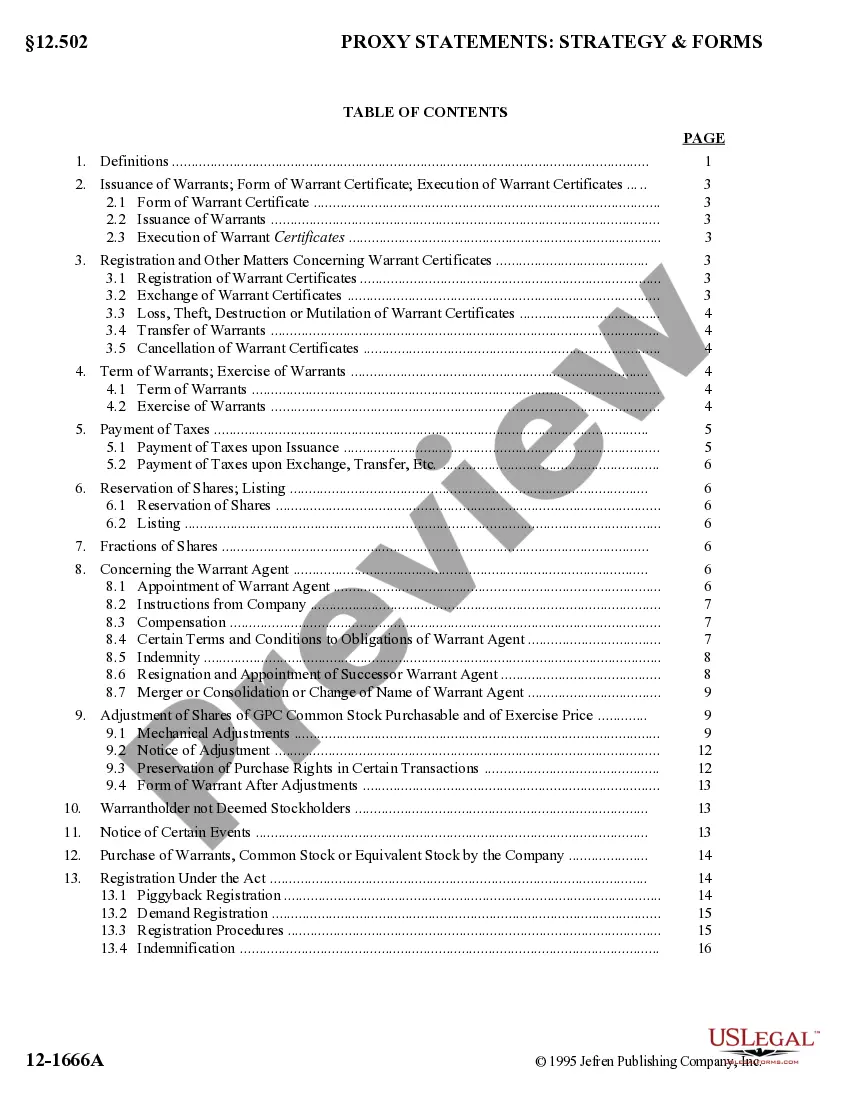

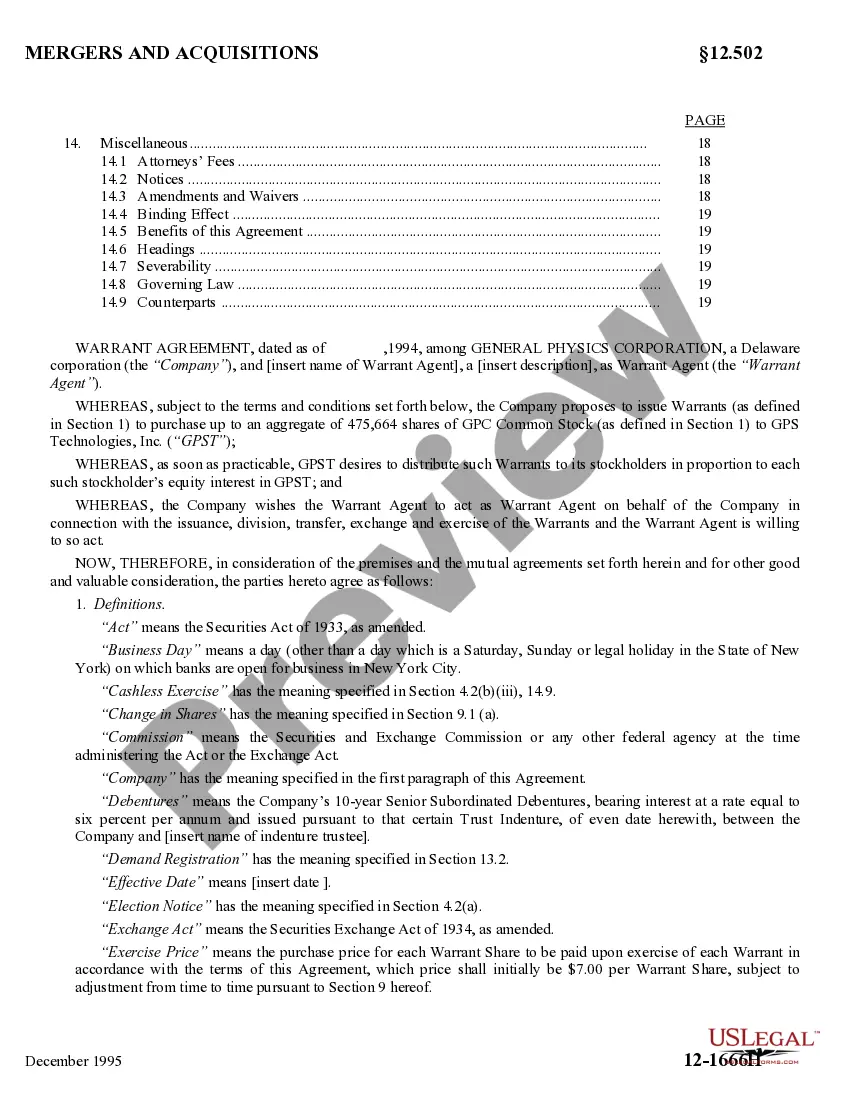

Vermont Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

US Legal Forms - among the most significant libraries of legal types in the States - delivers a wide range of legal papers layouts you can down load or print out. Utilizing the website, you can find 1000s of types for company and personal uses, categorized by classes, suggests, or search phrases.You will discover the most recent variations of types such as the Vermont Second Warrant Agreement by General Physics Corp. within minutes.

If you have a registration, log in and down load Vermont Second Warrant Agreement by General Physics Corp. from the US Legal Forms collection. The Obtain button will appear on every single kind you perspective. You get access to all formerly delivered electronically types inside the My Forms tab of your profile.

In order to use US Legal Forms the very first time, listed below are straightforward directions to help you get began:

- Ensure you have chosen the right kind for the town/region. Click on the Preview button to check the form`s content material. Look at the kind explanation to ensure that you have chosen the right kind.

- In the event the kind does not fit your specifications, use the Lookup discipline near the top of the screen to discover the the one that does.

- When you are happy with the form, validate your selection by clicking the Acquire now button. Then, select the prices prepare you want and offer your accreditations to register for the profile.

- Method the financial transaction. Make use of credit card or PayPal profile to finish the financial transaction.

- Find the formatting and down load the form in your system.

