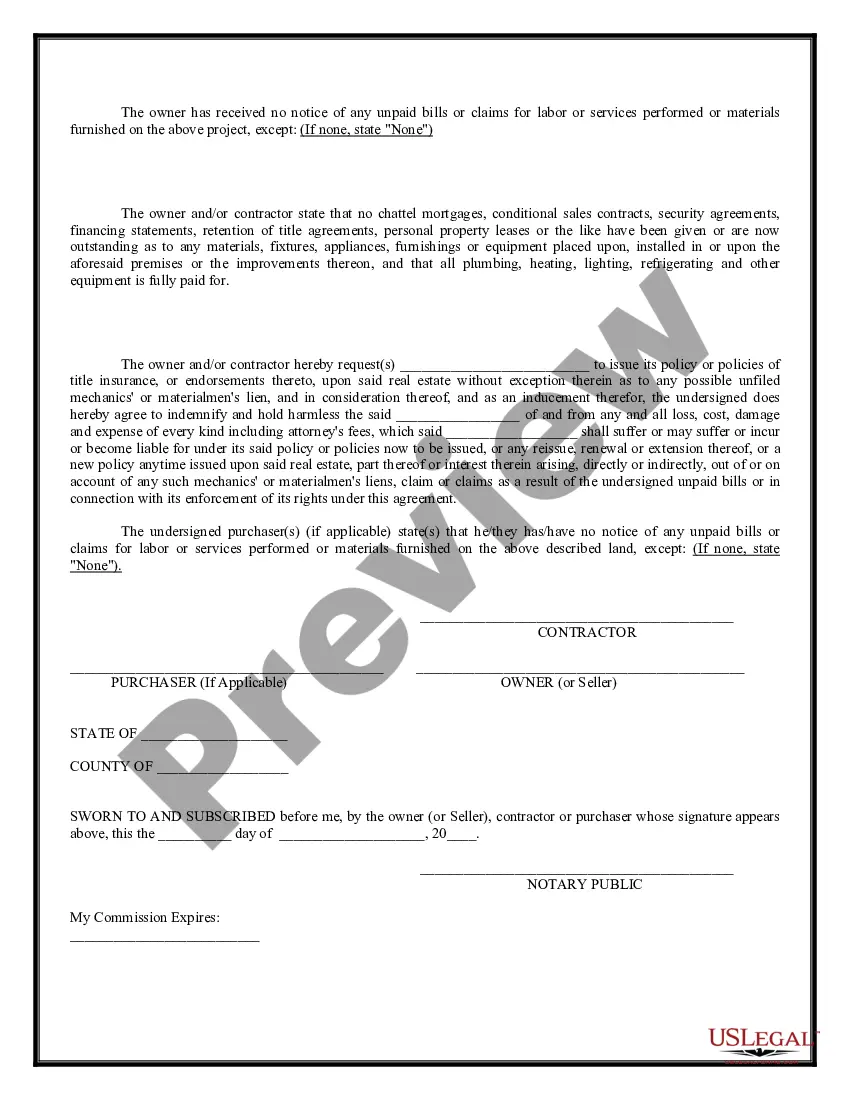

Vermont Owner's and Contractor Affidavit of Completion and Payment to Subcontractors

