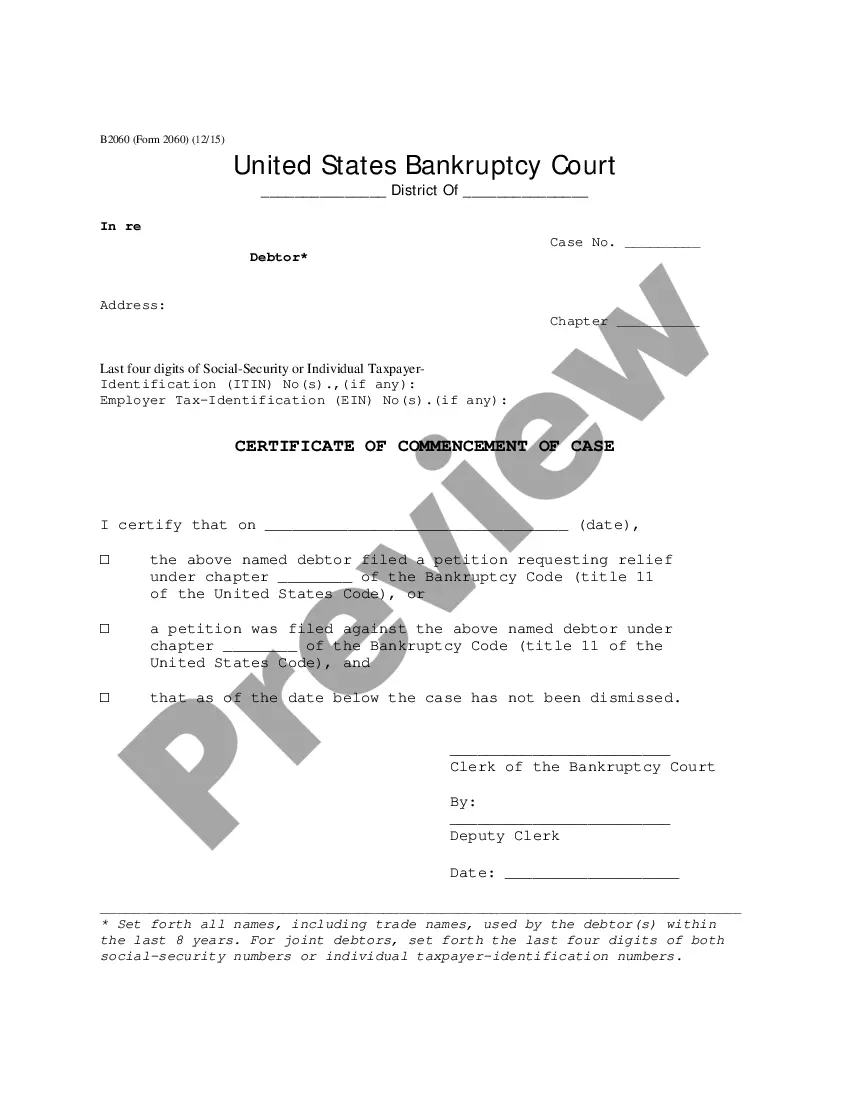

Vermont Certificate of Commencement Case - B 206

Description

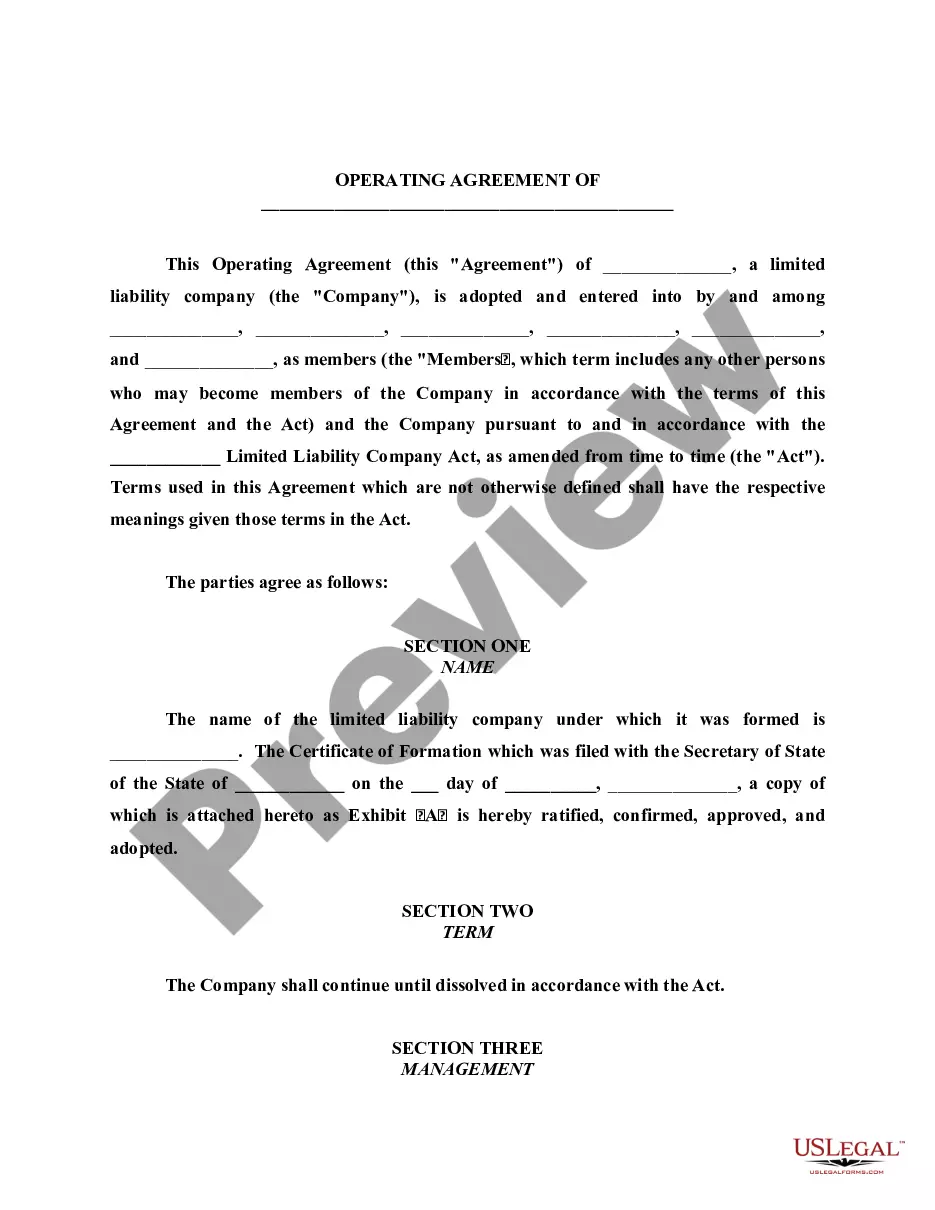

How to fill out Certificate Of Commencement Case - B 206?

