Vermont Demand Promissory Note

Description

How to fill out Demand Promissory Note?

Are you currently in a situation where you require documents for possible organization or specific tasks almost all of the time.

There are numerous legal document templates available online, but finding credible ones is quite challenging.

US Legal Forms offers a wide array of template forms, such as the Vermont Demand Promissory Note, which can be customized to fulfill state and federal requirements.

When you find the correct form, click Acquire now.

Select the pricing plan you desire, fill in the necessary information to create your account, and make the payment using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you'll be able to download the Vermont Demand Promissory Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the appropriate city/region.

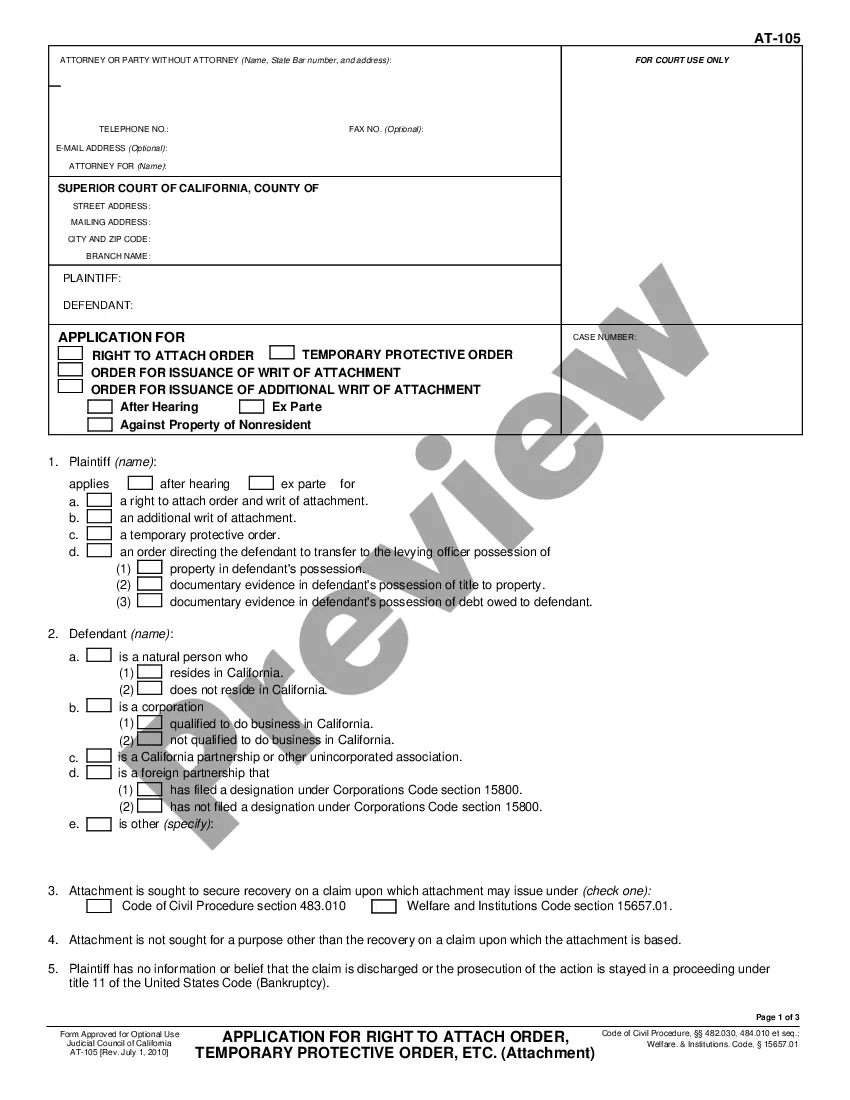

- Use the Review button to assess the form.

- Check the details to confirm that you have chosen the correct template.

- If the form is not what you're searching for, utilize the Search field to find a document that suits your needs.

Form popularity

FAQ

Yes, a promissory note can be classified as a demand instrument if it is structured that way. In the case of a Vermont Demand Promissory Note, it gives the holder the right to request payment whenever needed. This characteristic makes it a flexible financial tool suitable for different purposes, ensuring quick access to funds.

A promissory note is considered a negotiable instrument, meaning it can be transferred to others. This quality makes Vermont Demand Promissory Notes valuable in various transactions, allowing the holder to assign or sell the note. Proper documentation through platforms like uslegalforms can help in managing and transferring these instruments seamlessly.

Yes, a promissory note can be payable on demand, especially if it explicitly states so. A Vermont Demand Promissory Note allows the lender to request repayment at any time. Recognizing this feature can provide both security and flexibility for lenders in financial agreements.

In Vermont, the statute of limitations for enforcing a promissory note is typically six years. This period starts from the date of the note's maturity or the date of default. Understanding this limitation is crucial when managing Vermont Demand Promissory Notes to ensure you can enforce your rights effectively.

To demand payment on a Vermont Demand Promissory Note, begin by reviewing the terms outlined in the document. After that, send a formal written demand letter to the borrower, clearly stating the amount owed and the due date. If you’ve used USLegalForms to create your note, they provide templates and guidance to streamline this process effectively. Remember, prompt communication can help resolve repayment issues quickly.

To obtain a copy of your Vermont Demand Promissory Note, you should first check your personal records or contact the lender involved. If the note was filed with a court or government agency, you might be able to request a copy from them. Additionally, if you used a platform like USLegalForms, you can access your documents easily by logging into your account. Keep in mind that having a copy is essential for future references.

To legally enforce a promissory note, you typically start by sending a written demand for payment to the borrower. If the borrower fails to comply, you may need to initiate legal proceedings. It’s advisable to consult resources like uslegalforms for guidance, ensuring your Vermont Demand Promissory Note is compliant and enforceable in court.

To demand payment on a promissory note, you should notify the borrower in writing, specifying the amount owed and referring to the terms of the note. It's important to keep a record of this demand for future reference. Utilizing tools and templates from platforms like uslegalforms can simplify this process, ensuring your demand is clear and effective.

Yes, a promissory note can indeed be payable on demand. This means that the lender has the right to request payment at any time. This flexibility often makes the Vermont Demand Promissory Note a preferred choice for individuals or businesses looking for quick access to funds.

To fill out a Vermont Demand Promissory Note, begin by entering the date at the top. Include the borrower’s name, address, and the amount being borrowed. Next, specify the repayment terms, including interest rates and payment deadlines. Lastly, both the borrower and lender should sign the document to make it legally binding.