Missouri Sample Letter regarding Chapter 13 Plan

Description

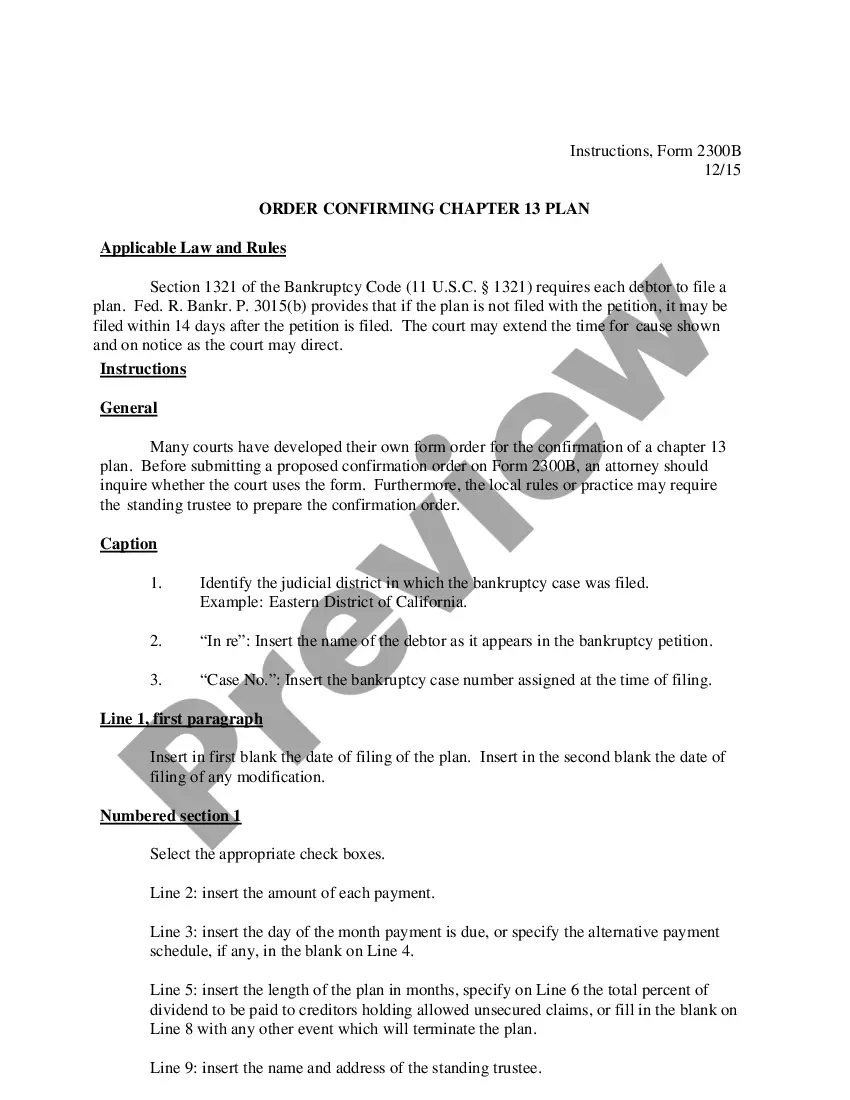

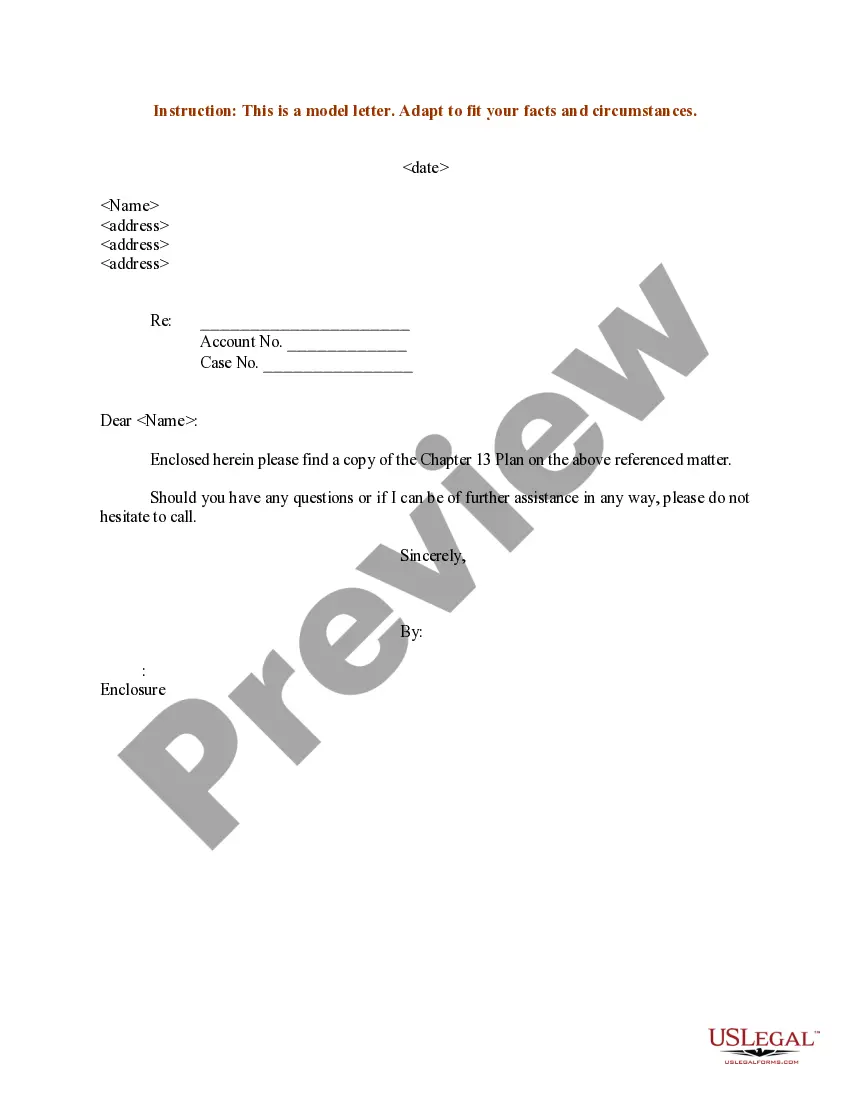

How to fill out Sample Letter Regarding Chapter 13 Plan?

US Legal Forms - one of many biggest libraries of legal forms in the United States - provides an array of legal papers web templates you are able to acquire or printing. Making use of the web site, you will get a huge number of forms for organization and personal purposes, sorted by groups, suggests, or keywords and phrases.You can find the most up-to-date variations of forms much like the Missouri Sample Letter regarding Chapter 13 Plan within minutes.

If you have a membership, log in and acquire Missouri Sample Letter regarding Chapter 13 Plan from the US Legal Forms catalogue. The Down load key will appear on every form you look at. You have access to all previously delivered electronically forms in the My Forms tab of your own account.

In order to use US Legal Forms for the first time, here are easy instructions to get you began:

- Make sure you have picked the correct form to your metropolis/county. Go through the Preview key to examine the form`s content material. Read the form outline to ensure that you have chosen the correct form.

- When the form does not suit your specifications, take advantage of the Search discipline at the top of the screen to obtain the one that does.

- If you are satisfied with the shape, affirm your decision by simply clicking the Get now key. Then, pick the prices program you favor and provide your qualifications to register to have an account.

- Approach the deal. Make use of your Visa or Mastercard or PayPal account to finish the deal.

- Pick the formatting and acquire the shape on your gadget.

- Make changes. Fill up, change and printing and indicator the delivered electronically Missouri Sample Letter regarding Chapter 13 Plan.

Every single web template you included with your account lacks an expiry time and is yours forever. So, if you wish to acquire or printing another duplicate, just visit the My Forms section and then click in the form you will need.

Obtain access to the Missouri Sample Letter regarding Chapter 13 Plan with US Legal Forms, by far the most considerable catalogue of legal papers web templates. Use a huge number of expert and express-particular web templates that meet your company or personal requires and specifications.

Form popularity

FAQ

