Vermont Shipping Reimbursement

Description

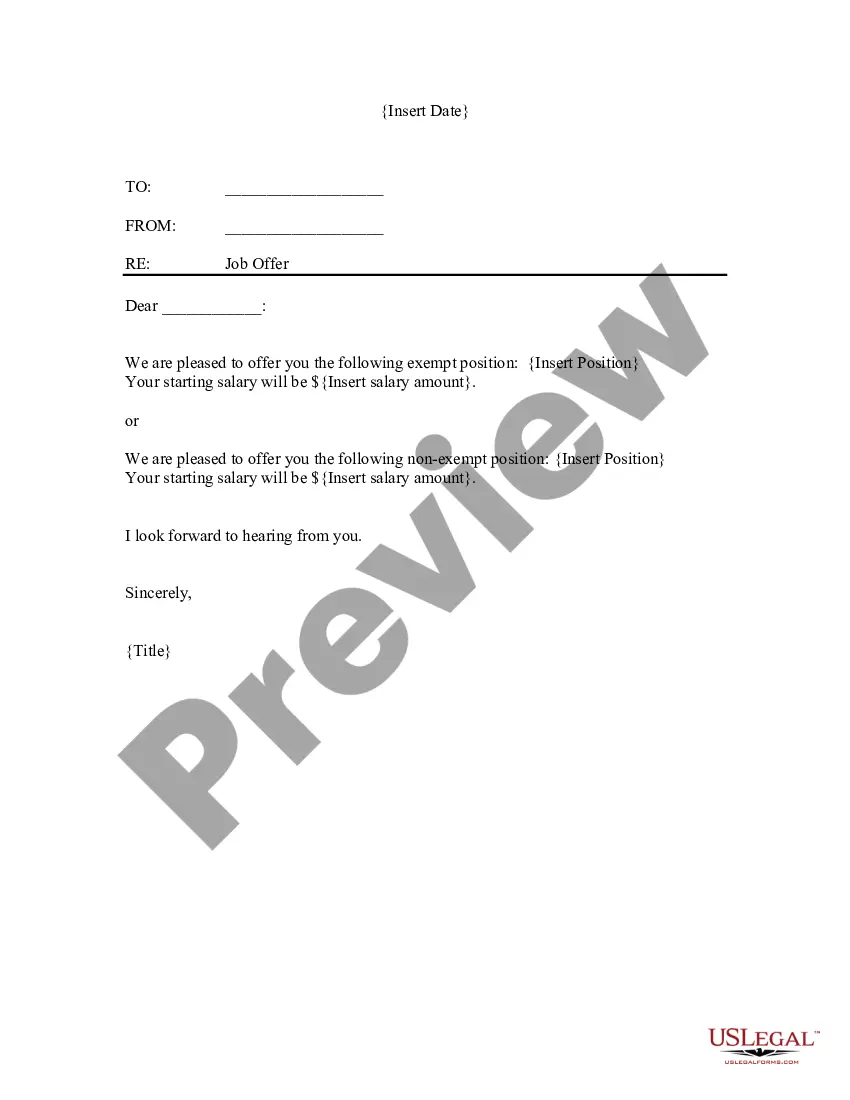

How to fill out Shipping Reimbursement?

Finding the appropriate official document format can be a challenge.

Clearly, there are numerous templates accessible online, but how will you locate the specific document you require.

