Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

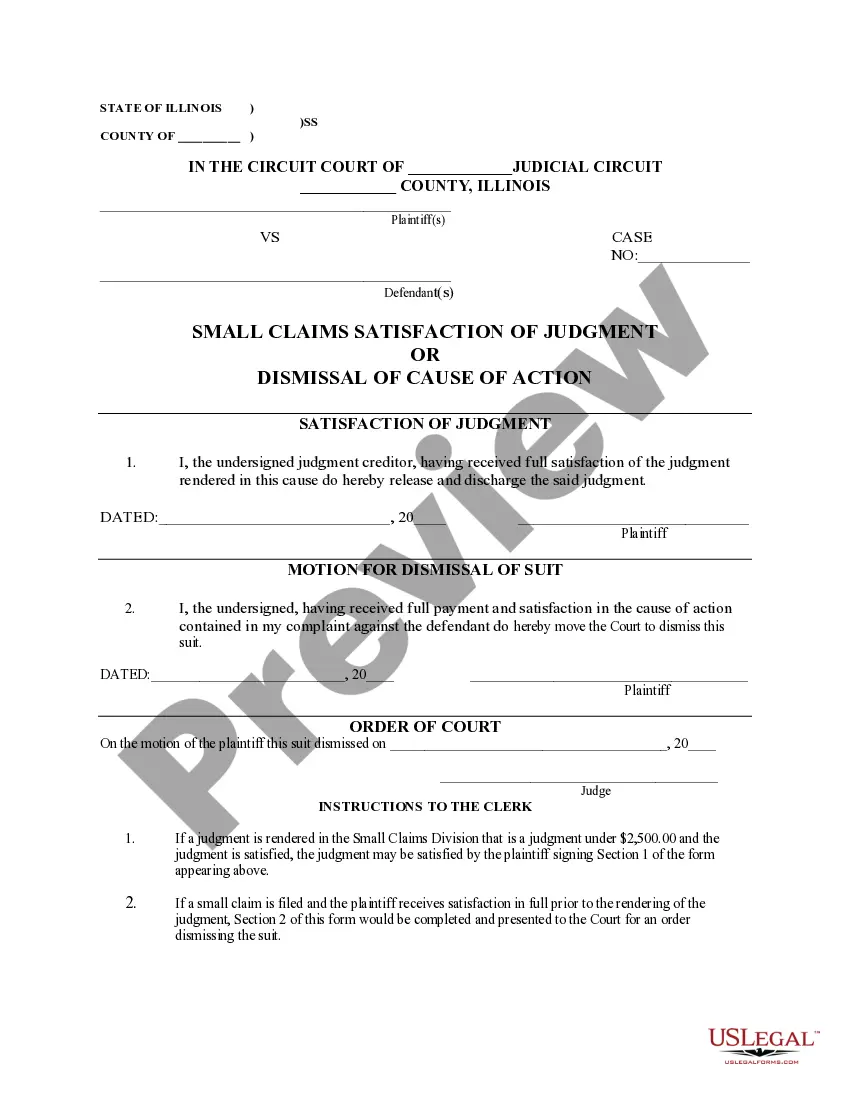

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you wish to obtain complete, download, or create authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site’s straightforward and user-friendly search feature to locate the documents you require.

Various templates for commercial and personal uses are sorted by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finish the payment.

- Utilize US Legal Forms to locate the Vermont Lease of Retail Space with Additional Rent Based on Percentage of Gross Receipts - Real Estate in just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click the Acquire button to download the Vermont Lease of Retail Space with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

In Vermont, the long term capital gains tax rate can significantly impact investors in real estate, including those involved in a Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts. The rate varies based on your taxable income but typically ranges from 0% to 8.75%. Understanding this tax can help you plan your finances more effectively. If you have further questions about taxes related to real estate, consider exploring resources available on the uslegalforms platform.

In Vermont, land gains tax is typically assessed at a rate of 25% on the profit from the sale of land. However, this tax applies only if you sell land you have held for a shorter duration, making timing crucial. It's essential to understand how this can affect your net returns on any property, including your Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. For further assistance, US Legal Forms can help you navigate the details and requirements of land gains tax.

One effective method to navigate capital gains tax is to reinvest your profits into similar property, benefiting from the 1031 exchange. This strategy enables you to defer taxes while maintaining your investment in real estate. To ensure a seamless approach, especially regarding your Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, consider utilizing US Legal Forms for proper structuring and documentation.

The 40 capital gains exclusion in Vermont allows you to exclude a portion of your capital gains from taxable income. This exclusion is particularly relevant when selling certain types of property, including real estate. Understanding how this interacts with your Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate can lead to significant savings. Consulting US Legal Forms can provide clarity on applying this exclusion to your specific situation.

To effectively avoid the Vermont estate tax, you might consider establishing a trust. This can help transfer assets outside your estate, minimizing tax obligations. Additionally, charitable donations can reduce the taxable estate amount. Using resources like US Legal Forms can guide you in structuring your Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate to align with tax benefits.

Yes, equipment rental in North Carolina is generally subject to sales tax, which can impact businesses operating under a Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Understanding the regulatory landscape concerning equipment rental taxation can aid in budgeting and financial planning. Keeping abreast of these tax implications is crucial. For assistance with lease agreements that consider such factors, uslegalforms provides comprehensive resources.

The pension exclusion in Vermont serves to exclude a portion of retirement income from taxation, providing financial relief to retirees. This exclusion can play a role in a tenant's overall financial picture, especially when negotiating a Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Making informed decisions about lease terms can help optimize financial outcomes in light of these exclusions. You can find valuable resources on uslegalforms for navigating these considerations.

The personal exemption for Vermont in 2024 allows residents to reduce their taxable income, making it an essential aspect of tax planning. This exemption impacts various financial agreements, including leases, by influencing a tenant's net income. Being informed about these exemptions enables better financial strategies in a Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. For precise calculations, it's beneficial to consult resources through uslegalforms.

The exclusion percentage refers to a specific portion of sales that may not be subject to additional rent calculations in a Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. This percentage helps retailers manage their expenses while adhering to lease agreements. Understanding this allows landlords and tenants to negotiate terms more effectively. For detailed guidance, consider leveraging tools from uslegalforms to craft tailored lease agreements.

The capital gains tax rate in Vermont is the same as the income tax rate, which ranges from 3.55% to 8.75% depending on your total income. This means that understanding your taxable income is crucial for effective financial planning. If you're leasing a retail space, such as under a Vermont Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, being aware of this rate can prevent costly surprises.