Vermont Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Consumer Investigative Report?

Are you in a situation where you require documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not straightforward.

US Legal Forms provides a vast array of form templates, such as the Vermont Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report, designed to comply with state and federal regulations.

Choose the payment plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Vermont Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and make sure it is for the correct state/region.

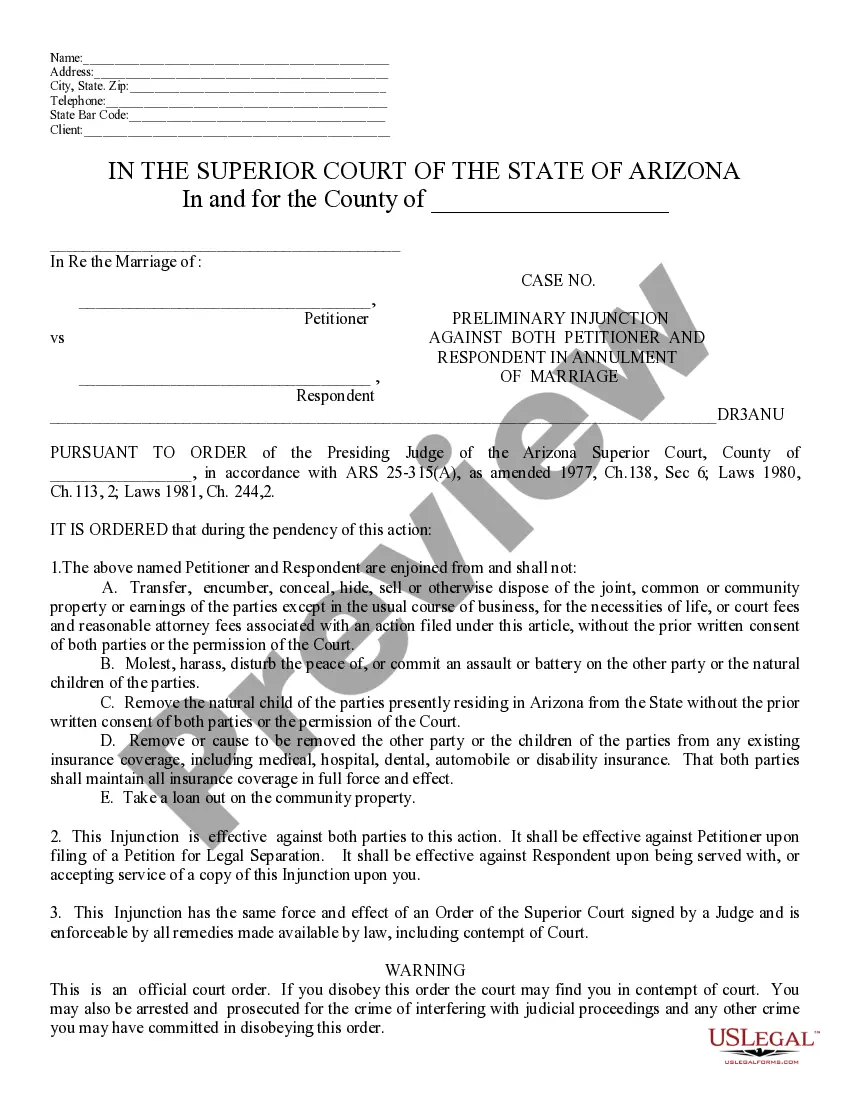

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and requirements.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

You typically have 60 days from the date you receive a notice of adverse action to request a copy of the investigative consumer report. This is important because the Vermont Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report process requires transparency. By taking action within this timeframe, you can ensure you have all necessary information about the report and how it influenced the decision. Stay informed and active to protect your rights.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

The following are examples of adverse actions employers might take: discharging the worker; demoting the worker; reprimanding the worker; committing harassment; creating a hostile work environment; laying the worker off; failing to hire or promote a worker; blacklisting the worker; transferring the worker to another

If you're an organization that processes credit applications, it is your duty to provide an Adverse Action Notice if a consumer is denied credit. And you've got to provide it within 30 days of receiving a credit application.

Information excluded from consumer reports further include: Arrest records more than 7 years old. Items of adverse information, except criminal convictions older than 7 years. Negative credit data, civil judgments, paid tax liens, and/or collections accounts older than 7 years.

Information excluded from consumer reports further include: Arrest records more than 7 years old. Items of adverse information, except criminal convictions older than 7 years. Negative credit data, civil judgments, paid tax liens, and/or collections accounts older than 7 years.

(l) An investigative consumer reporting agency shall maintain reasonable procedures designed to prevent the reappearance in the file of a consumer and in investigative consumer reports information that has been deleted pursuant to this section and not reinserted pursuant to subdivision (f).

adverse action might also occur at pointofsale transactions where an account transaction is denied in real time. Notably, the ECOA does not consider an adverse action to have occurred where an action or forbearance on an account is taken in connection with inactivity, default, or delinquency as to that account.

Duty to Investigate Disputes Filed with CRAs Finally, if the furnisher determines the disputed information is inaccurate or incomplete or cannot be verified, the furnisher must promptly modify or delete the information or permanently block the reporting of that information.

Adverse action is defined in the Equal Credit Opportunity Act and the FCRA to include: a denial or revocation of credit. a refusal to grant credit in the amount or terms requested. a negative change in account terms in connection with an unfavorable review of a consumer's account 5 U.S.C.