An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Vermont Detailed Consultant Invoice

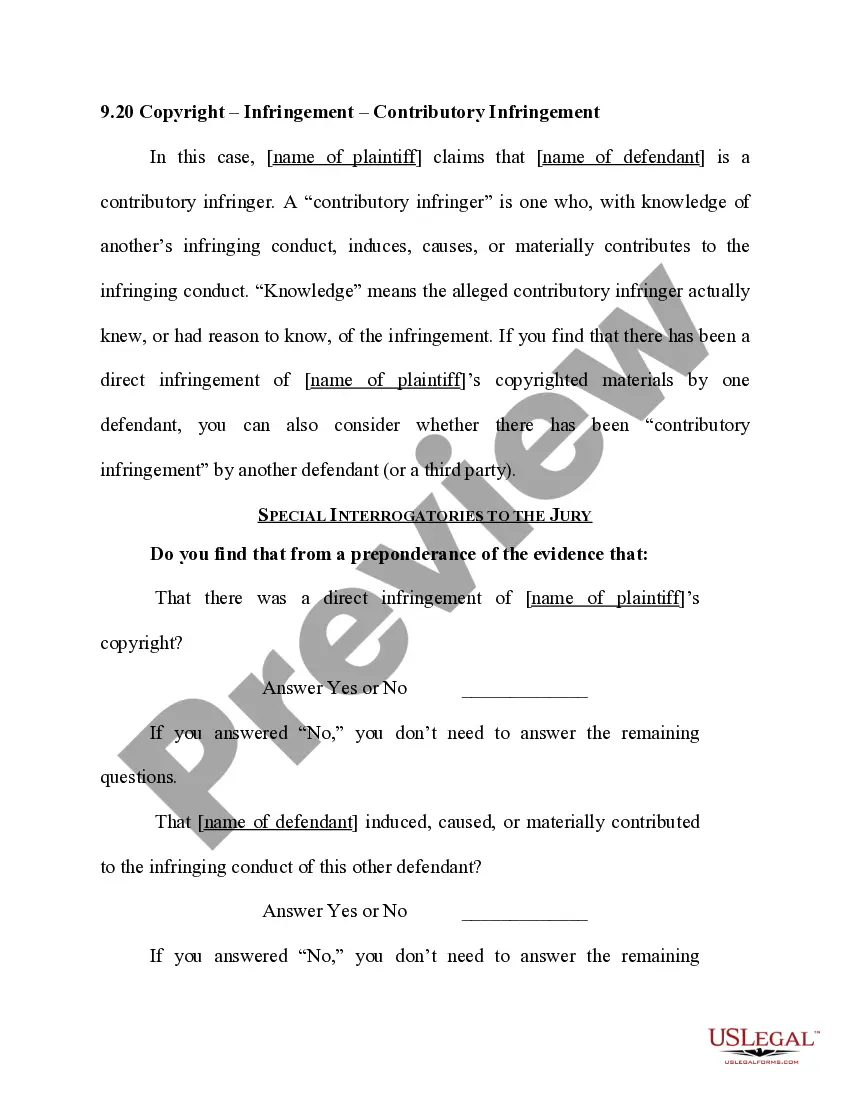

Description

How to fill out Detailed Consultant Invoice?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal needs are organized by categories and regions, or keywords. Employ US Legal Forms to procure the Vermont Detailed Consultant Invoice in just a few clicks.

If you are an existing US Legal Forms customer, Log In to your account and click on the Download button to find the Vermont Detailed Consultant Invoice. You can also access forms you have previously downloaded in the My documents tab of your account.

Every legal document template you purchase is yours forever. You have access to every form you downloaded within your account. Select the My documents section and pick a form to print or download again.

Download and print the Vermont Detailed Consultant Invoice with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal business or specific needs.

- Step 1. Make sure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Vermont Detailed Consultant Invoice.

Form popularity

FAQ

Filling out a construction invoice requires you to detail the services rendered, specifying materials used, labor costs, and total project expenses. It’s beneficial to include your business logo for branding purposes and make sure to state the payment terms clearly. A well-organized Vermont Detailed Consultant Invoice will facilitate easier processing and improved payment timelines.

Writing up a contractor invoice involves listing your services clearly, including descriptions and costs for each item. Start with your company’s details, and add the client’s information, date, and an invoice number. Incorporating all these elements will result in a professional Vermont Detailed Consultant Invoice that enhances prompt client payments.

To properly fill out an invoice, begin by entering your business name and the client's details at the top. Then, break down your services with clear descriptions and itemized costs. Don’t forget to include payment terms and due dates, ensuring your Vermont Detailed Consultant Invoice is straightforward and easy to process.

A contractor invoice typically includes your business name, contact details, client information, and a detailed list of services provided. Make sure to specify payment terms, due dates, and the invoice number for tracking purposes. By incorporating these elements, your Vermont Detailed Consultant Invoice becomes a comprehensive document that facilitates smooth financial transactions.

Filling out an invoice format begins with adding your business information and the client’s information at the top. Then, list the services provided along with their costs, including relevant dates and any applicable taxes. Utilizing a standardized invoice format helps ensure all critical details are covered, enhancing the legitimacy of your Vermont Detailed Consultant Invoice.

Filing Vermont state taxes involves completing the necessary forms and submitting them to the Vermont Department of Taxes. You may choose to file online or by mail, depending on your preference. To streamline this process, utilizing a Vermont Detailed Consultant Invoice can help maintain organized records of your income and expenses.

Products not taxed by sales tax in Vermont include most food items consumed at home, prescription medications, and specific agricultural products. This exemption can impact financial reporting, so when creating a Vermont Detailed Consultant Invoice, identify these non-taxable items clearly.

Several items are exempt from sales tax in Vermont, including most groceries, prescription drugs, and certain medical devices. Additionally, some nonprofit organizations may qualify for exemptions. If you're preparing a Vermont Detailed Consultant Invoice, be clear about any exempt items to avoid confusion.

To amend a Vermont tax return, you will need to submit Form ACH-1, the Amended Return for Individual Income Tax. Ensure you gather all necessary documents that support your changes. Using a detailed invoice like the Vermont Detailed Consultant Invoice can help you track the details accurately for any adjustments needed.

Vermont's sales tax applies to various goods and services, including tangible personal property and some services. Certain items like clothing and groceries usually qualify for exemption. For a comprehensive understanding, consider structuring your Vermont Detailed Consultant Invoice to clarify these tax obligations.