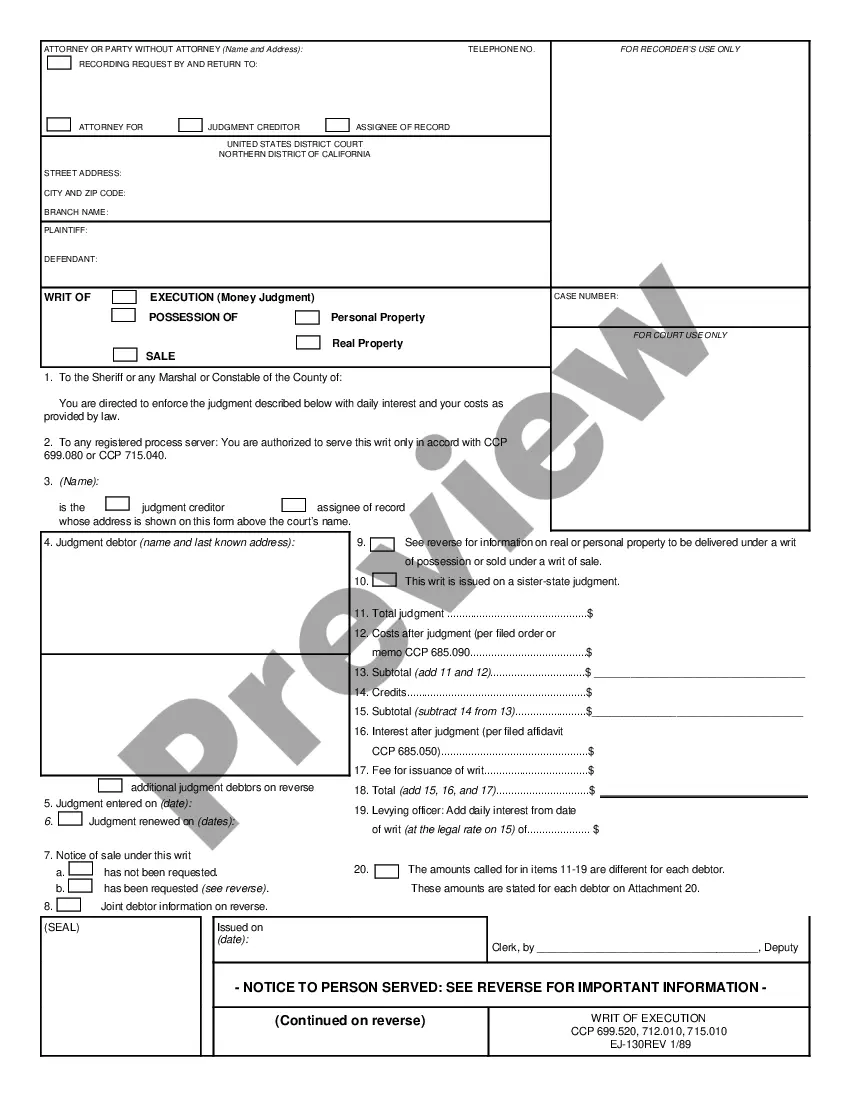

This form is a sample letter in Word format covering the subject matter of the title of the form.

Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions

Description

How to fill out Sample Letter For Settlement Offer - Instructions To Settle With Conditions?

US Legal Forms - one of the most prominent collections of legal documents in the country - offers a selection of legal template formats you can download or print. By utilizing the site, you can access countless forms for commercial and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents like the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions in just a few minutes.

If you already hold a monthly subscription, Log In and retrieve the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions from the US Legal Forms collection. The Download button will show up on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to assist you in getting started: Make sure you have chosen the correct form for your specific city/county. Click the Preview button to review the form's details. Check the form information to confirm you've selected the right document. If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does. If you are satisfied with the form, affirm your choice by clicking the Get now button. Then, select your preferred payment plan and provide your credentials to register for an account. Process the transaction. Use a credit card or PayPal account to complete the transaction. Choose the file format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions. Every template you upload to your account has no expiration date, meaning you have it indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the document you need.

- Access the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions through US Legal Forms, one of the largest collections of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

Form popularity

FAQ

Creating a settlement letter involves stating the relevant facts of your case, outlining your proposed terms for settlement, and expressing your willingness to negotiate. It is important to be clear and concise in your communication. By referencing the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions, you can streamline your writing process and enhance the effectiveness of your letter.

To write a settlement counter offer letter, start by acknowledging the original offer you received. Then, specify the changes you would like to make while explaining your reasoning. Utilizing the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions can guide you in framing your counter offer professionally and persuasively.

An example of a settlement offer letter includes a clear statement of the terms you propose for settling a dispute. It typically outlines the reasons for the offer, the conditions you expect, and any deadlines for acceptance. By using a Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions, you can ensure that your letter is structured effectively and conveys your intentions clearly.

To write a settlement offer letter, start by addressing the recipient formally and stating the purpose of your letter upfront. Detail the terms of your offer, including any conditions that need to be met to finalize the agreement. It's also wise to include a deadline for acceptance to encourage a timely response. For a comprehensive approach, check out the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions on uslegalforms, which can guide you through the process.

When writing a letter asking for a settlement, begin with a clear introduction stating your intention to resolve the issue amicably. Be specific about the terms you are proposing, and ensure to express your willingness to negotiate. Providing context about the dispute and the reasons for your proposal can strengthen your request. You can find useful examples in the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions on uslegalforms.

To write a settlement agreement template, start by clearly identifying the parties involved and the nature of the dispute. Next, outline the terms of the settlement, including any conditions that both parties must meet. It is also essential to include a clause stating that the agreement is final and binding. For a detailed guide, refer to the Vermont Sample Letter for Settlement Offer - Instructions to Settle with Conditions available on uslegalforms.

Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report. Ask for a written confirmation after settling on an agreement.

Two Options for Taking the Settlement Offer Read the settlement offer carefully or have an attorney review the offer to be sure it's legally binding ? that the creditor or collector can't come after you for the remaining balance at some point in the future. Or, you can even try to negotiate a lower settlement.

How do you make a settlement offer? Firstly you need to work out how much to offer your creditors and then send your offer to them in writing. Always ask your creditors to confirm they accept your offer in writing before you send them any money.