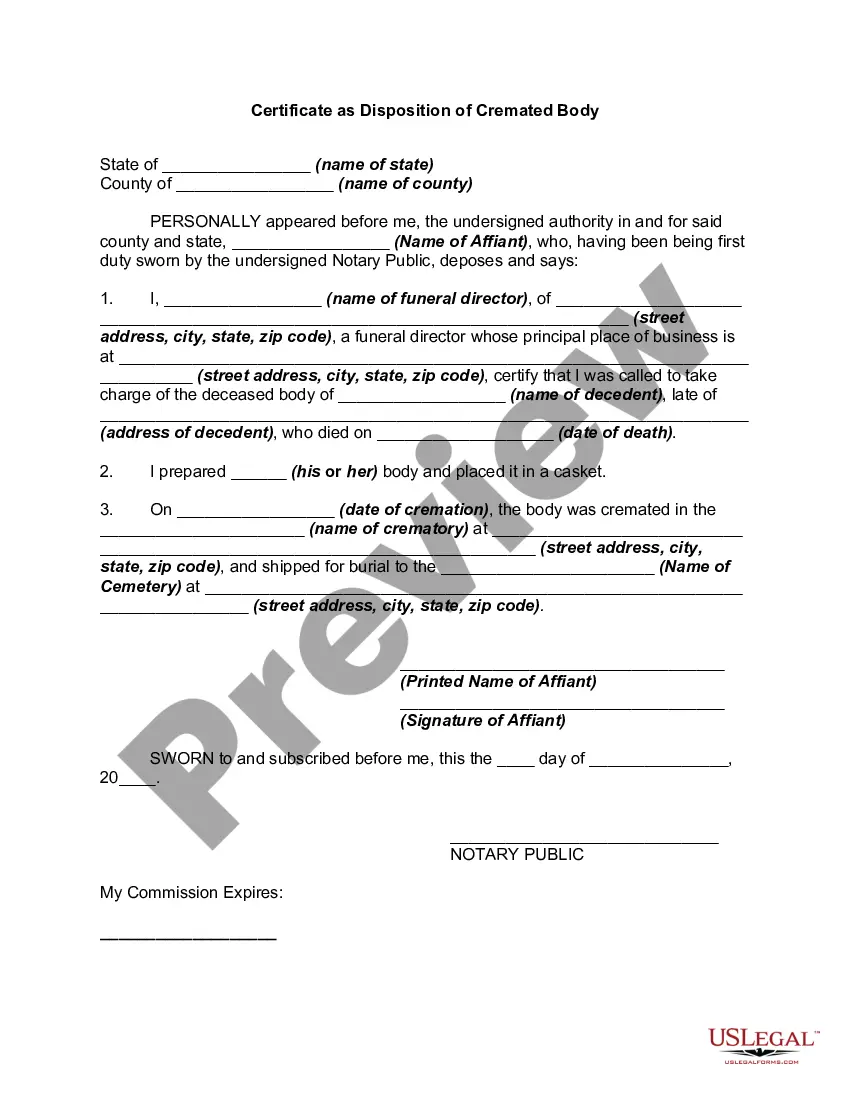

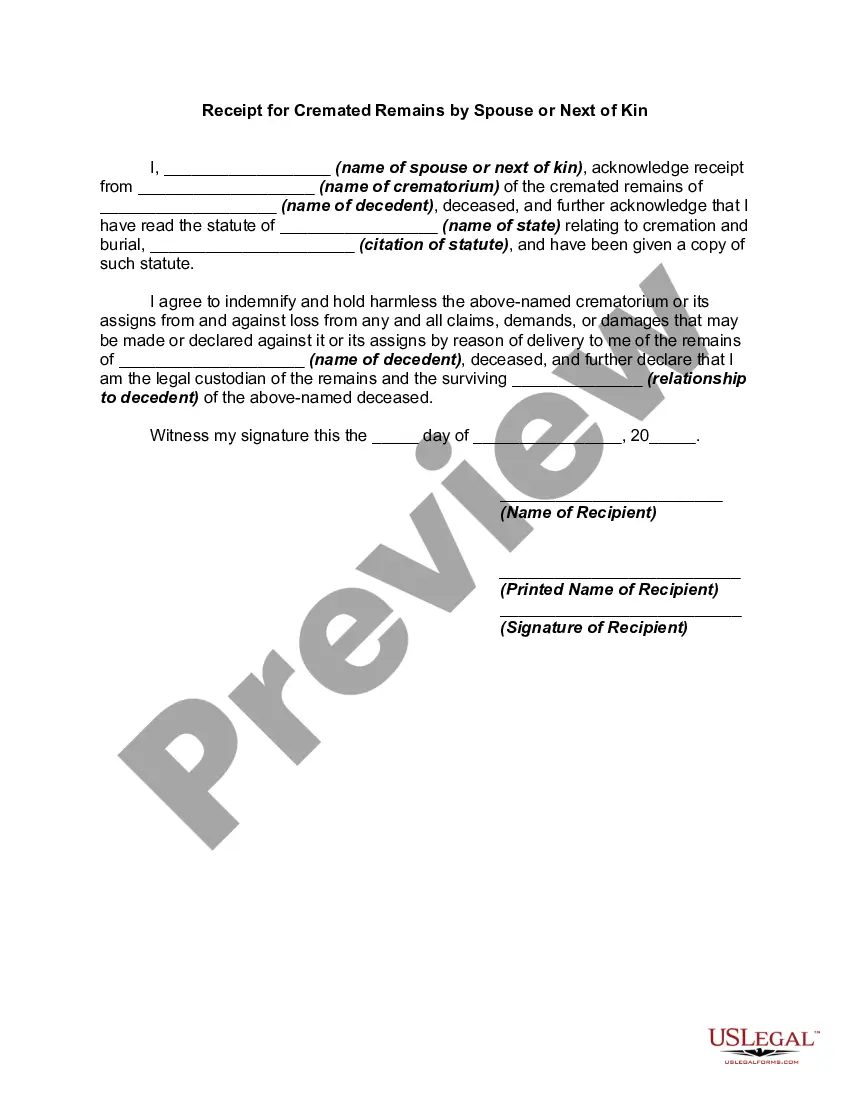

Cremation may serve as a funeral or post funeral rite that is an alternative to the interment of an intact body