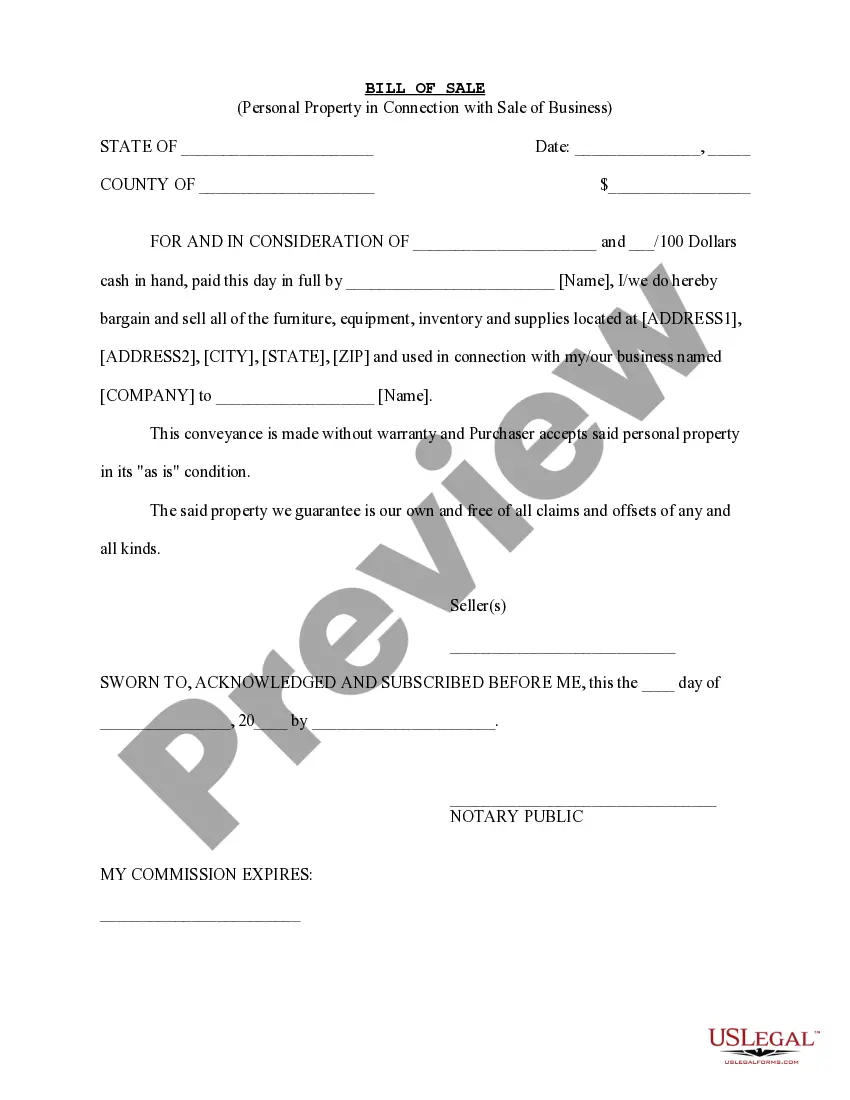

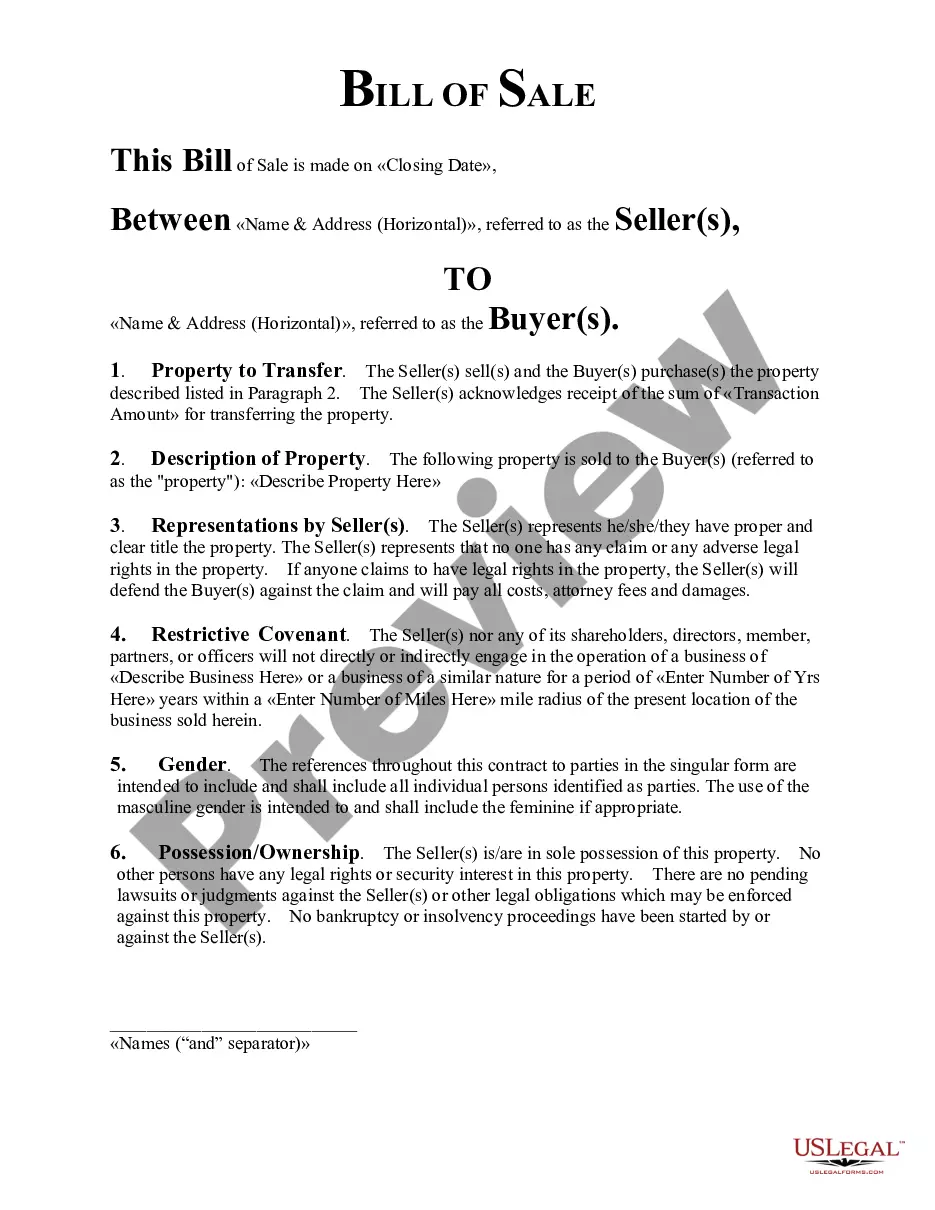

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Vermont Simple Bill of Sale for Personal Property Used in Connection with Business

Description

How to fill out Simple Bill Of Sale For Personal Property Used In Connection With Business?

Locating the appropriate legitimate document template can be a challenge.

Clearly, there are numerous designs accessible online, but how can you find the official form you need.

Utilize the US Legal Forms platform.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have chosen the correct form for your specific city/county. You can preview the form using the Preview option and review the form details to confirm it is suitable for you.

- The service offers a vast array of templates, such as the Vermont Simple Bill of Sale for Personal Property Used in Connection with Business, which you can utilize for both business and personal purposes.

- All documents are verified by professionals and satisfy both state and federal requirements.

- If you are already registered, Log In to your account and click on the Download button to access the Vermont Simple Bill of Sale for Personal Property Used in Connection with Business.

- Leverage your account to view the legal documents you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the form you need.

Form popularity

FAQ

Burlington's business personal property (BPP) tax is budgeted to generate about $1.15 million from about 260 businesses in the current fiscal year, plus an additional $80,000 from entities making payment in lieu of taxes (PILOT) payments.

Every person or entity owning or operating a telephone line or business is subject to a tax equal to 2.37 percent of net book value as of the preceding December 31st of all personal property located in Vermont, used in whole or in part for conducting a telecommunications business.

