Vermont Equal Pay - Administration and Enforcement Checklist

Description

How to fill out Equal Pay - Administration And Enforcement Checklist?

Selecting the optimal legal document template can be a challenge. Clearly, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Vermont Equal Pay - Administration and Enforcement Checklist, which you can access for both business and personal purposes.

All templates are vetted by professionals and comply with both state and federal regulations.

If the form does not meet your requirements, use the Search field to find the right form. Once you are confident that the form is appropriate, click the Get Now button to obtain it. Choose the pricing plan you prefer and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained Vermont Equal Pay - Administration and Enforcement Checklist. US Legal Forms is the largest library of legal forms where you can discover a variety of document templates. Use the service to download professionally crafted documents that meet state requirements.

- If you are already registered, Log In to your account and click the Download button to access the Vermont Equal Pay - Administration and Enforcement Checklist.

- Use your account to verify the legal forms you may have previously purchased.

- Navigate to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state.

- You can view the form using the Preview button and read the form details to confirm it is suitable for you.

Form popularity

FAQ

In Vermont, wrongful termination occurs when an employee is fired in violation of state or federal laws. Common examples include dismissals due to discrimination, retaliation for reporting unlawful practices, or breaches of an employment contract. Understanding these conditions is crucial for protecting your rights. For a comprehensive guide, consider exploring the Vermont Equal Pay - Administration and Enforcement Checklist, which can help you navigate potential workplace issues.

Yes, it is illegal to ask about salary history in Massachusetts during the hiring process. This law is designed to prevent wage discrimination and to promote equal pay for equal work. By adhering to the Vermont Equal Pay - Administration and Enforcement Checklist, organizations can align their practices with this legislation and help eliminate pay disparities. Utilizing this checklist will guide employers in creating a fair environment for all employees.

The salary history ban in Vermont prohibits employers from inquiring about the salary history of job applicants. This law aims to promote fair pay practices and combat wage discrimination. By following the Vermont Equal Pay - Administration and Enforcement Checklist, employers can ensure compliance with this important regulation, creating a more equitable workplace. Implementing these guidelines will help foster transparency and trust in the hiring process.

Amount and Duration of Unemployment Benefits in Vermont If you are eligible to receive unemployment, your weekly benefit rate is your total wages in the two highest paid quarters of the base period divided by 45. The current maximum is $513 per week. You ordinarily may receive benefits for a maximum of 26 weeks.

Like many other states in the U.S., Vermont is an at-will employment state. Under these employment laws, employers can terminate an employee at any time and for any reason or no reason at all, unless there is a contract in place or there are other statutes governing the employee-employer relationship.