This is where an experienced Chapter 13 bankruptcy lawyer can help. There are a number of reasons why a trustee might object to your repayment plan: Your payments exceed your income. Your plan doesn't have all of your disposable income going to unsecured creditors.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

So, every month you have $200 in disposable income. In your Chapter 13 plan, you propose $200/month over the next 60 months, or $12,000. Of that $12,000, your tax debt, car loan arrears, attorney fees and the Chapter 13 trustee, who administers the case, will get paid back.

Chapter 13 Plan Confirmation Requirements Whether your plan is practical in terms of making the required payments on time. Whether unsecured creditors will get at least the amount they would have gotten had you filed a Chapter 7 bankruptcy.

Some common reasons creditors object to Chapter 13 plan confirmation include: Disagreement about the outstanding balance on the debt. Disagreement about the past-due amount. Objection to a ?cramdown? of an automobile loan. Disagreement about the classification of the debt.

Chapter 13 is essentially a consolidation loan in which you make a monthly payment to a court-appointed trustee, who then distributes the money to creditors. Creditors are not allowed to have any direct contact with you and must go through the trustee instead. You can keep your property and gain time to pay off debts.

If you are considering filing for Chapter 13 bankruptcy, it is important to be aware that one or more creditors may object to your proposed repayment plan. However, if you are prepared to respond to their objections, you may be able to overcome them and continue with your bankruptcy case.

For example, a family of four is allowed to spend up to $1740 on food, clothing, housekeeping supplies, personal care, and miscellaneous. That means if you can keep your grocery budget under $1000 every month you will have $740 to spend across all these other categories.

Some common reasons creditors object to Chapter 13 plan confirmation include: Disagreement about the outstanding balance on the debt. Disagreement about the past-due amount. Objection to a ?cramdown? of an automobile loan.

The Trustee may file other notices that a case is not feasible. If you are close to making the final payments on your plan and the case is still not feasible, the Trustee will file a motion asking to dismiss the case because it will not pay creditors in the manner required by the plan.