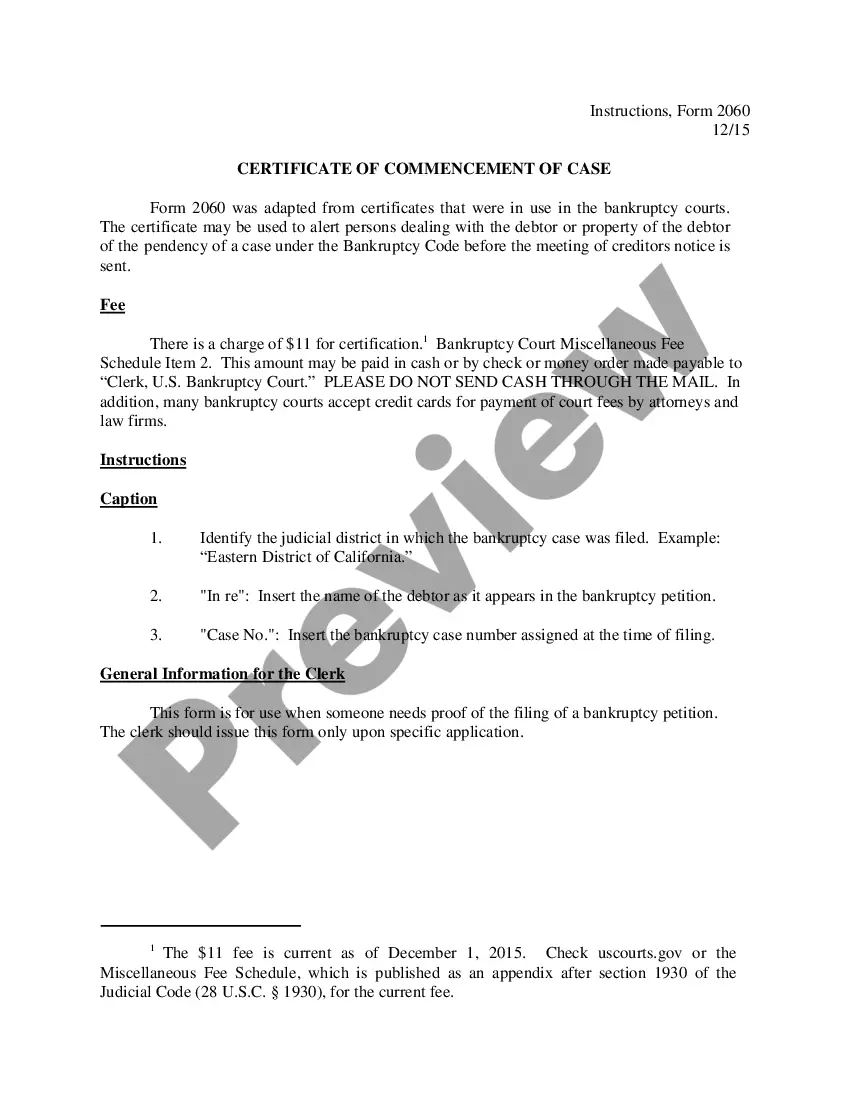

You can devote time online searching for the legitimate record design that meets the state and federal demands you need. US Legal Forms supplies thousands of legitimate varieties which are evaluated by professionals. It is possible to down load or printing the Vermont Certificate of Commencement Case - B 206 from our support.

If you already have a US Legal Forms account, it is possible to log in and then click the Download key. After that, it is possible to total, edit, printing, or indication the Vermont Certificate of Commencement Case - B 206. Every single legitimate record design you get is your own permanently. To get another copy for any acquired type, go to the My Forms tab and then click the related key.

