Vermont Checklist - Action to Improve Collection of Accounts

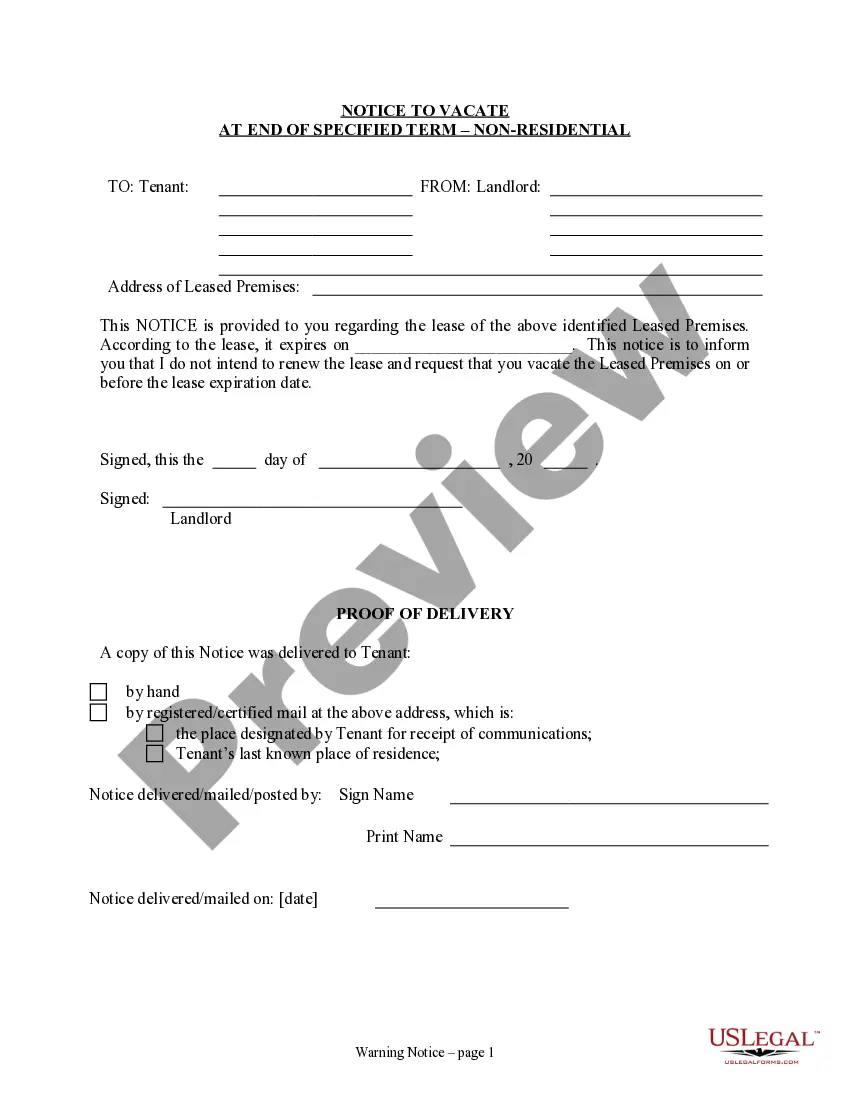

Description

How to fill out Checklist - Action To Improve Collection Of Accounts?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords. You can find the latest versions of forms such as the Vermont Checklist - Action to Enhance Account Collection in just minutes.

If you already have an account, Log In to download the Vermont Checklist - Action to Enhance Account Collection from your US Legal Forms library. The Download option will be visible on every form you view. You can find all previously downloaded forms within the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Modify it. Complete, adjust, print, and sign the downloaded Vermont Checklist - Action to Enhance Account Collection. All templates added to your account have no expiration date and are yours to keep indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Vermont Checklist - Action to Enhance Account Collection with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your region/area.

- Click the Preview option to verify the form's details.

- Review the form description to ensure it meets your needs.

- If the form does not align with your requirements, utilize the Search field at the top of the screen to find the right one.

- Once satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and enter your information to create an account.

Form popularity

FAQ

To file an extension on your taxes in Vermont, you need to complete the IN-151 form and submit it to the Vermont Department of Taxes by the regular filing deadline. This extension helps you avoid penalties, allowing more time to accurately complete your state tax return. Following your Vermont Checklist - Action to Improve Collection of Accounts will ensure that you remain organized and compliant. You can also find assistance on uslegalforms to simplify this process for you.

In Vermont, the tax extension form is typically the IN-151, which you must submit for an extension to file your state taxes. This form grants you more time to prepare your return while avoiding penalties for late filing. Being proactive in using the Vermont Checklist - Action to Improve Collection of Accounts can help you stay informed about important deadlines. Uslegalforms offers guidance through this process, ensuring you have the right resources at your fingertips.

The extension form IN-151 is used in Vermont for taxpayers who need extra time to file their state tax return. This form must be submitted before the filing deadline and allows you to extend your deadline for filing, but not for payment. Ensuring you have this form prepared is a key step in your Vermont Checklist - Action to Improve Collection of Accounts. For convenience and accuracy, uslegalforms can assist you in obtaining and completing this form.

The elderly tax credit in Vermont is designed to provide financial relief to qualifying elderly taxpayers. This credit can reduce your tax burden based on age and income limitations, which can be beneficial for those on fixed incomes. Incorporating this option into your Vermont Checklist - Action to Improve Collection of Accounts enhances your financial planning. Consider consulting uslegalforms for resources to help navigate eligibility and application procedures.

To obtain a tax extension form in Vermont, you need to fill out the appropriate extension request form, which is often accessible through the Vermont Department of Taxes website. Once completed, this form allows you to extend the time for filing your state tax return. Utilizing the Vermont Checklist - Action to Improve Collection of Accounts can guide you in managing deadlines wisely. Additionally, you can leverage uslegalforms to easily obtain the necessary forms for your tax extension.

Form IN-111 in Vermont is the state's individual income tax return form. Taxpayers use this form to report their income, deductions, and credits when filing their state taxes. Ensuring accurate completion of IN-111 is essential in following your Vermont Checklist - Action to Improve Collection of Accounts. Using resources from uslegalforms can simplify your filing process, making it easier to stay on track.

The charitable contribution credit in Vermont allows taxpayers to receive a credit for donations made to eligible charitable organizations. This credit can reduce your state tax liability, making charitable giving more attractive. It plays a crucial role in maximizing your benefits as you complete your Vermont Checklist - Action to Improve Collection of Accounts. By taking advantage of this credit, you can support local causes while enhancing your overall tax situation.

The 7 7 7 rule for debt collection suggests that debt collectors should contact a debtor seven times, within seven days, and utilize seven different methods of communication. This approach maximizes the chances of engaging with the debtor and encourages repayment. Applying the Vermont Checklist - Action to Improve Collection of Accounts can help you implement this rule effectively, ensuring you do not miss any opportunity to collect your dues.

A checklist for debt collectors includes various steps such as verifying the debtor's information, assessing the amount owed, and understanding relevant state laws. It is also important to track previous communications and establish a timeline for follow-ups. The Vermont Checklist - Action to Improve Collection of Accounts is designed to help collectors remain organized and efficient throughout the collection process.

Debt collectors typically need to prove three key elements: the amount of debt, the identity of the debtor, and that the debt is valid and enforceable. Additionally, they should demonstrate that they have made reasonable attempts to collect payment. Following the Vermont Checklist - Action to Improve Collection of Accounts ensures you meet these requirements with confidence.