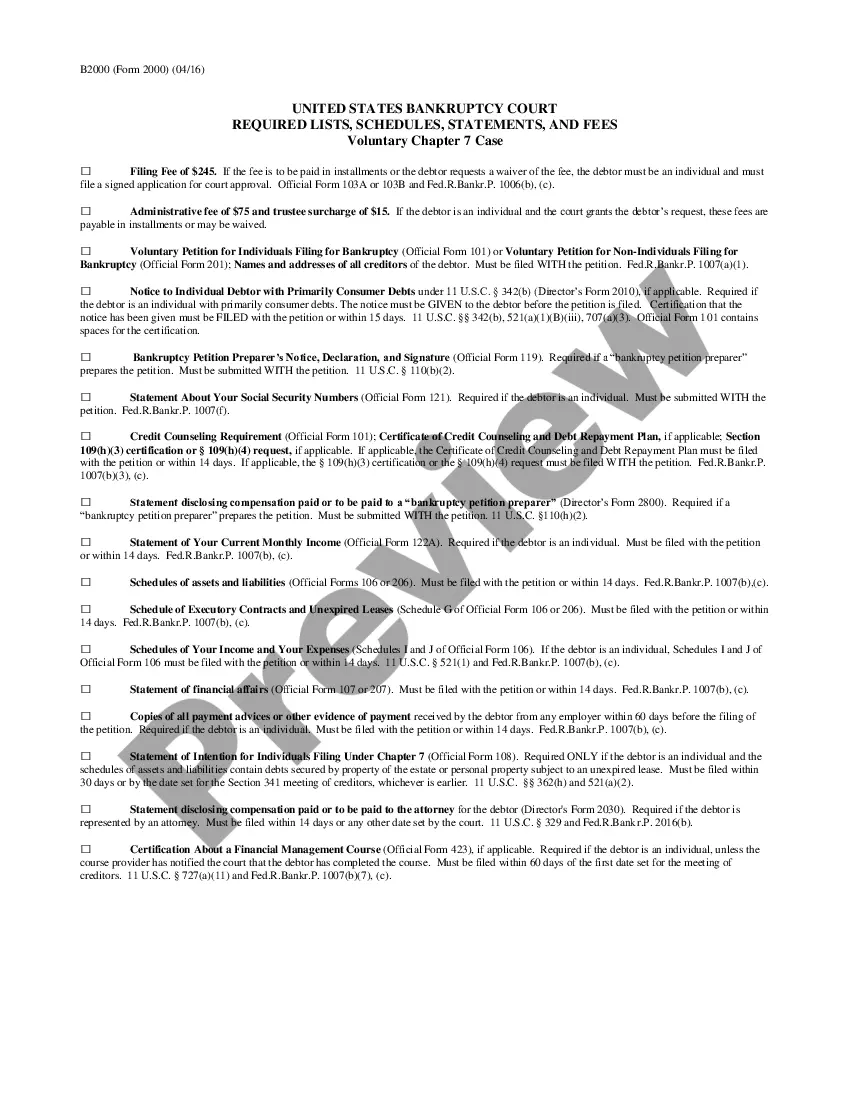

Vermont Required Lists, Schedules, Statements, and Fees refer to the taxes, fees, and other documents that businesses and individuals are legally required to submit to the Vermont Department of Taxes. These documents are used to report income, calculate and pay taxes, and provide information about assets, liabilities, and other financial matters. The most common types of Vermont Required Lists, Schedules, Statements, and Fees are: • Vermont Income Tax Return (VT-100): This form is used to report income, calculate taxes due, and pay taxes to the Vermont Department of Taxes. • Vermont Estimated Income Tax Payment (VT-20ES): This form is used to estimate and pay taxes on income earned in the current year. • Vermont Inheritance and Estate Tax Return (VT-102): This form is used to report and pay inheritance and estate taxes. • Vermont Property Tax Return (VT-103): This form is used to report and pay property taxes. • Vermont Business Tax Return (VT-104): This form is used to report and pay business taxes. • Vermont Sales & Use Tax Return (VT-105): This form is used to report and pay sales and use taxes. • Vermont Withholding Tax Return (VT-106): This form is used to report and pay withholding taxes. • Vermont Estate Tax Return (VT-107): This form is used to report and pay estate taxes. • Vermont Unclaimed Property Report (VT-108): This form is used to report and pay unclaimed property taxes. • Vermont Real Estate Transfer Tax Return (VT-109): This form is used to report and pay real estate transfer taxes. • Vermont Business Personal Property Tax Return (VT-110): This form is used to report and pay business personal property taxes. • Vermont Fiduciary Income Tax Return (VT-111): This form is used to report and pay fiduciary income taxes.

Vermont Required Lists, Schedules, Statements, and Fees

Description

How to fill out Vermont Required Lists, Schedules, Statements, And Fees?

If you’re searching for a way to properly prepare the Vermont Required Lists, Schedules, Statements, and Fees without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of paperwork you find on our online service is created in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to get the ready-to-use Vermont Required Lists, Schedules, Statements, and Fees:

- Ensure the document you see on the page complies with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and select your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Vermont Required Lists, Schedules, Statements, and Fees and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Vermont State 1099 and WHT-434 Filing Requirements The State of Vermont mandates the filing of 1099 forms, including 1099-NEC, 1099-MISC, 1099-INT, 1099-DIV, 1099-B, 1099-G, 1099-K, and 1099-OID. The State of Vermont also mandates the filing of Form WHT-434, Annual Withholding Reconciliation.

The 2022 Vermont Livable Wage is $15.33 per hour. 1 The Livable Wage is different from the wage for a single person because it accounts for the economies achieved by multiple-person households. This figure does not, however, include all potential household expenses because it is for families without children.

You earned or received more than $100 in Vermont income, or. you earned or received gross income of more than $1,000 as a nonresident.

Nonresidents with a filing requirement will file Form IN-111, Vermont Income Tax Return and Schedule IN-113, Income Adjustment Calculations.

How does Vermont's tax code compare? Vermont has a graduated individual income tax, with rates ranging from 3.35 percent to 8.75 percent. Vermont also has a graduated corporate income tax, with rates ranging from 6.00 percent to 8.5 percent.

On Form 1040-X, enter your income, deductions, and credits from your return as originally filed or as previously adjusted by either you or the IRS, the changes you are making, and the corrected amounts. Then, figure the tax on the corrected amount of taxable income and the amount you owe or your refund.

You qualify as a Vermont resident for that part of the taxable year during which: You are domiciled in Vermont, or. You maintain a permanent home in Vermont, and you are present in Vermont for more than 183 days of the taxable year.