in a casket. Cremation is the process of reducing dead human bodies to basic chemical compounds in the form of gases and bone fragments. This is accomplished through high temperatures and vaporization. Cremated remains, which are not a health risk, may be buried or immured in memorial sites or cemeteries, or they may be legally retained by relatives or dispersed in a variety of ways and locations.

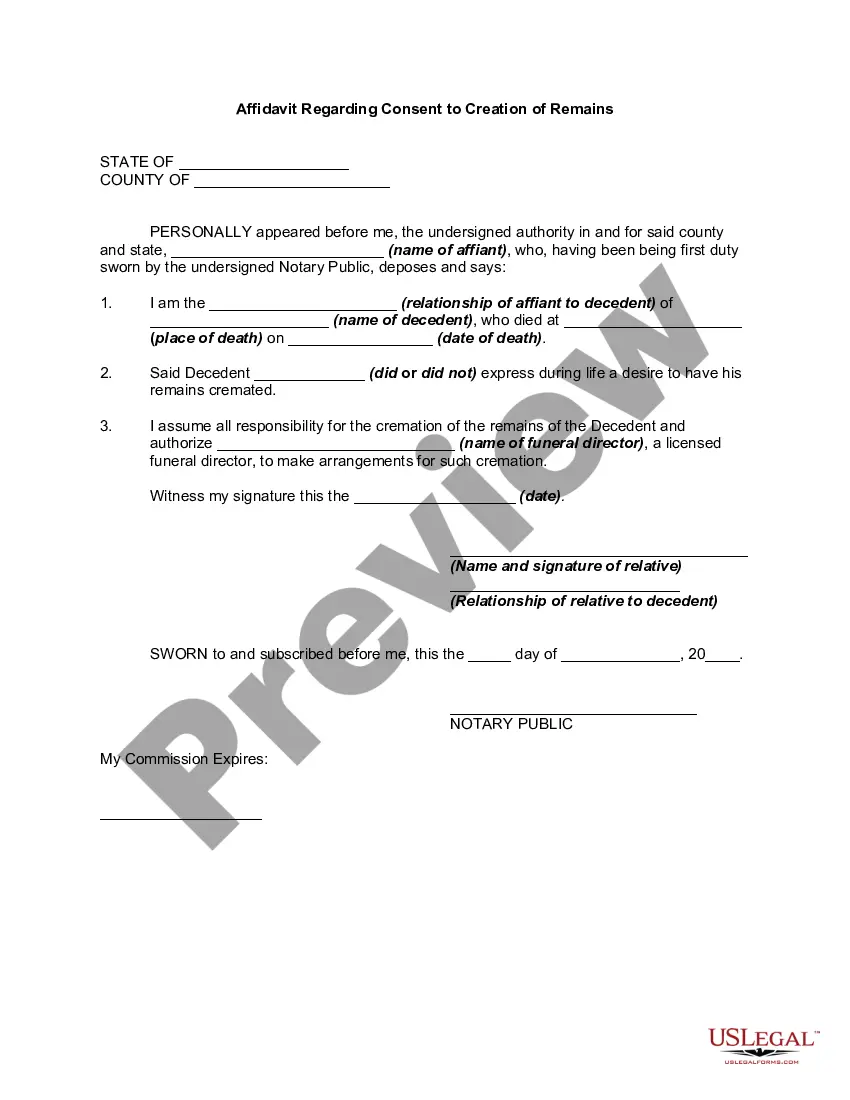

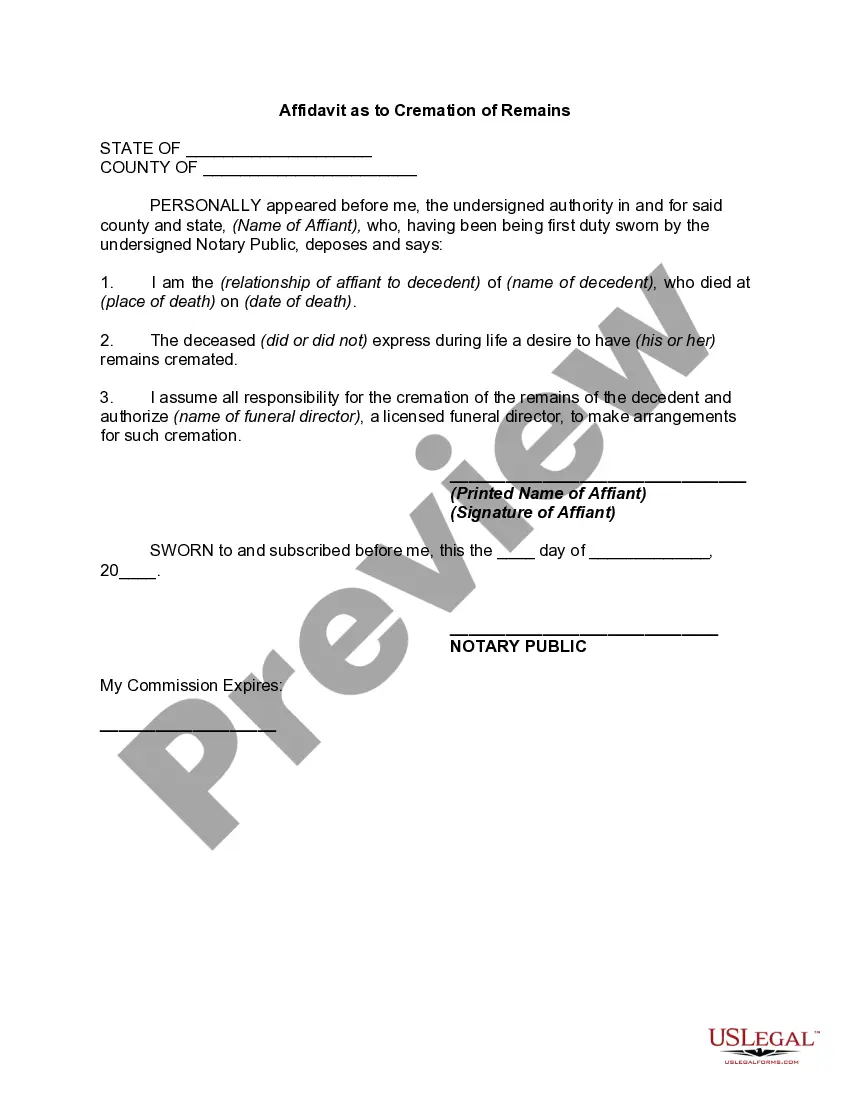

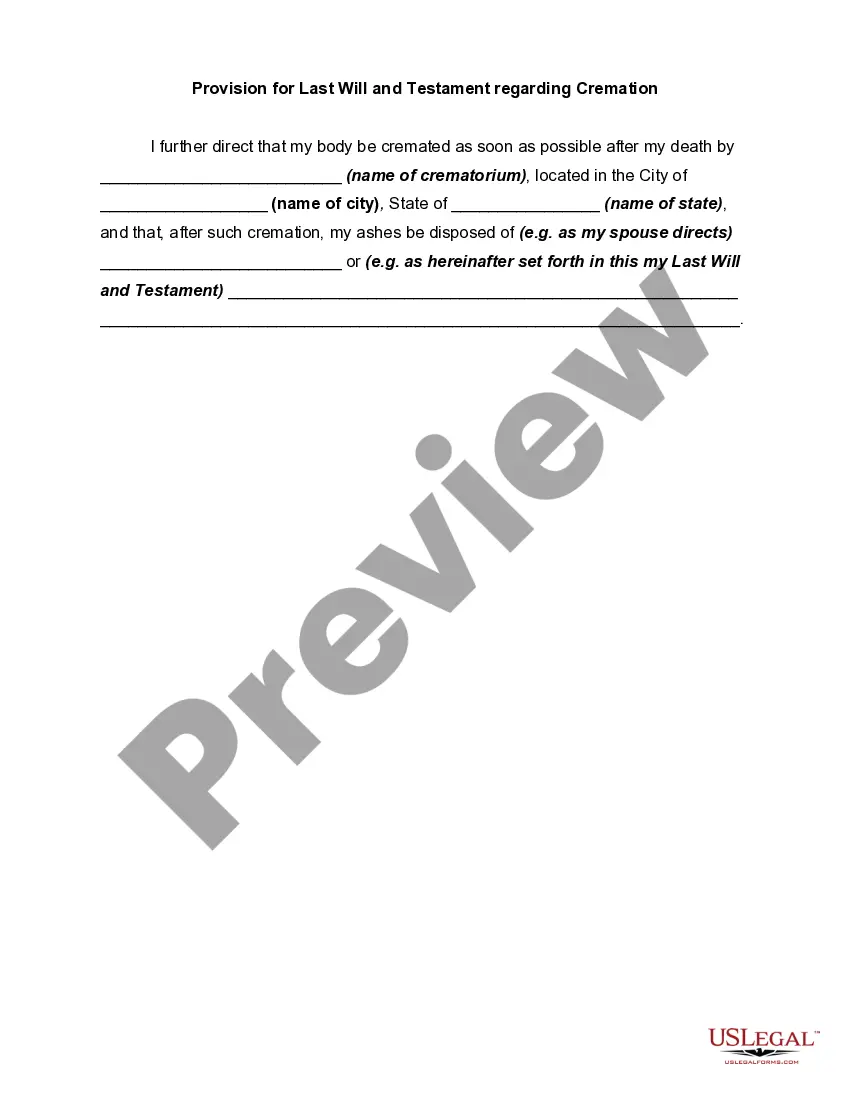

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.