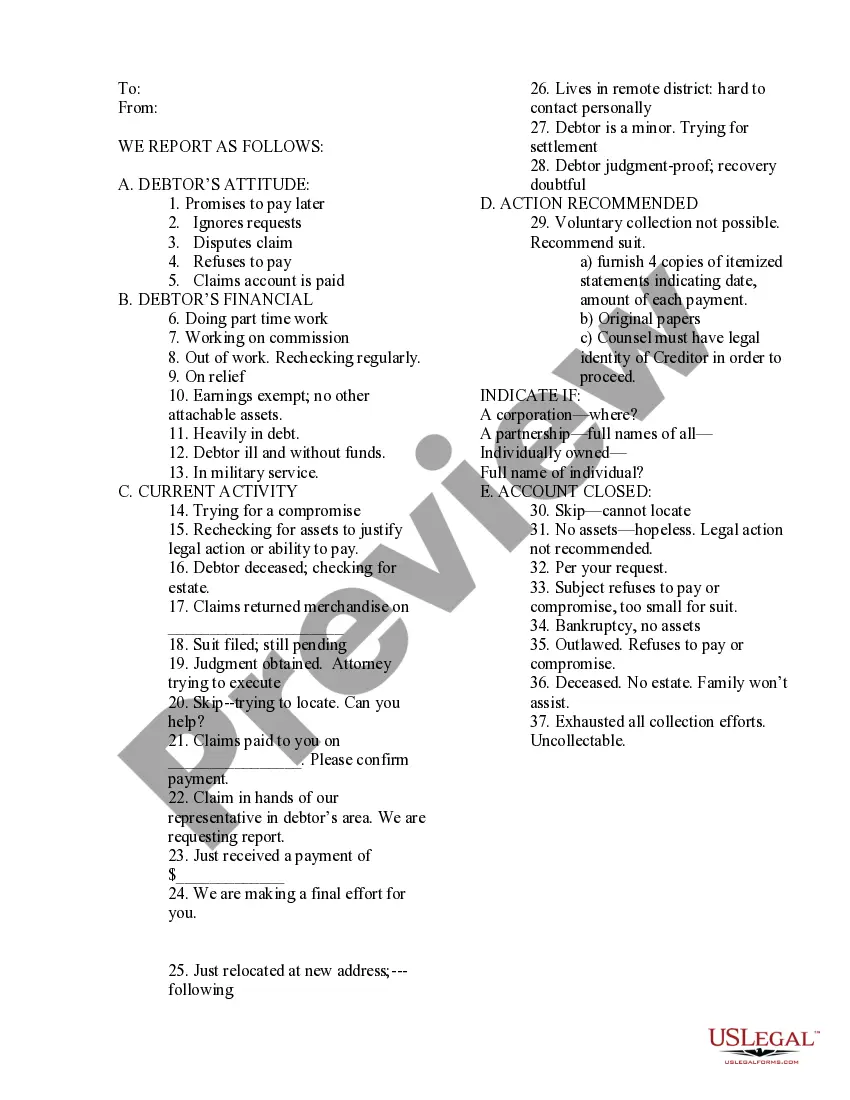

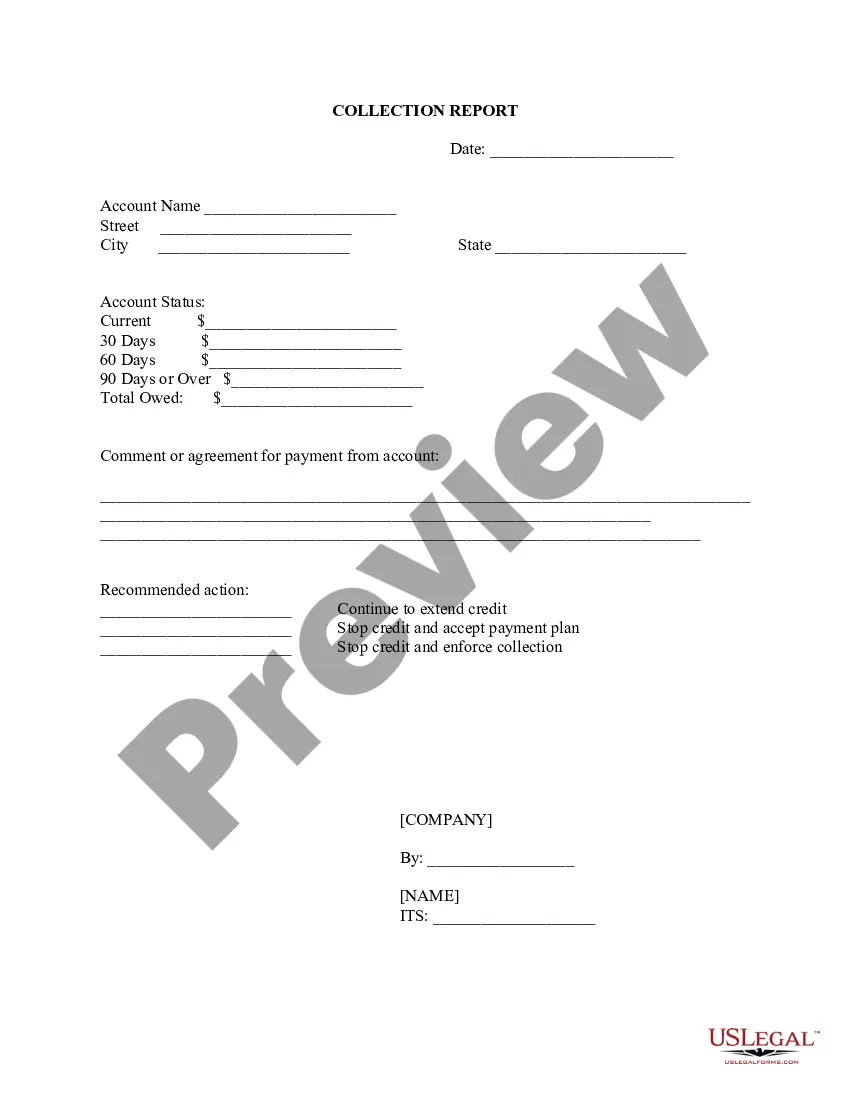

This is a form to track progress on a delinquent customer account and to record collection efforts.

Vermont Delinquent Account Collection History

Description

How to fill out Delinquent Account Collection History?

Selecting the optimal sanctioned document template can be quite a challenge.

Clearly, there are numerous templates on the internet, but how can you find the authorized document you require.

Utilize the US Legal Forms website.

First, ensure that you have selected the appropriate document for your city/state. You can preview the form using the Preview feature and review the form details to confirm it is suitable for your needs.

- The service offers a vast selection of templates, including the Vermont Delinquent Account Collection History, suitable for both business and personal uses.

- All forms are reviewed by professionals and comply with state and federal requirements.

- If you are already a registered user, Log In to your account and click on the Download option to retrieve the Vermont Delinquent Account Collection History.

- Use your account to browse the legal forms you have previously obtained.

- Navigate to the My documents section in your account and download an additional copy of the document you need.

- If you are a new client of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Vermont is often considered a high-tax state compared to many others in the U.S., primarily due to its income and property taxes. While the taxes support various public services, they can impact individuals financially, particularly those with a Vermont Delinquent Account Collection History. It's important to assess how these tax rates influence your overall financial health and explore resources that may help you manage your obligations.

Vermont state tax encompasses various types of taxes, with the most notable being income tax, sales tax, and property tax. The state employs a progressive income tax system, which means that higher earnings incur higher tax rates. Knowing this can help you plan your finances more effectively, particularly if you have a Vermont Delinquent Account Collection History, as it may affect your budgeting strategies.

Vermont state sales tax is currently set at 6%, which applies to most goods and services sold within the state. Additionally, some municipalities can impose local sales taxes, raising the total to 7%. For individuals inquiring about their financial obligations, especially those with a Vermont Delinquent Account Collection History, understanding the sales tax can play a crucial role in budgeting and being aware of local economic conditions.

Calculating the amount of $80,000 after taxes in Vermont involves several factors, including state and federal taxes. Vermont has a progressive income tax system, where your tax rate increases as your income rises. Generally, after deductions, you could expect to keep around $50,000 to $60,000, depending on your specific tax situation. Understanding your Vermont Delinquent Account Collection History could aid in financial planning and managing your overall tax implications.