- Make adjustments. Complete, modify and print out and signal the delivered electronically Vermont Second Warrant Agreement by General Physics Corp..

Each and every design you included with your money does not have an expiration day and is also your own forever. So, if you want to down load or print out an additional copy, just check out the My Forms section and click on in the kind you want.

Gain access to the Vermont Second Warrant Agreement by General Physics Corp. with US Legal Forms, one of the most extensive collection of legal papers layouts. Use 1000s of professional and condition-particular layouts that fulfill your business or personal requires and specifications.

Form popularity

FAQ

What is a Warrant? A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

Form of settlement in which the issuer of the warrant pays a cash sum to the warrant holder instead of delivering the underlying instrument.

The intrinsic value of a warrant is the difference between the current price of the underlying shares and the strike price of the warrant, multiplied by the warrant ratio. It represents the profit you would make if you exercised the warrant and sold the shares immediately.

Warrants are profitable ? or ?in the money? ? when they allow an investor to buy a stock for less than its market price or sell a stock for more than its market price. A call warrant is profitable when its strike price is lower than the market price of the underlying stock.

When an investor exercises a warrant, they purchase the stock, and the proceeds are a source of capital for the company. However, a warrant does not mean the actual ownership of the stocks but rather the right to purchase the company shares at a particular price in the future.