Vermont Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

Finding the appropriate legal document template can be quite challenging. Naturally, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms platform. This service provides a vast array of templates, such as the Vermont Wage Withholding Authorization, suitable for both business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Vermont Wage Withholding Authorization. Use your account to search through the legal documents you have previously acquired. Navigate to the My documents section of your account to obtain another copy of the document you need.

Complete, revise, print, and sign the obtained Vermont Wage Withholding Authorization. US Legal Forms is the largest collection of legal templates where you can access numerous document formats. Use the service to download professionally-crafted documents that meet state criteria.

- If you are a new user of US Legal Forms, follow these straightforward instructions.

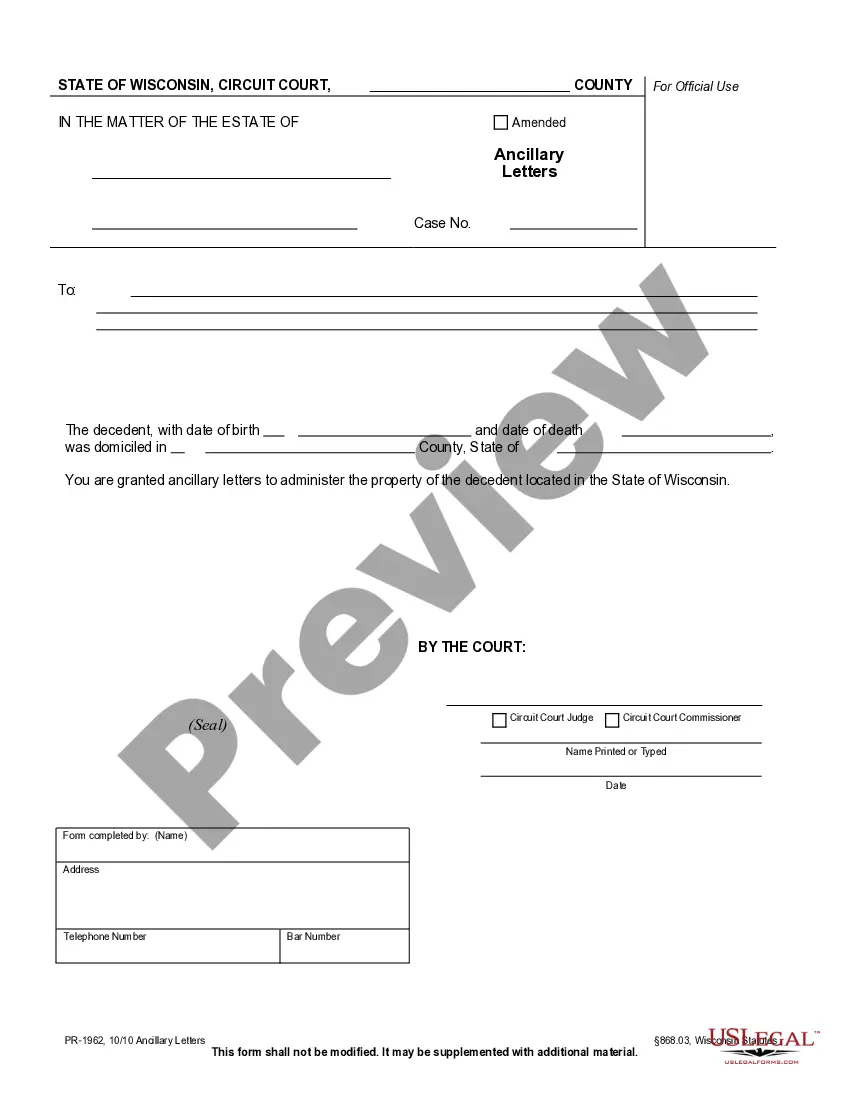

- First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form details to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search field to find the appropriate document.

- Once you are confident that the form is correct, click the Get now button to obtain the form.

- Choose the pricing plan you desire and fill in the required information. Create your account and finalize the payment using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Several states, such as Texas and Florida, do not impose state-level income tax, meaning there is no withholding required from employee paychecks. This can benefit businesses, as they simplify payroll processes. However, knowing your obligations in states like Vermont, where Vermont Wage Withholding Authorization is necessary, will keep you compliant. Always verify the specific state laws to stay informed.

The Vermont withholding tax for non-residents applies to income earned in the state. Non-residents may have different rates based on their income level. When filing, non-residents should consider Vermont Wage Withholding Authorization to ensure proper tax deductions. Utilizing a reliable platform, like uslegalforms, can help you navigate the specifics of this process.

An employer is required to withhold Vermont income tax. To help employers determine which payments are subject to Vermont income tax withholding and how much to withhold from an employee's paycheck the Department publishes a guide with withholding instructions, tables, and charts.

Summary. The income tax withholding for the State of Vermont includes the following changes: The annual amount per allowance has changed from $4,350 to $4,400. The Single or Head of Household and Married income tax withholding tables have changed.

Exemption from Federal Income TaxIf you are exempt from withholding, you are exempt from federal withholding for income tax. This means you don't make any federal income tax payments during the year. You need to indicate this on your W-4.

If you want to temporarily stop tax withholding from your paycheck, you'll need to file a new Form W-4 with your employer.

If you want to change your withholding allowances, you'll need to find your own state's Employee's Withholding Allowance Certificate and complete the worksheet. You can use this form to claim an exemption from state taxes or to have additional tax withheld from your paycheck.

What does Exempt mean? You may enter Exempt on Form W-4VT if you: had the right to a full refund of all your taxes withheld in the last tax year because you had no tax liability and. expect to have no tax liability again for this tax year.

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

U.S. States that Require State Tax Withholding FormsAlabama.Arizona.Arkansas.California.Connecticut.District of Columbia.Georgia.Hawaii.More items...