Iowa Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

Are you inside a place the place you require files for both organization or specific reasons nearly every day time? There are plenty of authorized file layouts available online, but discovering kinds you can rely isn`t simple. US Legal Forms delivers 1000s of kind layouts, such as the Iowa Franchisee Closing Questionnaire, that happen to be written to meet state and federal demands.

In case you are currently acquainted with US Legal Forms site and also have your account, basically log in. Afterward, you can acquire the Iowa Franchisee Closing Questionnaire format.

If you do not have an bank account and want to begin to use US Legal Forms, follow these steps:

- Get the kind you will need and ensure it is to the proper area/county.

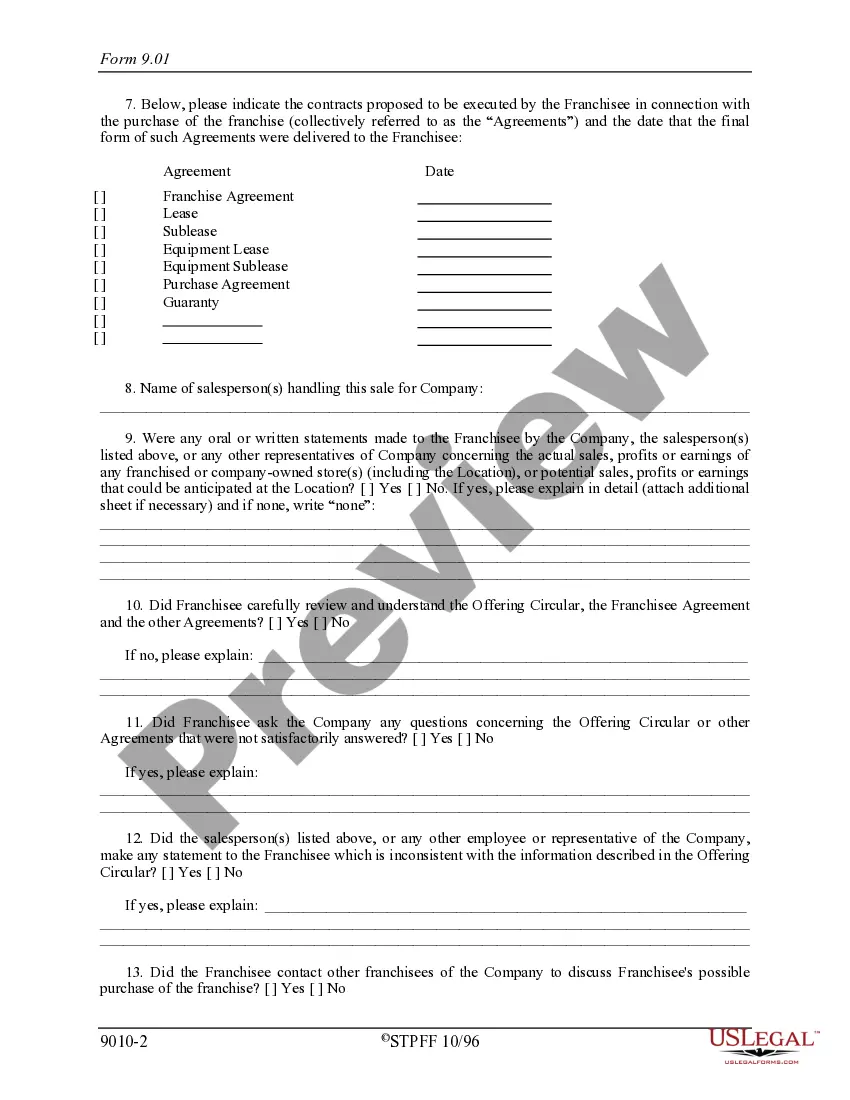

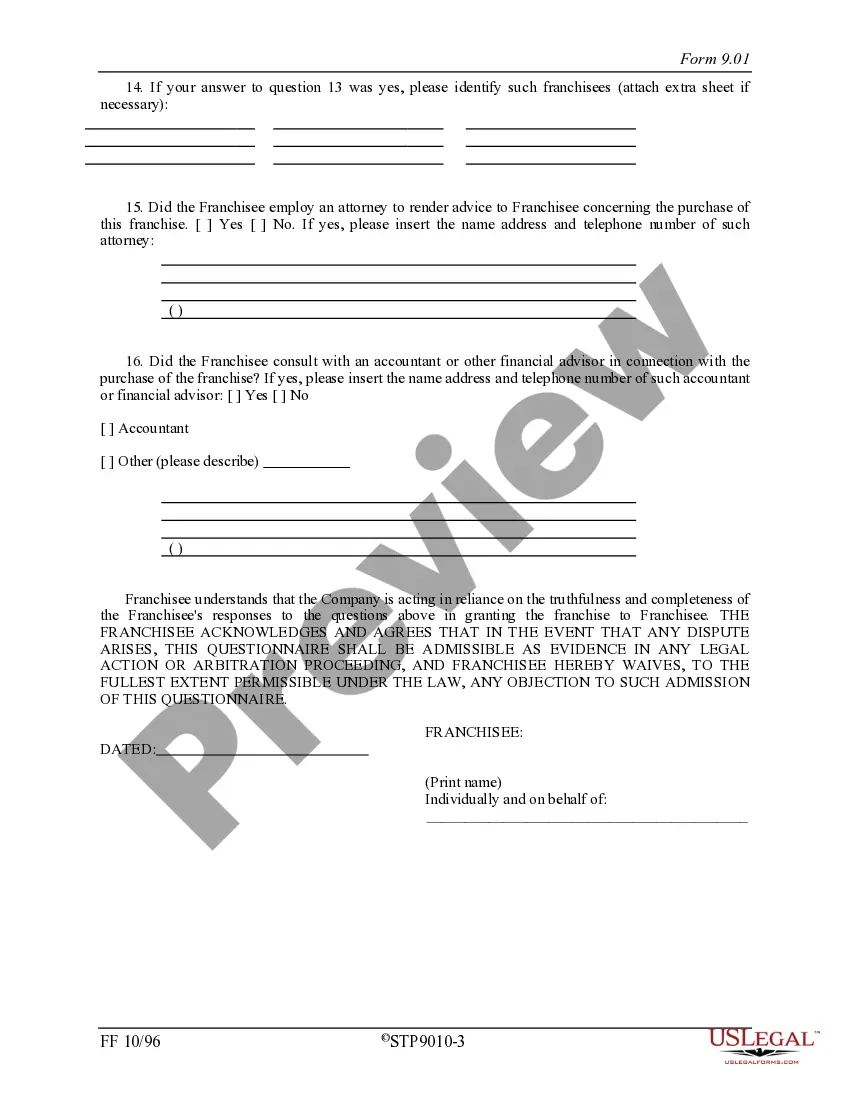

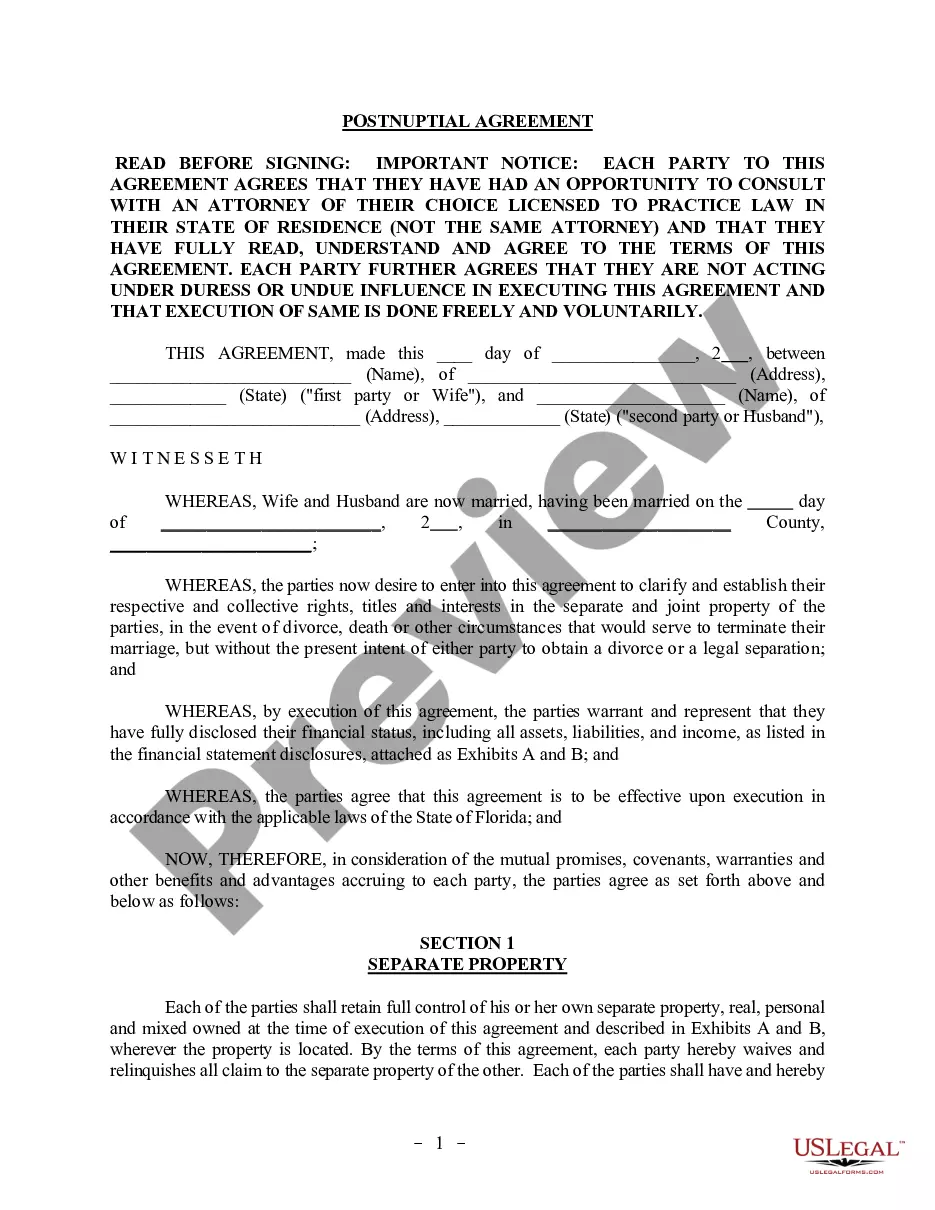

- Use the Review switch to check the form.

- Browse the explanation to actually have selected the appropriate kind.

- If the kind isn`t what you are searching for, use the Search industry to obtain the kind that meets your requirements and demands.

- Once you find the proper kind, click on Buy now.

- Pick the costs prepare you desire, fill out the necessary information and facts to generate your money, and purchase an order with your PayPal or credit card.

- Decide on a handy document file format and acquire your version.

Get all of the file layouts you might have purchased in the My Forms food list. You can get a additional version of Iowa Franchisee Closing Questionnaire at any time, if possible. Just select the essential kind to acquire or printing the file format.