Personal property sales involve the transfer of personal property from one party to another. This may be done either through an informal oral agreement (like at a garage sale) or through a written contract. Personal property sales involve the sale of moveable items such as: Appliances and furniture.

Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. The sales tax rate is 6%. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

The following items are deemed nontaxable by the IRS:Inheritances, gifts and bequests.Cash rebates on items you purchase from a retailer, manufacturer or dealer.Alimony payments (for divorce decrees finalized after 2018)Child support payments.Most healthcare benefits.Money that is reimbursed from qualifying adoptions.More items...?

Types of Personal Property Personal property is divided into "tangible" and "intangible" forms. Tangible personal property is just that: it has a physical form. It can be seen, touched, and moved. Examples of tangible personal property include clothing, books, and computers.

Personal property can be characterized as either tangible or intangible. Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Stocks, bonds, and bank accounts fall under intangible personal property.

Everything you own, aside from real property, is considered personal property. This includes material goods such as all of your clothing, any jewelry, all of your household goods and furnishings, and anything else that is movable and not permanently attached to a fixed location such as your home.

You have a capital gain if you sell the asset for more than your adjusted basis. You have a capital loss if you sell the asset for less than your adjusted basis. Losses from the sale of personal-use property, such as your home or car, aren't tax deductible.

Business personal property includes:Office supplies: pens, staplers, and calculators.Furniture: chairs, desks, and tables.Furnishings: rugs, blinds, and curtains.Computers: desktops and laptops.Electronics: smartphones and tablets.Heavy equipment: forklifts and excavators.Machinery: 3D printers.More items...