If you use the US Legal Forms site for the first time, follow the straightforward directions listed below:

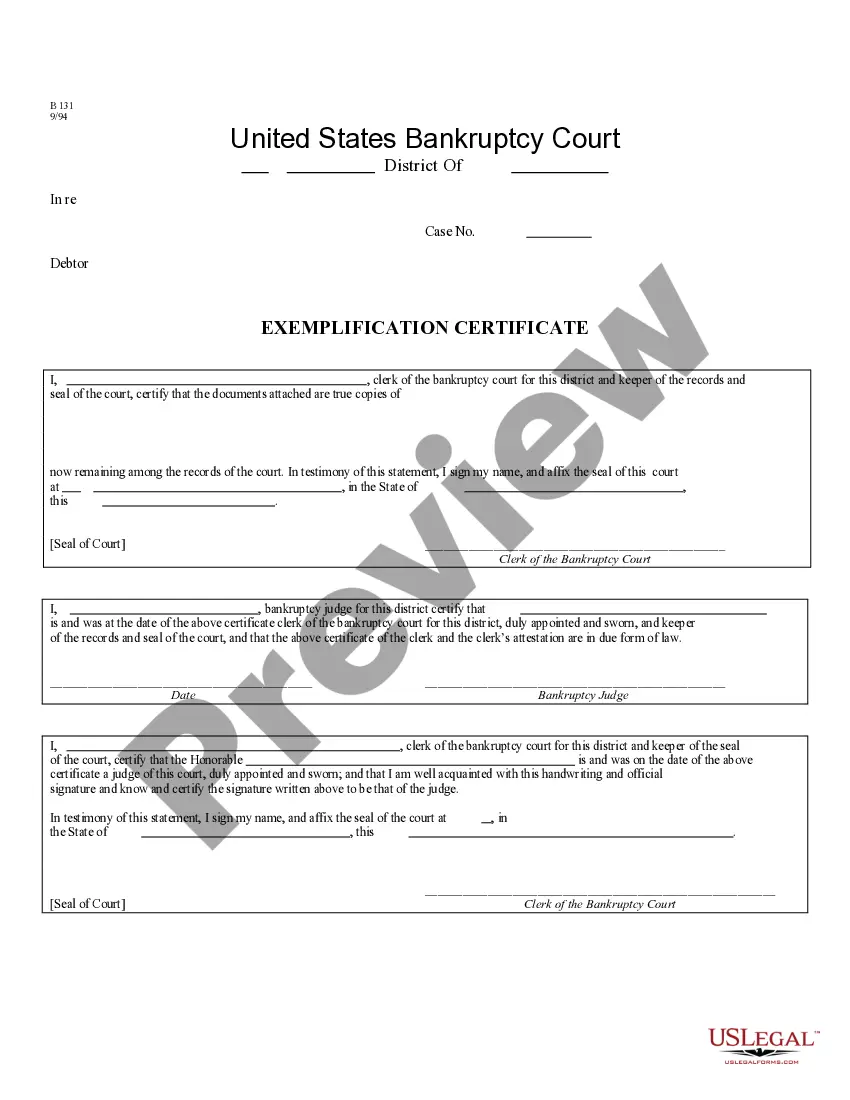

- Very first, ensure that you have chosen the best record design for the area/town that you pick. Read the type description to make sure you have selected the appropriate type. If accessible, make use of the Preview key to check through the record design too.

- In order to get another version in the type, make use of the Look for area to obtain the design that suits you and demands.

- When you have identified the design you desire, click on Acquire now to move forward.

- Find the pricing prepare you desire, key in your qualifications, and register for your account on US Legal Forms.

- Full the deal. You can utilize your charge card or PayPal account to purchase the legitimate type.