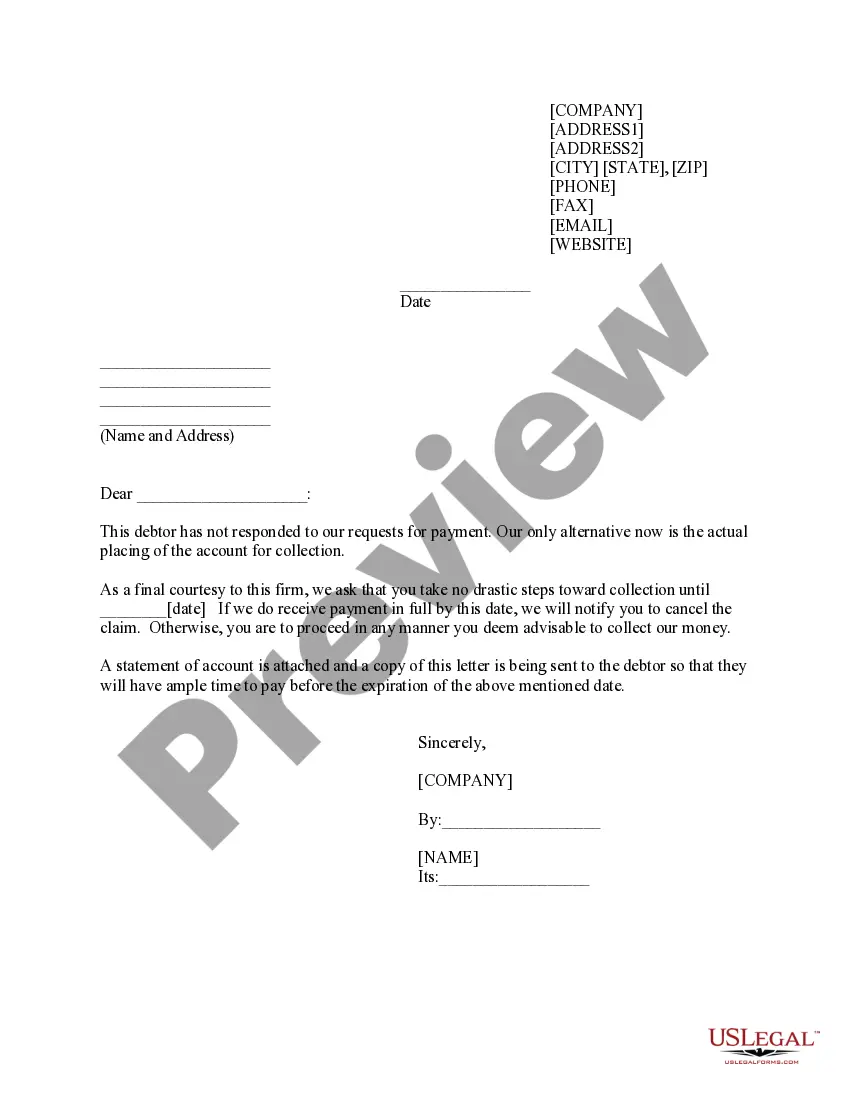

To send a delinquent account to collections, you should first document the details of the debt extensively. Using a collection agency or service equips you with the expertise to handle the process efficiently. Platforms like uslegalforms provide valuable resources to guide you through the necessary steps, ensuring that your action complies with the law. Familiarizing yourself with Vermont delinquent account collection history can further enhance your strategy for effectively tackling collections.

Vermont operates under a tax lien system, which means that unpaid property taxes lead to a lien placed on the property rather than a deed transfer. This process offers a chance for property owners to resolve their tax debts without losing ownership immediately. Knowing whether Vermont is a tax lien or tax deed state can be critical for understanding the implications of property delinquency in relation to Vermont delinquent account collection history.

Before initiating a collections process, review all your communication with the debtor to ensure transparency. Gather all relevant documents like invoices and contracts to support your claim. It’s also wise to attempt one final direct communication with the debtor, giving them a chance to resolve the issue amicably. Understanding the Vermont delinquent account collection history may guide your approach, offering tools and techniques that improve your chances for success.

To pull a tax delinquent list, you will need to access your local tax authority’s website. Many states provide online resources to help you find properties with unpaid taxes. This information, which contributes to the Vermont Delinquent Account Collection History, is publicly available and can assist you in making informed decisions. Consider using uslegalforms for additional resources and guidance.

In Monkton, Vermont, the tax collector is the town treasurer, who handles all tax payments and records. This official oversees the collection of property taxes and maintains records related to unpaid accounts. You can reach out to the tax collector’s office for details on your tax accounts and the Vermont Delinquent Account Collection History. Knowing your tax collector can simplify your inquiries.

In Kansas, property taxes can go unpaid for several years before the county takes action. The exact timeline may vary by county, but generally, counties will initiate a tax sale after three years of delinquency. It's important to address any unpaid property taxes promptly to avoid complications that could affect your Vermont Delinquent Account Collection History. Ignoring tax responsibilities can lead to eventual loss of ownership.