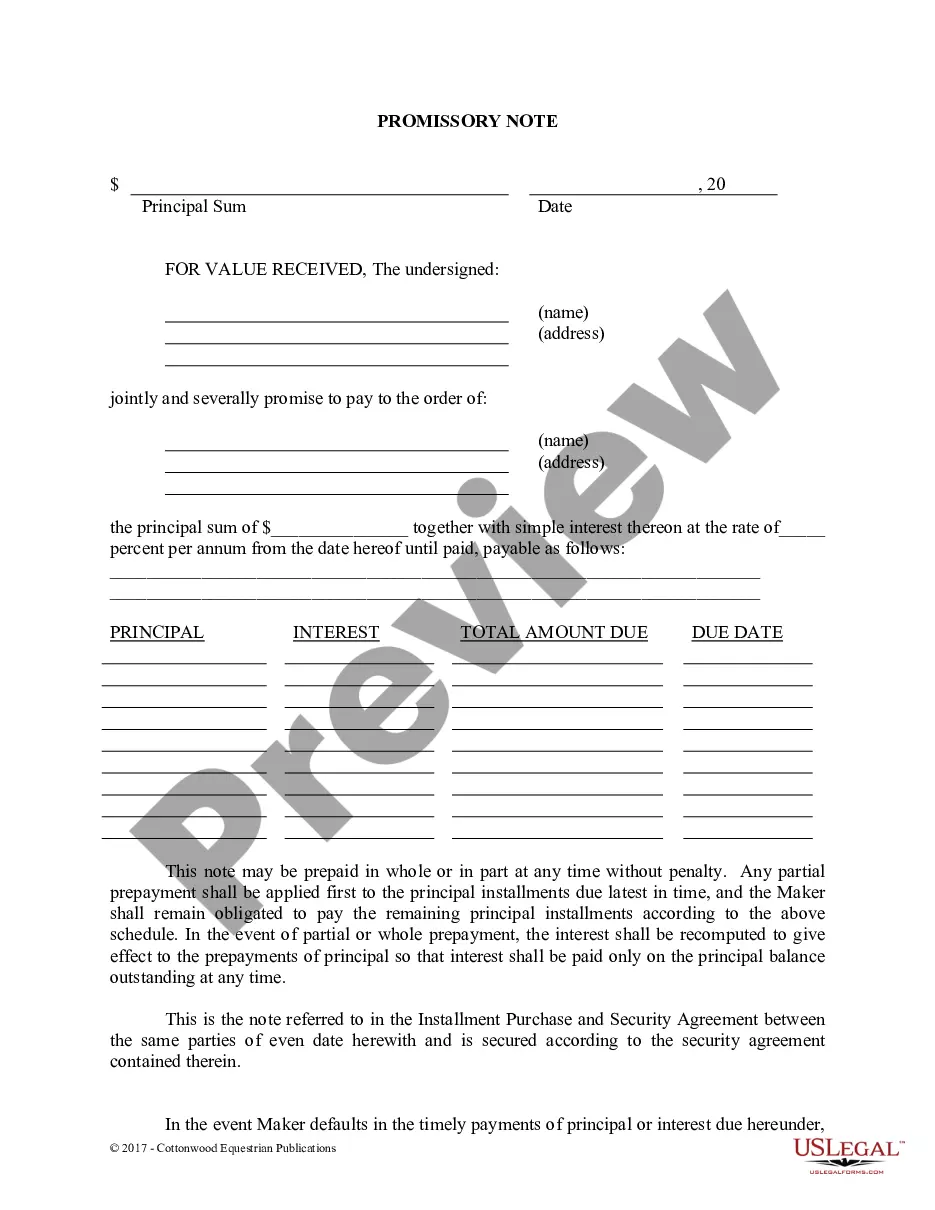

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Vermont Shipping Reimbursement, which can be utilized for professional and personal reasons.

You can review the document using the Review button and examine the document details to confirm it suits your needs.

- All documents are vetted by experts and comply with national and state regulations.

- If you are already registered, sign in to your account and click the Download button to retrieve the Vermont Shipping Reimbursement.

- Use your account to navigate through the official documents you have acquired previously.

- Access the My documents section of your account and obtain another version of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure that you have chosen the correct document for your region/state.

Form popularity

FAQ

Nexus determination is primarily controlled by the U.S. Constitution, in which the Due Process Clause requires a definite link or minimal connection between a state and the entity it wants to tax, and the Commerce Clause requires substantial presence.

FOOD, FOOD PRODUCTS, AND BEVERAGES - TAXABLE Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks.

FOOD, FOOD PRODUCTS, AND BEVERAGES - TAXABLE Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks.

Sales tax nexus is the connection between a seller and a state that requires the seller to register then collect and remit sales tax in the state. Certain business activities, including having a physical presence or reaching a certain sales threshold, may establish nexus with the state.

Overview. Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

What goods and services are considered taxable in Vermont?Sales of tangible goods at retail.Repairs or alterations of tangible personal property.Property rentals, leases, or licenses e.g. commercial, mini-warehouseSelling service warranty contracts.More items...

In general, delivery-related charges for taxable products are not taxable when you ship directly to the purchaser via common carrier, contract carrier, or USPS; delivery, shipping, freight, or postage charges are separately stated; and the charge isn't greater than the actual cost of delivery.

The economic presence of an out-of-state business is sufficient to create income tax nexus in Vermont. ( 32 V.S.A. 5811(15)) So, nexus in Vermont is established through engaging in any business activity not protected by federal P.L. 86-272, the Interstate Income Law.

Taxable and exempt shipping charges Charges for shipping, handling, delivery, freight, and postage are generally taxable in Vermont. If the sale is tax exempt, the shipping charges are generally exempt as well.

The majority of states (Arkansas, Connecticut, Georgia, Illinois, Kansas, Kentucky, Michigan, Mississippi, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Washington, West Virginia and