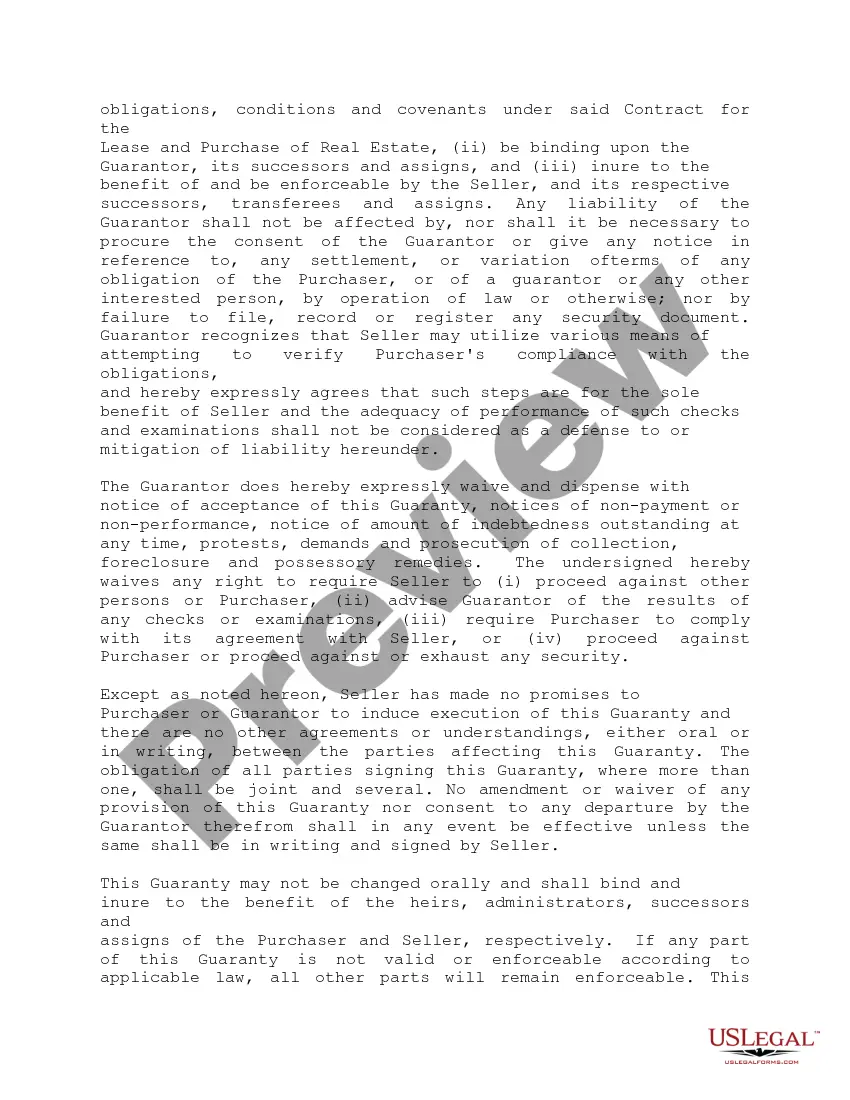

Vermont Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Are you presently in a role that requires documents for either professional or personal tasks almost every workday.

There is a multitude of authentic document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template forms, such as the Vermont Personal Guaranty - Assurance of Agreement for the Rental and Acquisition of Property, designed to comply with federal and state regulations.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Vermont Personal Guaranty - Assurance of Agreement for the Rental and Acquisition of Property at any time, if required. Just click on the respective form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Then, you will be able to download the Vermont Personal Guaranty - Assurance of Agreement for the Rental and Acquisition of Property template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the appropriate city/county.

- Use the Preview option to review the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your needs, utilize the Search field to locate the form that fits your criteria.

- Once you find the correct form, click on Buy now.

- Select the payment plan you wish to choose, fill out the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

The form for non-resident income tax in Vermont is Form IN-111. This form is specifically designed for non-residents who are obligated to report income from Vermont sources. When considering a Vermont Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, it is essential for non-residents to stay informed about their tax obligations to avoid potential penalties.

VT Form 113 is the Vermont Household Income Tax Form, which claims a property tax adjustment for homeowners and renters. It can affect how much you owe or receive back from the state, especially if you're involved in a Vermont Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. This form helps maintain a fair approach to property taxes, giving residents an opportunity for adjustment based on their income.

Form IN-111 in Vermont is the Income Tax Return for Non-Residents. This document is essential for individuals earning income from Vermont while residing out of state. If you're entering into a Vermont Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, ensure you are aware of the tax implications by completing this form accurately.

In Vermont, the tax extension form is Form M-505. This form allows taxpayers to request additional time to file their state income tax returns. It is beneficial for individuals involved in complex transactions, such as a Vermont Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, where more time may be needed to gather financial documentation.

The non-resident tax form for Vermont is Form IN-111. Non-residents who earn income from Vermont sources need to file this form to report their earnings accurately. When engaging in real estate transactions or making Vermont Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, understanding your tax obligations is essential.

Act 111 in Vermont provides important guidelines regarding the execution and enforcement of personal guaranties in contractual agreements, particularly around real estate transactions. Understanding Act 111 is crucial for anyone considering a Vermont Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. This legislation helps ensure that all parties involved are aware of their rights and responsibilities under the guaranty.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.