Maryland Stock Option Agreement of Hayes Wheels International, Inc. - general form

Description

How to fill out Stock Option Agreement Of Hayes Wheels International, Inc. - General Form?

You are able to devote hrs on the Internet looking for the legal file format which fits the federal and state requirements you need. US Legal Forms supplies thousands of legal kinds which are evaluated by professionals. It is possible to download or print the Maryland Stock Option Agreement of Hayes Wheels International, Inc. - general form from the support.

If you already have a US Legal Forms accounts, you are able to log in and click on the Acquire key. Following that, you are able to comprehensive, edit, print, or signal the Maryland Stock Option Agreement of Hayes Wheels International, Inc. - general form. Each legal file format you get is the one you have forever. To have another backup for any bought kind, visit the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms internet site initially, adhere to the straightforward guidelines under:

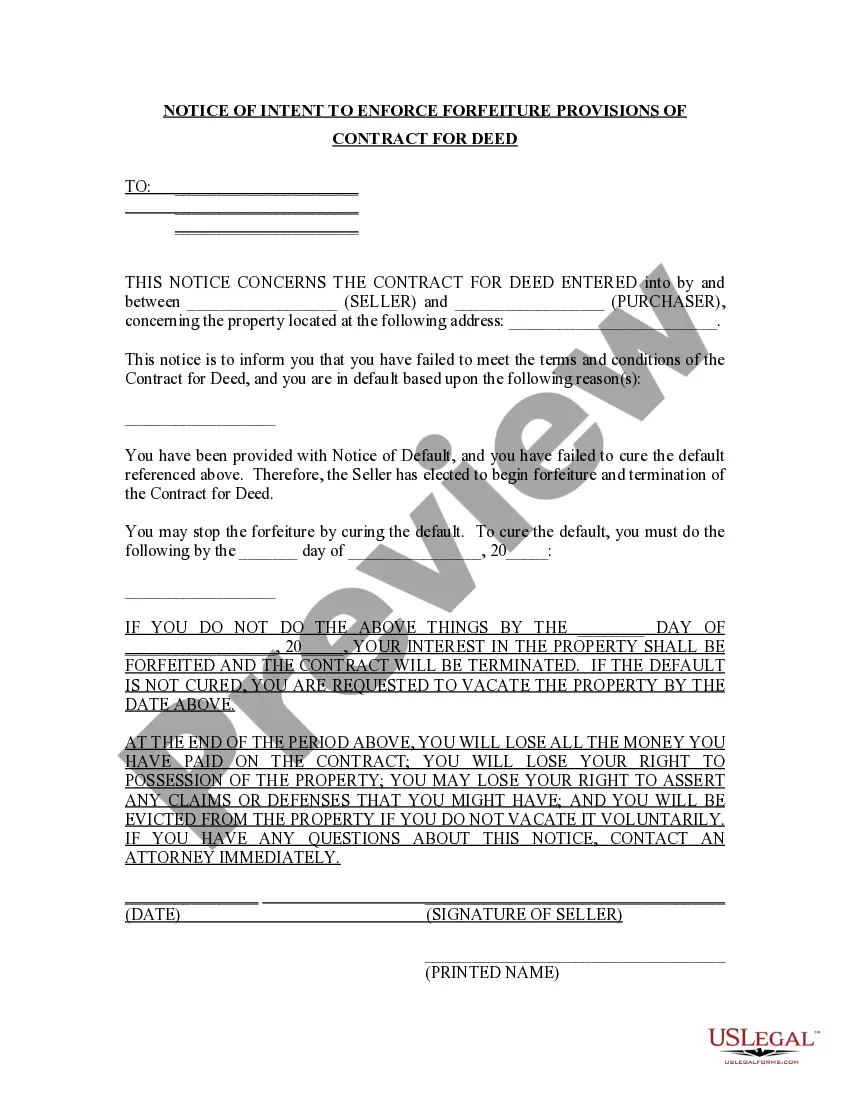

- Initially, make sure that you have chosen the best file format for your state/metropolis of your choosing. Look at the kind description to ensure you have chosen the correct kind. If available, make use of the Preview key to check with the file format at the same time.

- If you wish to locate another edition in the kind, make use of the Lookup discipline to discover the format that meets your needs and requirements.

- Upon having discovered the format you want, simply click Acquire now to move forward.

- Select the pricing prepare you want, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the deal. You can use your charge card or PayPal accounts to purchase the legal kind.

- Select the formatting in the file and download it in your gadget.

- Make alterations in your file if possible. You are able to comprehensive, edit and signal and print Maryland Stock Option Agreement of Hayes Wheels International, Inc. - general form.

Acquire and print thousands of file layouts using the US Legal Forms web site, which provides the greatest variety of legal kinds. Use specialist and state-specific layouts to deal with your business or individual demands.