Use US Legal Forms, probably the most considerable variety of authorized kinds, in order to save efforts and steer clear of errors. The support delivers appropriately made authorized file layouts that can be used for a range of reasons. Create your account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Registering as an Iowa Withholding Agent Register with the Internal Revenue Service first to obtain a Federal Identification Number (FEIN) or call the IRS at 1-800-829-4933. There is no fee for registering. After obtaining a FEIN, register with Iowa.

IA W-4 Employee's Withholding Certificate and Centralized Employee Registry 44-019 | Iowa Department Of Revenue.

A tariff is a tax added onto goods imported into a country; protective tariffs are taxes that are intended to increase the cost of an import so it is less competitive against a roughly equivalent domestic good. Protective tariff - Wikipedia wikipedia.org ? wiki ? Protective_tariff wikipedia.org ? wiki ? Protective_tariff

3 years The latest date, by law, you can claim a credit or federal income tax refund for a specific tax year is generally the later of these 2 dates: 3 years from the date you filed your federal income tax return, or. 2 years from the date you paid the tax. Time You Can Claim a Credit or Refund | Internal Revenue Service irs.gov ? filing ? time-you-can-claim-a-credi... irs.gov ? filing ? time-you-can-claim-a-credi...

A Protective Claim preserves a taxpayers' right to a refund until a contingent event is resolved. The IRS can hold a Protective Claim in abeyance indefinitely. For example, a taxpayer had just resolved, favorably, criminal tax prosecution. File a Protective Claim with IRS to preserve a possible refund claim shindelrock.com ? file-a-protective-claim-wi... shindelrock.com ? file-a-protective-claim-wi...

A foreign corporation that engages in limited activities in the United States so that it determines its activities will not give rise to gross income effectively connected with a U.S. trade or business may file a protective return to preserve the right to deductions and credits if it is later determined that the ...

Registering as an Iowa Withholding Agent Register with the Internal Revenue Service first to obtain a Federal Identification Number (FEIN) or call the IRS at 1-800-829-4933. There is no fee for registering. After obtaining a FEIN, register with Iowa.

The Iowa Department of Revenue's e-Services portal, GovConnectIowa, enables customers to manage business taxes, withholding, corporate income tax, individual income tax, in one convenient location, 24/7.

15961: 1120-F - U.S. Income Tax Return of a Foreign Corporation Form 1120-F is used by foreign corporations who are required to file a U.S. tax return. ... Form 1120-F can be paper-filed at the following address: Internal Revenue Service Center. P.O. Box 409101. Ogden, UT 84409.

Protective return. A foreign corporation should also file a protective return if it determines initially that it has no U.S. tax liability under the provisions of an applicable income tax treaty (for example, because its income is not attributable to a permanent establishment in the United States). 2022 Instructions for Form 1120-F - IRS IRS (.gov) ? pub ? irs-pdf IRS (.gov) ? pub ? irs-pdf PDF