Description

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

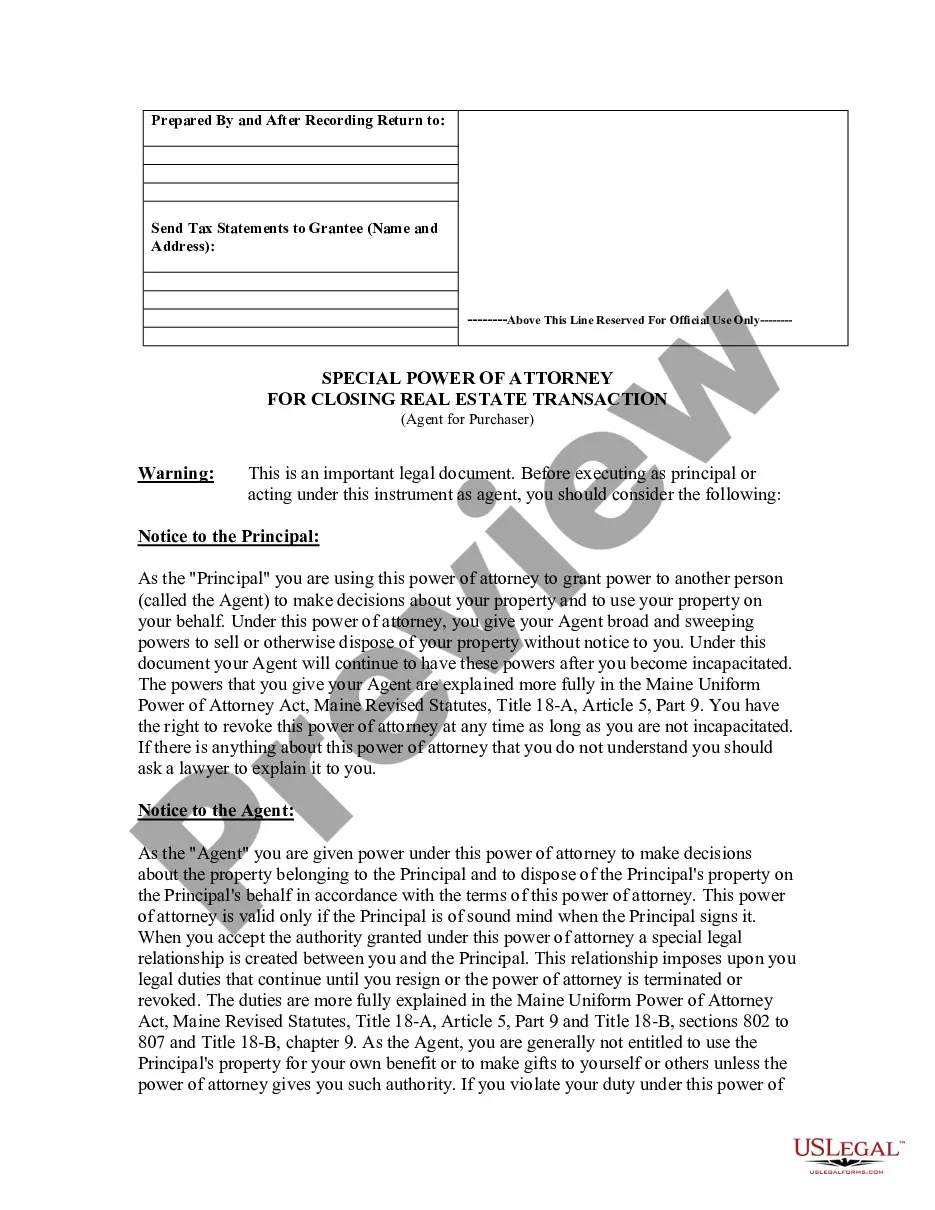

You might spend a few hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can download or print the Vermont Owner's and Contractor Affidavit of Completion and Payment to Subcontractors from our service.

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- After that, you can complete, modify, print, or sign the Vermont Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

- Each legal document template you receive is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the easy instructions below.

- First, ensure that you have selected the correct document template for the region/city that you have chosen.

- Review the form details to confirm you have chosen the appropriate template.

