Vermont Trust Agreement - Family Special Needs

Description

How to fill out Trust Agreement - Family Special Needs?

You can spend several hours online attempting to locate the legal document template that satisfies both state and federal requirements you will have.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can conveniently download or print the Vermont Trust Agreement - Family Special Needs from your account.

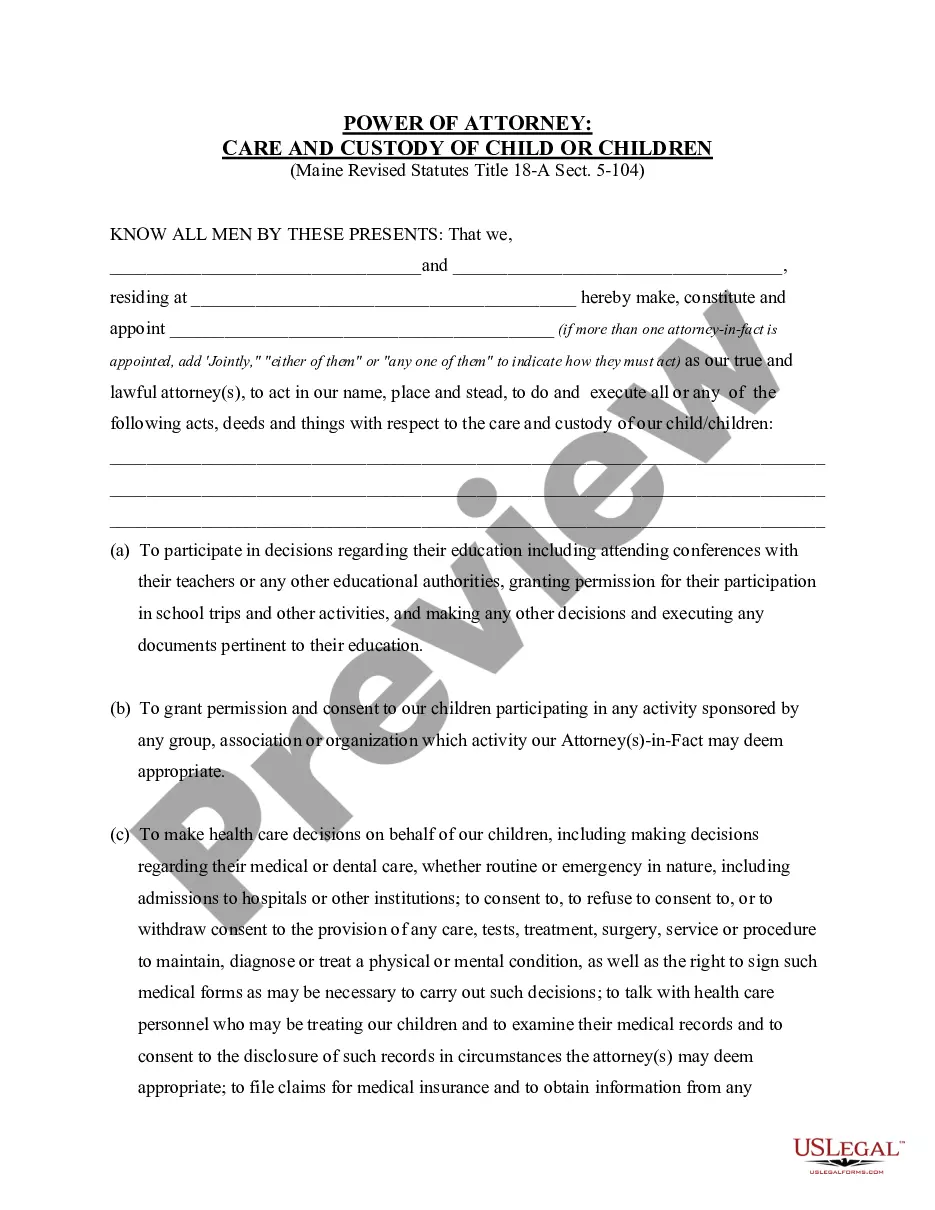

Utilize the Preview button if available to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Subsequently, you may complete, modify, print, or sign the Vermont Trust Agreement - Family Special Needs.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any downloaded form, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the basic instructions listed below.

- First, ensure you have selected the correct document template for the county/town you choose.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

A special type of trust that many families consider is the special needs trust, designed specifically for individuals with disabilities. This trust type allows for financial support without affecting eligibility for government benefits. Crafting a Vermont Trust Agreement - Family Special Needs ensures that your loved one can access essential funds while maintaining necessary support, giving peace of mind to you and your family.

Filing a special needs trust involves several steps, starting with drafting the trust document that outlines your wishes and the management of assets. After establishing the trust, you'll need to apply for a tax identification number from the IRS, and depending on income, you may also have to file annual tax returns. Using a platform like uslegalforms can simplify the process, helping you create a Vermont Trust Agreement - Family Special Needs efficiently and effectively.

Not all special needs trusts qualify as a qualified disability trust. A qualified disability trust must meet specific criteria set by the IRS, ensuring it provides benefits exclusively to individuals with disabilities. While a special needs trust aims to supplement government benefits, it may not automatically qualify for those tax benefits. It's essential to consult legal advisors familiar with a Vermont Trust Agreement - Family Special Needs to navigate these complexities.

The key difference between a complex trust and a qualified disability trust lies in their purpose and tax treatment. A complex trust may distribute income or accumulate it, often incurring taxes on earnings. In contrast, a qualified disability trust, particularly relevant under specific regulations, can provide financial support exclusively for beneficiaries with disabilities while offering tax benefits. Understanding these distinctions helps when forming a Vermont Trust Agreement - Family Special Needs tailored to your family's needs.

A special needs trust in Vermont is a legal arrangement that allows you to manage assets for a person with disabilities without jeopardizing their eligibility for government benefits. This type of trust can provide financial support for medical expenses, education, and care without interfering with crucial benefits like Medicaid. Establishing a Vermont Trust Agreement - Family Special Needs can ensure that your loved one receives the care they need while maintaining essential support.

While trusts offer many benefits, they also come with some disadvantages. Setting up a trust can be more costly than a simple will, and managing a trust requires time and ongoing administration. Furthermore, a Vermont Trust Agreement - Family Special Needs might limit your access to funds, as assets are tied up in the trust for the designated beneficiary’s use.

To set up a trust in Vermont, begin by defining your goals and choosing the right type of trust. Next, you'll want to draft a trust agreement, which you can do with the help of an attorney or resources like uslegalforms. Once the Vermont Trust Agreement - Family Special Needs is finalized, you will need to transfer assets into the trust to ensure it is effective.

There is no strict minimum amount to set up a trust; it often depends on your goals and the type of trust involved. Some trusts can be established with modest assets, while others, such as a Vermont Trust Agreement - Family Special Needs, may benefit from larger funds to ensure adequate support for a disabled family member. Consulting with a financial advisor helps determine the best approach for your situation.

The simplest way to set up a trust is to consult an estate planning attorney who specializes in trust creation. They will guide you through the necessary documents and ensure your Vermont Trust Agreement - Family Special Needs is tailored to meet your family's requirements. Alternatively, online platforms like uslegalforms provide user-friendly templates to help you create a trust efficiently.

A special needs trust, although primarily for California, serves a vital role in protecting disabled individuals' financial interests. It allows assets to be used for the beneficiary's benefit without affecting their eligibility for government benefits. While we focus on the Vermont Trust Agreement - Family Special Needs, understanding special needs trusts across states helps inform the best practices for setting up similar protections in Vermont.