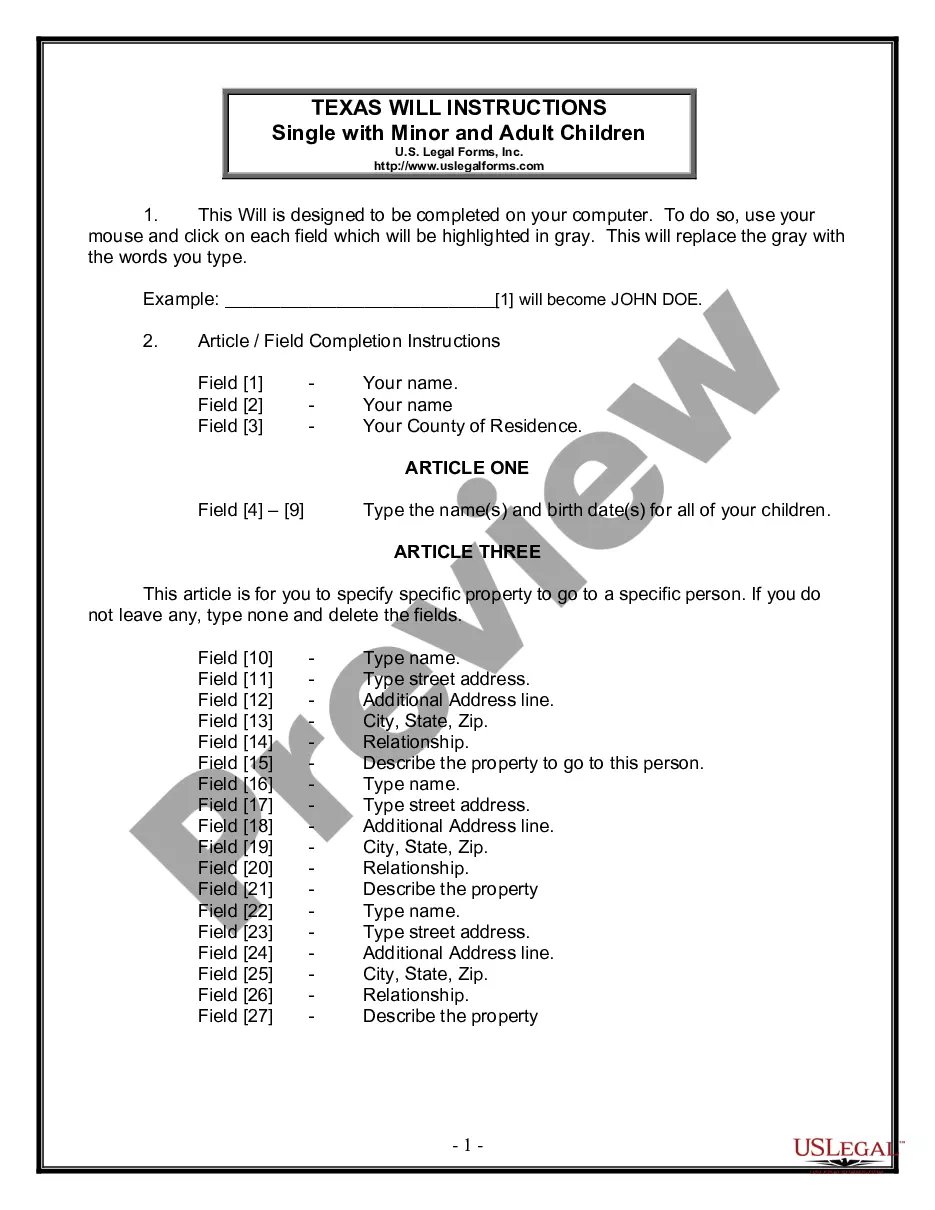

In case you are a fresh user of US Legal Forms, listed below are straightforward guidelines that you can stick to:

- Very first, ensure you have selected the right type to your metropolis/state. It is possible to check out the shape using the Review switch and study the shape outline to make sure it will be the right one for you.

- In case the type is not going to fulfill your requirements, make use of the Seach field to get the proper type.

- When you are certain the shape is proper, click the Buy now switch to get the type.

- Opt for the rates strategy you would like and enter the required information and facts. Design your account and pay for the order with your PayPal account or Visa or Mastercard.

- Opt for the submit format and download the lawful file design to your system.

- Comprehensive, revise and produce and indicator the acquired Vermont Stock Redemption Agreements with exhibits of Fair Lanes, Inc..

US Legal Forms may be the greatest library of lawful varieties in which you will find a variety of file templates. Use the service to download expertly-made files that stick to state needs.

Form popularity

FAQ

A redemption agreement sometimes called a stock redemption agreement, is a legally binding agreement between shareholders of a company. It allows parties to specify the terms in which they may buy, sell, or transfer shares of a company. These agreements may include partners, shareholders, or LLC members. Redemption Agreement: Definition & Sample Contracts Counsel ? redemption-agree... Contracts Counsel ? redemption-agree...

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

A membership interest redemption agreement, or MERA, is a legal document that allows a business to purchase the ownership interest of another company.

If the distribution is treated as a dividend, the amount of the distribution is considered ordinary income. A redemption is treated as a sale or exchange in the following situations: The distribution is not essentially equivalent to a dividend. It is substantially disproportionate with respect to the shareholder. Stock Redemptions - Federal - Topics | Wolters Kluwer cch.com ? topic ? stock-redemptions cch.com ? topic ? stock-redemptions