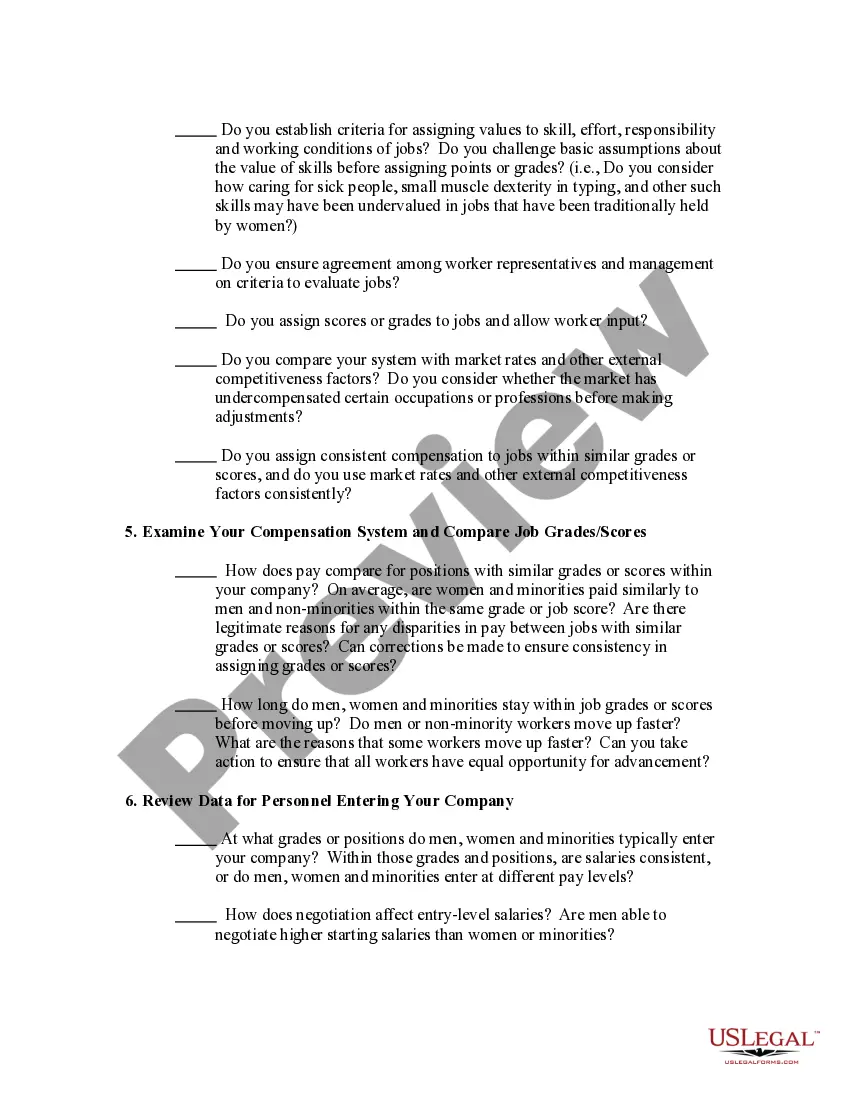

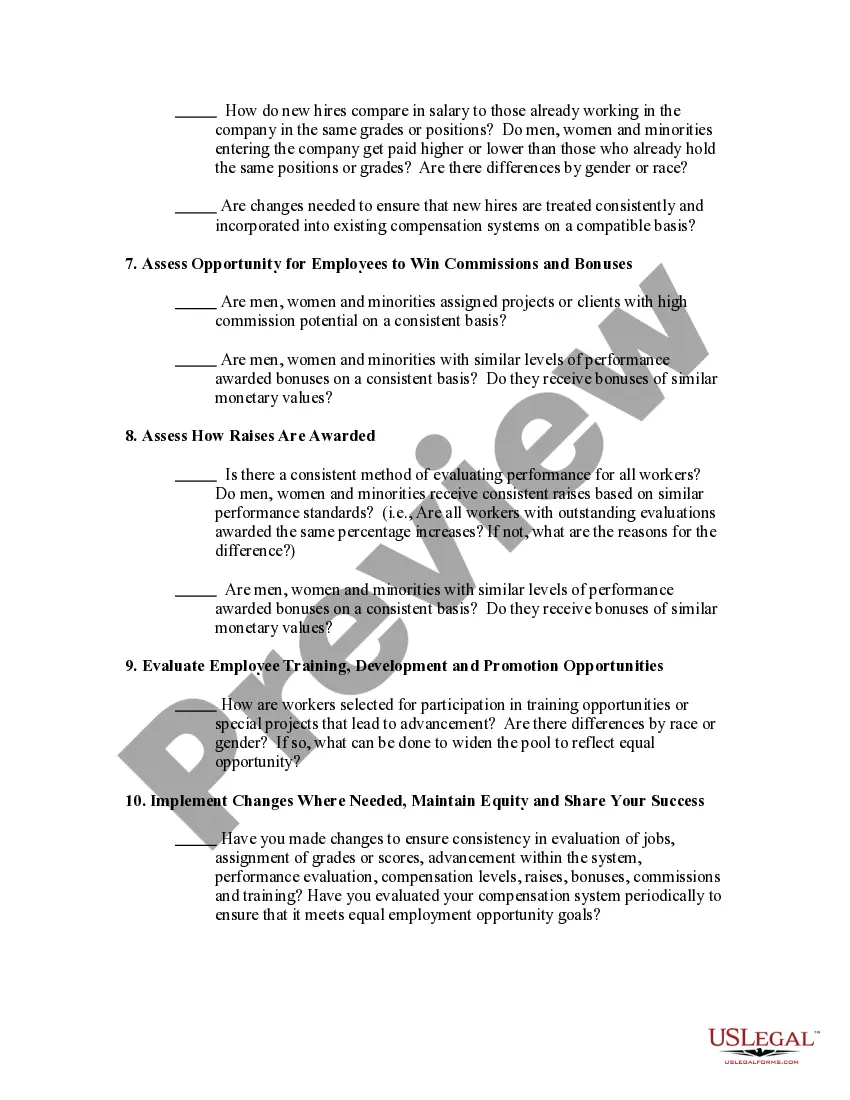

Conducting a seven-step pay auditPlan early and plan well.Research your pay policies.Gather the data.Compare the work of employees with similar positions.Analyze the data.Assess whether pay differences are legally justified.Take action to mitigate any pay differences.

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26, rounded down to the next lower whole dollar.

If you work 35 hours or more or your earnings exceed your weekly benefit amount plus your disregarded earnings, you will be considered fully employed and will not be entitled to receive benefit for that week.

Even if you are still working part-time, you may be eligible for unemployment benefits, depending on your earnings and your situation. California has several programs that offer "partial" unemployment benefits: A portion of the benefit you would receive if you were fully unemployed, reduced to take into account your