Form popularity

FAQ

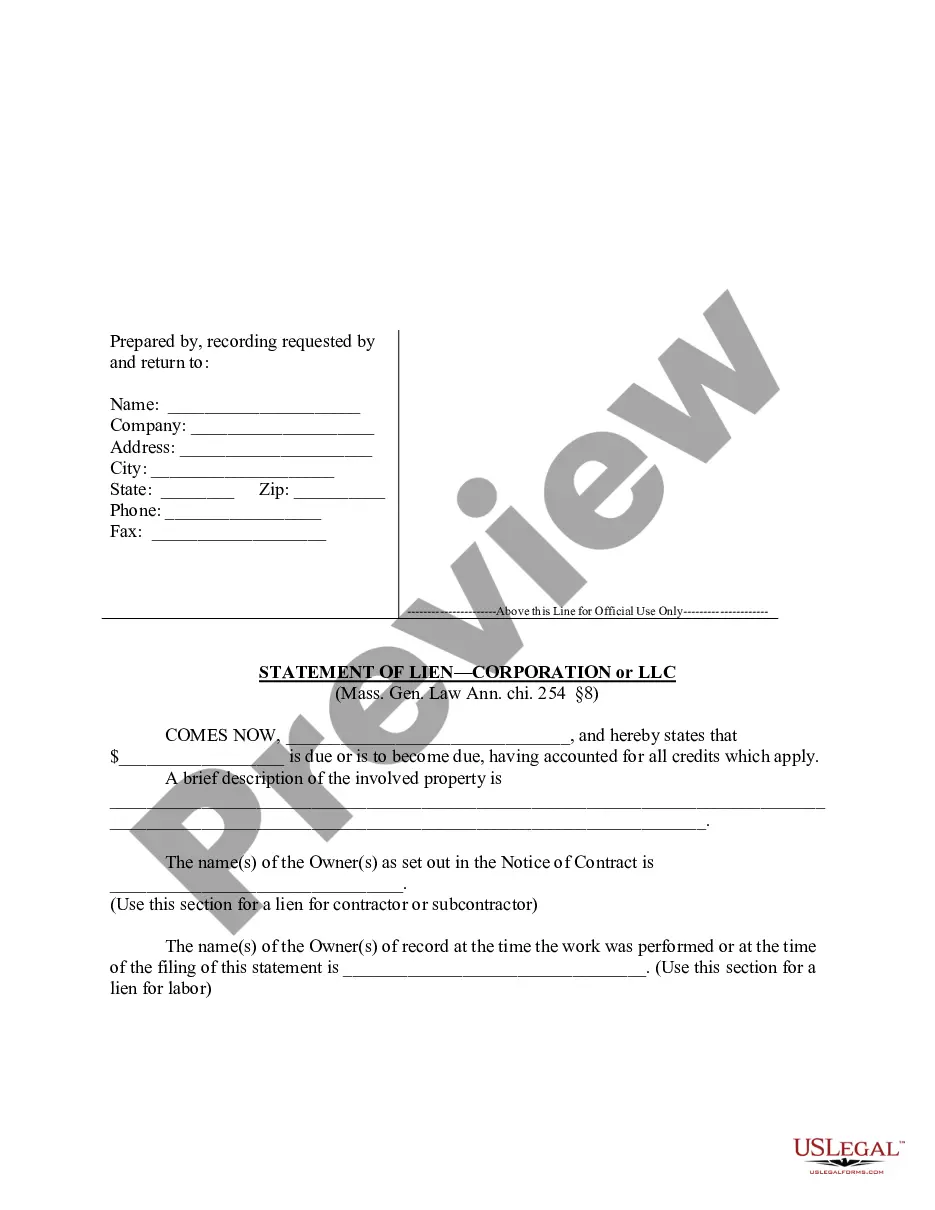

To file a lien in Vermont, you must complete specific forms and submit them to the appropriate county office where the property is located. Ensure you include all relevant details, such as the property's legal description and the amount owed. For guidance through this process, consider using the Vermont Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, which streamlines your dealings with subcontractors and helps protect against potential liens.

Yes, Vermont is a tax lien state, meaning that if property taxes remain unpaid, the government can place a lien on the property. This lien allows local authorities to recover unpaid taxes by claiming rights to the property until the debt is settled. It is essential to keep your affairs in order to avoid such tax issues, and a Vermont Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can assist in managing contractor payments efficiently.

In Vermont, a lien can remain on your property for a significant period, typically up to ten years. After this timeframe, the lien may be removed unless renewed by the creditor. Utilizing a Vermont Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can help prevent liens by ensuring all debts to subcontractors are settled promptly.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

Certificate. The document that you send to the subcontractor, usually with the payments, as an acknowledgement of the payment.

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

The courts recognize the subcontractor's right to sue the owner directly for the payment of its claim to the extent that the master contract creates an express obligation on the owner's part (must) as opposed to a mere option (may) to make payment to the general contractor conditional upon the latter's having