- Find the format in the record and down load it to the device.

- Make modifications to the record if necessary. You can total, edit and indication and printing Vermont Certificate of Commencement Case - B 206.

Download and printing thousands of record web templates making use of the US Legal Forms website, which offers the greatest collection of legitimate varieties. Use professional and state-particular web templates to tackle your organization or personal needs.

Form popularity

FAQ

Hear this out loud PauseNot All Debts Are Discharged Certain debts will remain on your account when you file for Chapter 7 bankruptcy. You will still be responsible for alimony and child support. Tax liens, student loans, and personal injury debts caused by intoxicated drivers are still on the docket, as well.

Hear this out loud PauseMost consumer debt is dischargeable in bankruptcy. Chapter 7 bankruptcy wipes out medical bills, personal loans, credit card debt, and most other unsecured debt. Debt that is related to some kind of ?bad act? like causing someone injury or lying on a credit application can't be wiped out.

Hear this out loud PauseIn many cases, Chapter 7 bankruptcy is a better fit than Chapter 13 bankruptcy. For instance, not only is Chapter 7 quicker, many people prefer the following two things as well: filers keep all or most of their property, and. filers don't pay creditors through a three- to five-year Chapter 13 repayment plan.

Debts have different degrees of priority. The debts that must be repaid in Chapter 13 are priority debts including child support, alimony, certain taxes, and wages owed to employees. Your plan must also address your secured debts. Secured debts are those that are secured by collateral, such as a mortgage or car loan.

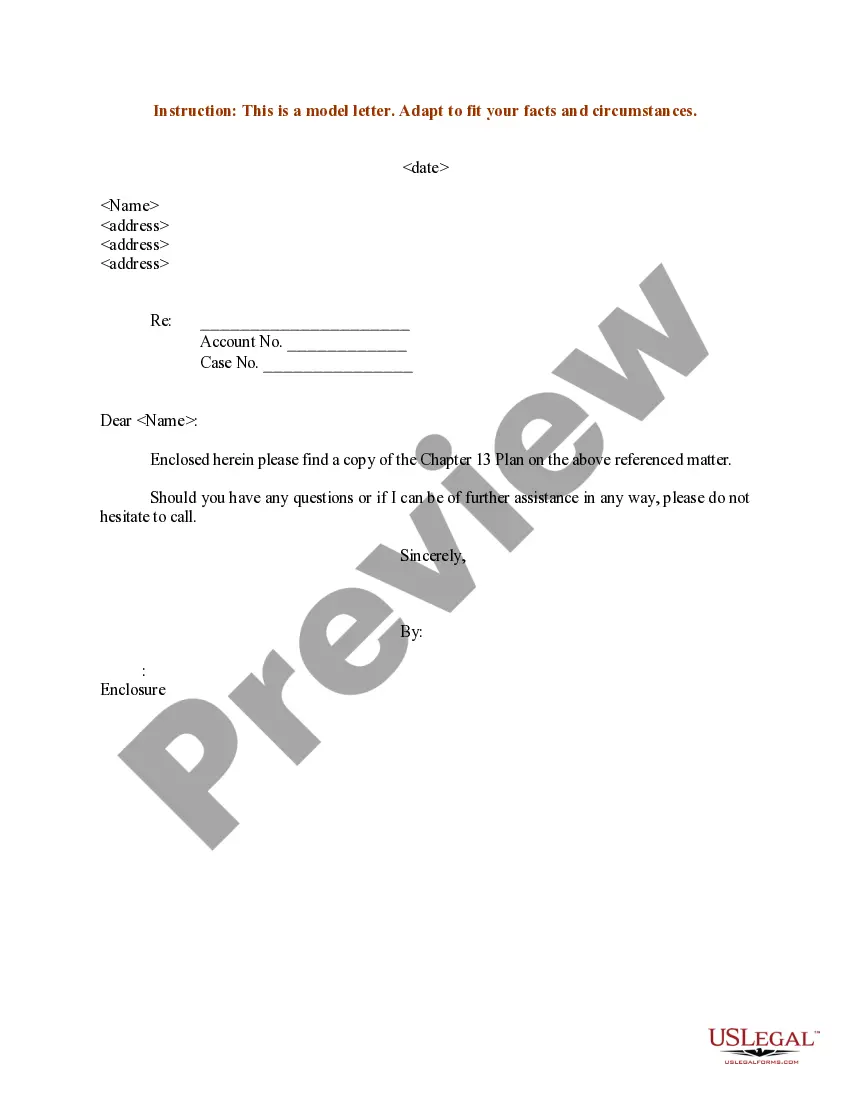

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

That being said, here's what you're not allowed to do with a Chapter 7: Lie under oath about your financial or property assets. Keep property that must be used to discharge your debts. Miss payments to certain creditors in order to keep your home.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.