Virgin Islands Form - Stock Purchase Agreement Providing for Strategic Investment in a Public Company

Description

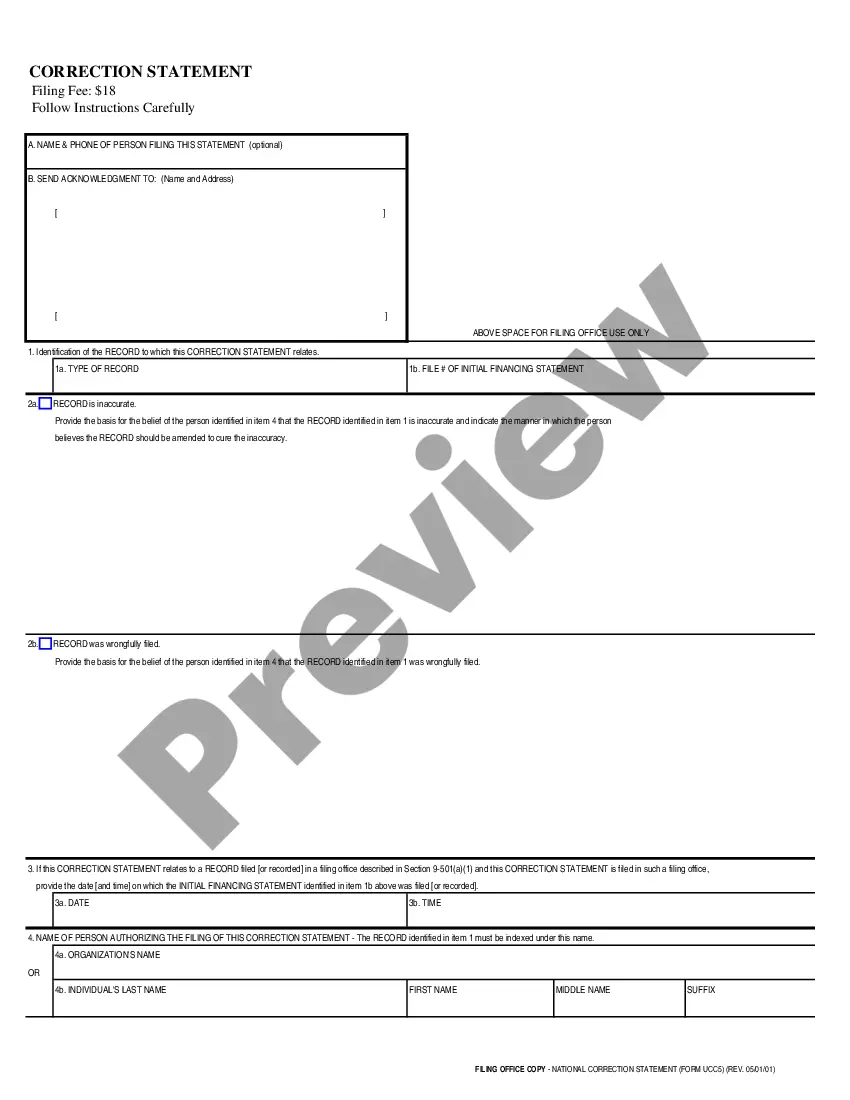

How to fill out Form - Stock Purchase Agreement Providing For Strategic Investment In A Public Company?

If you want to complete, acquire, or produce legal record templates, use US Legal Forms, the greatest collection of legal forms, that can be found on the web. Make use of the site`s simple and easy practical research to find the papers you need. A variety of templates for company and personal uses are categorized by classes and says, or keywords. Use US Legal Forms to find the Virgin Islands Form - Stock Purchase Agreement Providing for Strategic Investment in a Public Company within a handful of clicks.

If you are already a US Legal Forms client, log in to your account and click on the Obtain option to find the Virgin Islands Form - Stock Purchase Agreement Providing for Strategic Investment in a Public Company. You can also access forms you formerly downloaded within the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape for your right area/land.

- Step 2. Use the Preview method to check out the form`s content. Never forget about to learn the explanation.

- Step 3. If you are unsatisfied with the form, utilize the Research field towards the top of the display to discover other versions of your legal form format.

- Step 4. After you have located the shape you need, click on the Acquire now option. Choose the rates strategy you choose and add your credentials to register on an account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Select the formatting of your legal form and acquire it on your device.

- Step 7. Total, modify and produce or indicator the Virgin Islands Form - Stock Purchase Agreement Providing for Strategic Investment in a Public Company.

Every legal record format you purchase is the one you have forever. You may have acces to each form you downloaded with your acccount. Go through the My Forms portion and pick a form to produce or acquire again.

Remain competitive and acquire, and produce the Virgin Islands Form - Stock Purchase Agreement Providing for Strategic Investment in a Public Company with US Legal Forms. There are millions of expert and state-distinct forms you can utilize for your personal company or personal requirements.

Form popularity

FAQ

In order to have a valid contract the law requires that there be an offer made, an acceptance and consideration for the contract. In a real estate transaction, the offer is made by the Buyer when wanting to purchase the property at a set price.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

Financial regulations state that, for any stock transaction, both parties must give written consent. If you're preparing to sell stocks in your company, you'll want to have a stock purchase agreement template readily available that you can easily modify to reflect the terms of the sale and the buyer's information.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

The purpose of an asset purchase agreement It lets your business get exactly the assets it wants without purchasing anything it does not. It also helps a business limit the potential liabilities it could face. For example, asset purchase agreements are commonly used to purchase: Intellectual property.

By Practical Law Corporate & Securities. A long-form agreement for the purchase and sale of preferred stock securities to be used in connection with a private equity transaction, such as a growth equity investment in a private corporation.

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount.