Maine Franchisee Closing Questionnaire

Description

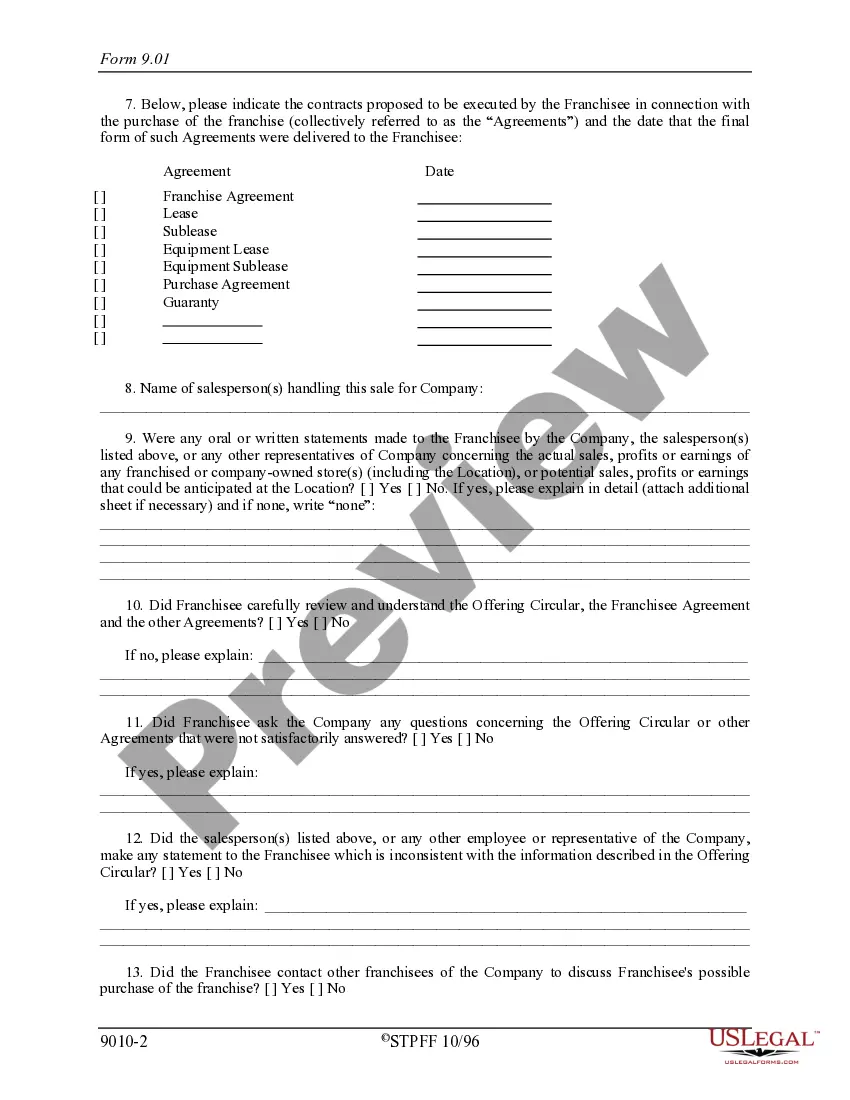

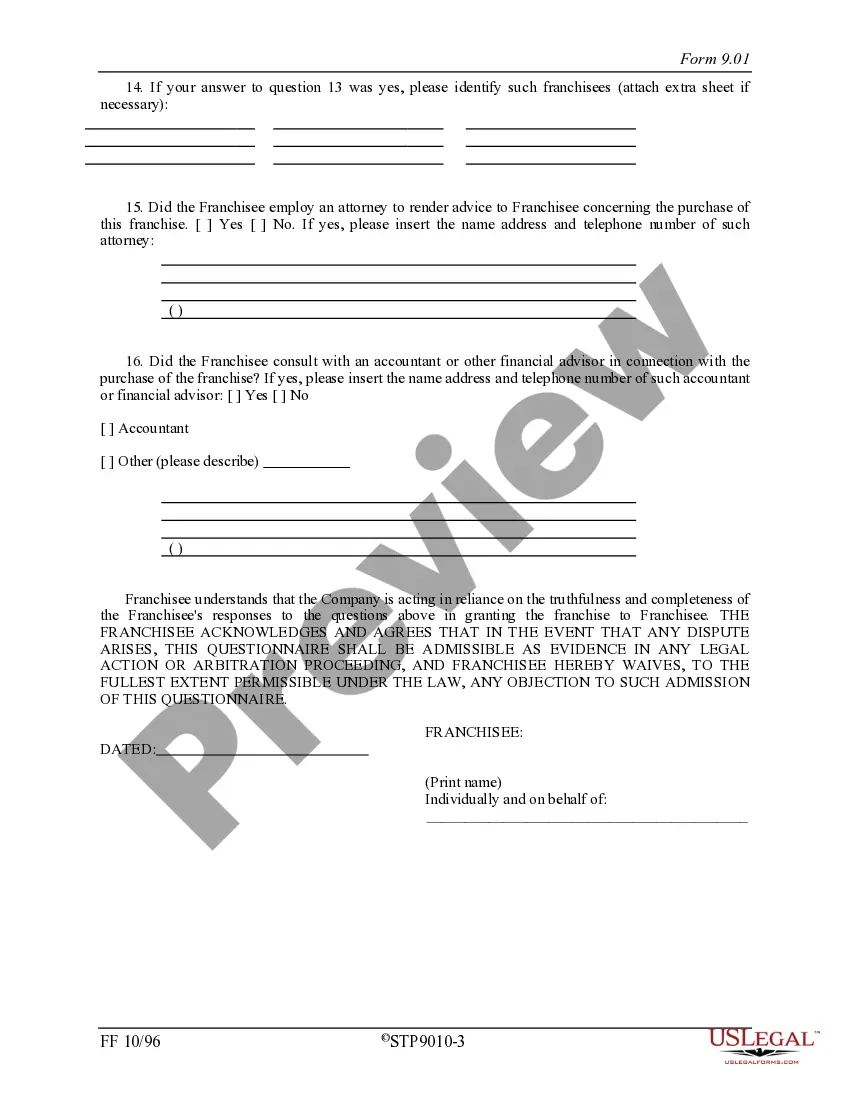

How to fill out Franchisee Closing Questionnaire?

Have you been within a place in which you will need papers for sometimes organization or person functions just about every day? There are a lot of legitimate file layouts available online, but getting ones you can depend on isn`t straightforward. US Legal Forms delivers a huge number of kind layouts, just like the Maine Franchisee Closing Questionnaire, which can be written in order to meet federal and state specifications.

When you are currently knowledgeable about US Legal Forms internet site and have a merchant account, merely log in. Following that, you can download the Maine Franchisee Closing Questionnaire design.

If you do not come with an bank account and would like to start using US Legal Forms, abide by these steps:

- Get the kind you need and ensure it is for your right area/state.

- Make use of the Preview button to analyze the shape.

- See the information to ensure that you have chosen the proper kind.

- In the event the kind isn`t what you`re searching for, utilize the Research field to find the kind that fits your needs and specifications.

- If you find the right kind, click on Acquire now.

- Opt for the prices program you want, submit the necessary information and facts to generate your bank account, and buy an order utilizing your PayPal or credit card.

- Select a convenient data file format and download your duplicate.

Find every one of the file layouts you may have purchased in the My Forms food list. You can obtain a additional duplicate of Maine Franchisee Closing Questionnaire whenever, if required. Just select the necessary kind to download or print the file design.

Use US Legal Forms, the most considerable assortment of legitimate varieties, in order to save some time and prevent faults. The support delivers skillfully produced legitimate file layouts which can be used for a variety of functions. Make a merchant account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

