This pamphlet provides an overview on the dissolution of a limited liability company (LLC). Topics included cover the reasons for dissolution, different types of dissolution, and steps needed to dissolve an LLC.

Virgin Islands USLegal Pamphlet on Dissolving an LLC

Description

How to fill out USLegal Pamphlet On Dissolving An LLC?

Are you presently in a position where you need documents for either organization or specific objectives almost daily.

There are numerous legal document formats available online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of document templates, such as the Virgin Islands USLegal Pamphlet on Dissolving an LLC, that are published to meet federal and state requirements.

Select the pricing plan you prefer, complete the required information to create your account, and make a payment using your PayPal or credit card.

Choose a convenient file format and download your copy. Retrieve all the document templates you have purchased in the My documents list. You can download an additional copy of Virgin Islands USLegal Pamphlet on Dissolving an LLC whenever necessary. Click on the desired document to download or print the file template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Virgin Islands USLegal Pamphlet on Dissolving an LLC template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/county.

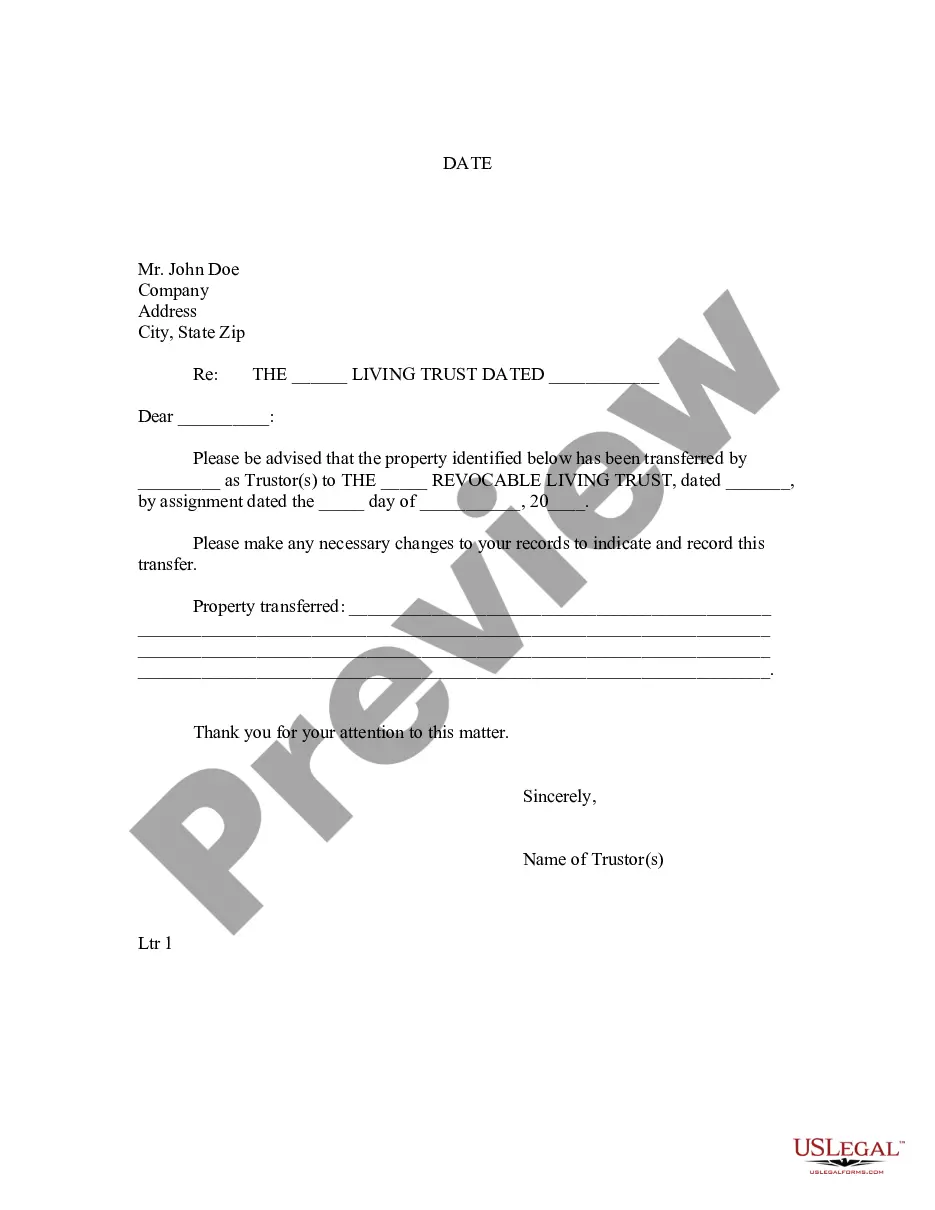

- Use the Preview button to view the form.

- Check the description to confirm that you have selected the right form.

- If the document is not what you are looking for, utilize the Search field to find the form that fits your needs and requirements.

- Once you find the right document, click on Buy now.

Form popularity

FAQ

To close your LLC in Virginia, you must first hold a meeting to discuss the dissolution with the members, then file Articles of Dissolution with the Virginia State Corporation Commission. It is also important to settle any outstanding debts and notify relevant parties about the closure. For more detailed steps on dissolving an LLC, including similar processes in other regions, consult the Virgin Islands USLegal Pamphlet on Dissolving an LLC to ensure you follow all necessary legal steps.

Yes, U.S. law applies in the U.S. Virgin Islands, but there are some local laws and regulations that may differ. Residents and businesses in the islands must adhere to both federal laws and local statutes. Understanding these nuances is crucial for compliance. For comprehensive insights, the Virgin Islands USLegal Pamphlet on Dissolving an LLC can serve as a valuable resource.

To create an LLC in the U.S. Virgin Islands, begin by choosing a unique name for your business that complies with local regulations. Next, file the Articles of Organization with the Virgin Islands Department of Licensing and Consumer Affairs. You should also obtain any necessary permits and licenses relevant to your business activities. For detailed guidance, refer to the Virgin Islands USLegal Pamphlet on Dissolving an LLC, which provides essential information to ensure a smooth process.

Dissolving an LLC can have tax consequences that you need to be aware of, as described in the Virgin Islands USLegal Pamphlet on Dissolving an LLC. Depending on your situation, you may face tax liabilities on any remaining assets or gains. It is advisable to consult with a tax professional to understand your specific obligations and ensure compliance.

Absolutely, notifying the IRS is a critical step when you dissolve your LLC, as detailed in the Virgin Islands USLegal Pamphlet on Dissolving an LLC. You must file your final tax return and indicate that it is the last one for your business. This ensures that your tax obligations are properly managed and reduces future complications.

Yes, it is essential to inform the IRS that your business has closed, as indicated in the Virgin Islands USLegal Pamphlet on Dissolving an LLC. You should mark your final tax return as 'final' and provide the necessary information regarding your LLC's closure. This helps avoid any confusion or issues with your tax records.

After dissolving your LLC, you should take several important steps as highlighted in the Virgin Islands USLegal Pamphlet on Dissolving an LLC. First, ensure you notify the IRS and state tax authorities about the closure. Additionally, complete any final tax returns and address any outstanding obligations to maintain compliance.

To officially close your LLC, you need to follow the specific steps outlined in the Virgin Islands USLegal Pamphlet on Dissolving an LLC. Start by filing the Articles of Dissolution with the appropriate state office. After that, settle all debts, distribute any remaining assets, and notify any relevant parties about the closure.