Vermont Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Are you currently in a situation where you require documents for occasional business or specific purposes almost every day.

There are numerous legal document templates accessible online, but locating those you can trust is not easy.

US Legal Forms offers a wide array of form templates, such as the Vermont Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, that are designed to comply with federal and state regulations.

Leverage US Legal Forms, the largest selection of legal forms, to save time and avoid mistakes.

The service provides well-crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit simpler.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Vermont Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/state.

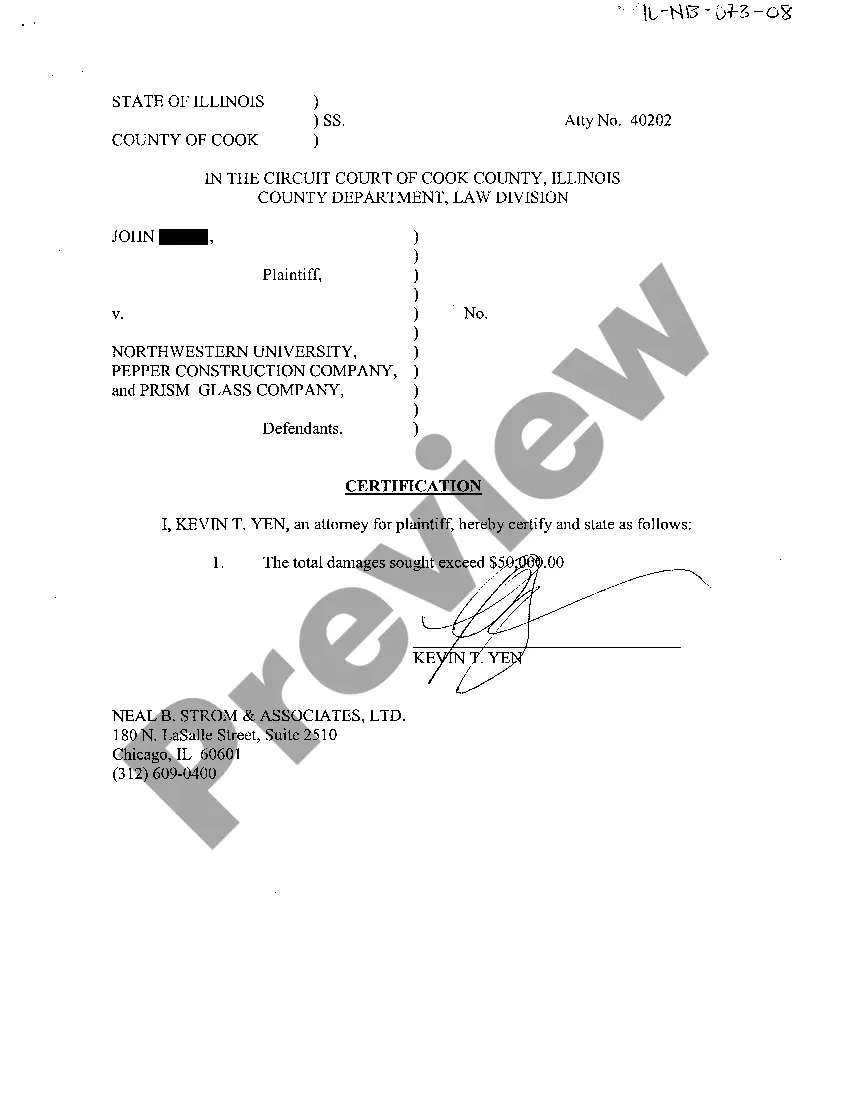

- Use the Review option to examine the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you're looking for, use the Research section to search for the form that fits your needs and criteria.

- When you have the appropriate form, click on Get now.

- Choose the pricing plan you prefer, complete the required details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient paper format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can download an additional copy of the Vermont Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption anytime, if needed. Just click the necessary form to download or print the document template.

Form popularity

FAQ

Not everyone receives a Form 1099-S when selling a home. The issuance of this form typically depends on the sale's specifics and whether you're exempt under the Vermont Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. If you meet certain criteria, you might not receive this form. It’s advisable to consult with a tax advisor or investigate platforms like US Legal Forms to determine your reporting obligations.

The homebuyer pays the taxWhen a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

FOOD, FOOD PRODUCTS, AND BEVERAGES - TAXABLE Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks.

A blanket certificate in California appears to not have an expiration date.

Definition of exemption 1 : the act of exempting or state of being exempt : immunity. 2 : one that exempts or is exempted especially : a source or amount of income exempted from taxation.

An exemption letter is an official document that allows an exemption requestee not to do an activity or pay some financial responsibilities. This letter is to be submitted to institutions and agencies and is subject to approval or denial.

An official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. Exemption certificates are not filed with the Vermont Department of Taxes, but the seller must produce an exemption certificate when it is requested by the Department.

The resale certificate is kept on file by the seller for three years from the date of the last sale and is not filed with the Vermont Department of Taxes.

Allowances Exempted as per Income Tax Act Section 10House Rent Allowance (HRA)Allowance on Transportation.Children Education Allowance.Subsidy on Hostel Facility.Income Tax Exemption on Housing Loan.Section 80C.