Maine's state sales tax rate is 5.5 percent on retail sales. It has several other taxes it charges, including a marijuana tax, lodging tax, and vehicle rental tax. Maine also charges excise fees for tires and batteries. Maine does not have discretionary taxes ? local sales taxes charged by local cities and counties.

Some goods are exempt from sales tax under Maine law. Examples include some groceries, prescription drugs, and medical devices. We recommend businesses review the bulletins and notices put forth by Maine Revenue Services to stay up to date on which goods are taxable and which are exempt, and under what conditions.

Maine resale certificates are only to be used when a purchaser intends to resell tangible property. A valid certificate must include the name and address of the purchaser. It should also include the purchaser's account ID or federal employer identification number (EIN).

How to calculate the discounted price including sales tax - YouTube YouTube Start of suggested clip End of suggested clip We can use the original. Price okay minus the original price. Okay original price times the percentMoreWe can use the original. Price okay minus the original price. Okay original price times the percent discount and I'm just gonna put a percent discount.

Here's how to calculate the sales tax on an item or service: Know the retail price and the sales tax percentage. Divide the sales tax percentage by 100 to get a decimal. Multiply the retail price by the decimal to calculate the sales tax amount.

Fortunately, collecting sales tax in Maine is fairly simple. The state sales tax rate is 5.5% and Maine doesn't have local sales tax rates. So whether you live in Maine or outside Maine but have nexus and sell to a customer there, you would charge your customer the 5.5% sales tax rate on most transactions.

Nexus with Maine is generally created by conducting business in Maine, or by owning or using property in Maine.

To close a tax account, a final return must be filed. For online filers: After completing the return, return to the Activity menu and choose ?Change Business Information.? Enter the date the business closed. Choose Submit. You will be redirected to the Activity screen.