Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

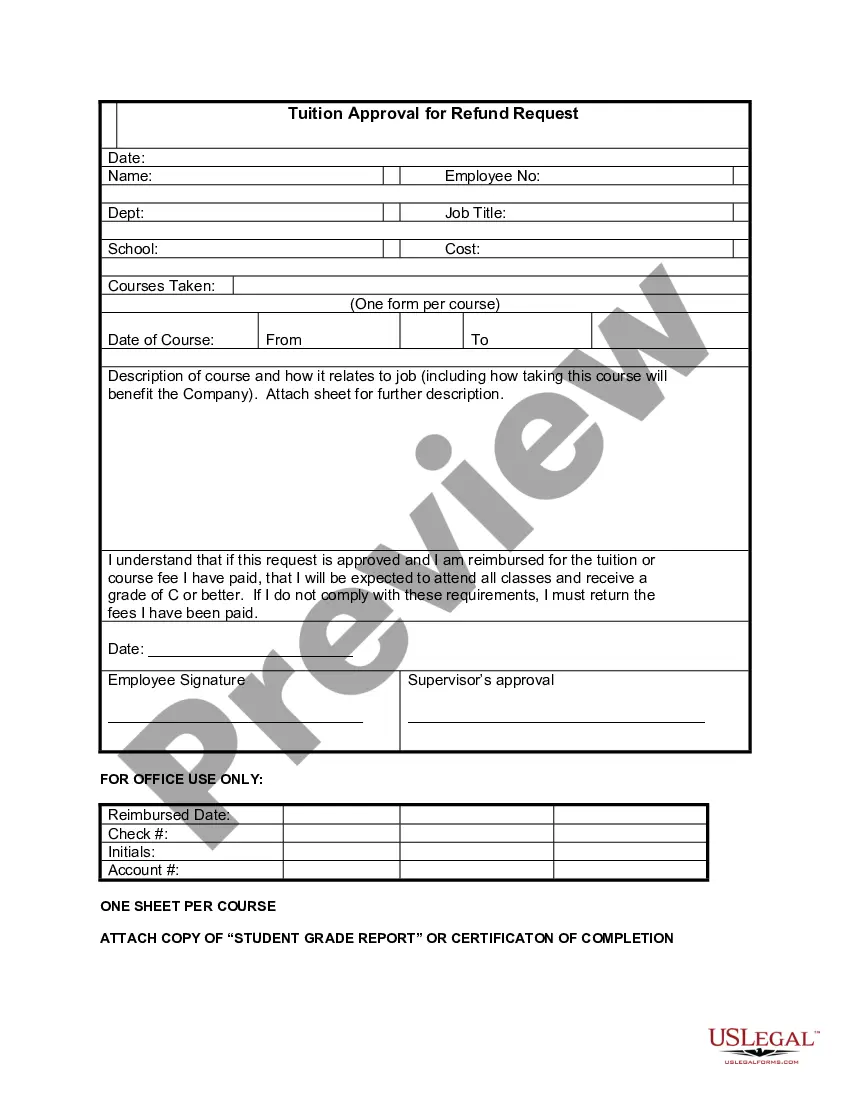

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

You can invest hours on the internet searching for the appropriate legal document format that meets your state and federal requirements.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can easily download or print the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions from your account.

Review the form details to confirm you have chosen the correct document. If available, utilize the Preview option to view the document format as well.

- If you already have a US Legal Forms account, you may Log In and select the Download option.

- After that, you can complete, edit, print, or sign the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

- Every legal document format you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/city you choose.

Form popularity

FAQ

Non-residents in Vermont typically use the VT Non-Resident Tax Return form to report their income earned within the state. This form is essential for ensuring compliance with Vermont tax laws and claiming any potential credits. In conjunction with resources like the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, non-residents can maximize their financial benefits while fulfilling their tax obligations.

In Vermont, the specific tax credit form can differ based on the credits claimed. Taxpayers must use designated forms to apply for various incentives aimed at reducing their tax bills. For individuals and businesses looking for additional reimbursement opportunities, the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can also provide substantial benefits.

A tax credit form is a document taxpayers use to apply for credits that reduce their overall tax liability. These forms vary by state and type of tax credit, making it important to understand which credits apply to your situation. Utilizing these credits can significantly impact your financial standing, especially when paired with the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

Form 111 in Vermont is a tax form that allows taxpayers to report their taxable income and calculate their tax liability. It's specifically tailored for various income sources, helping individuals ensure they meet their tax obligations. Proper use of form 111 is crucial for those seeking benefits such as the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

The 7202 tax credit form refers to the IRS form used by self-employed individuals to claim a credit for certain qualified expenses during the COVID-19 pandemic. This form helps reduce the tax burden for eligible business owners. Understanding its requirements may be helpful, especially in conjunction with Vermont’s own reimbursement options through the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

Form IN-111 is the Vermont personal income tax return form that individuals use to report their income and claim deductions. This form is essential for both residents and non-residents who earn income in Vermont. By completing the form correctly, taxpayers can help ensure they receive eligible refunds or credits, such as the Vermont Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

The Vermont form LC 142 is a legal document utilized for specific corporate resolutions, which allows for the reimbursement of expenditures. This form ensures that businesses follow proper protocols when documenting their financial transactions. Additionally, it plays a crucial role in maintaining compliance with Vermont's regulatory requirements.