Virgin Islands Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout

Description

How to fill out Assignment Of Overriding Royalty Interest Partially Convertible To A Working Interest At Payout?

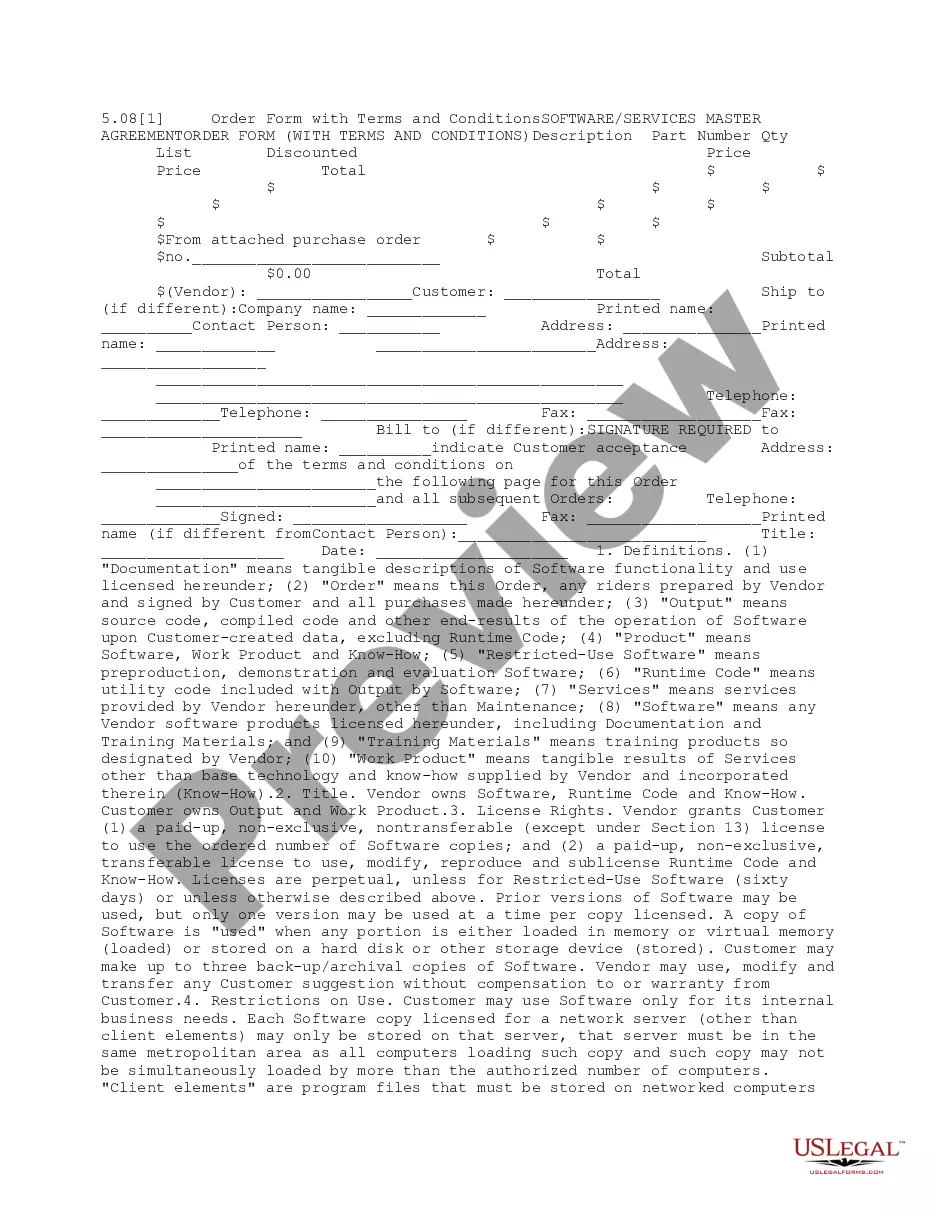

If you want to full, download, or print out legitimate file templates, use US Legal Forms, the biggest assortment of legitimate forms, which can be found on the Internet. Take advantage of the site`s basic and convenient research to obtain the files you want. Different templates for organization and individual functions are sorted by classes and claims, or keywords. Use US Legal Forms to obtain the Virgin Islands Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout with a handful of click throughs.

In case you are currently a US Legal Forms consumer, log in in your bank account and then click the Download button to obtain the Virgin Islands Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout. You can even accessibility forms you earlier saved from the My Forms tab of your respective bank account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

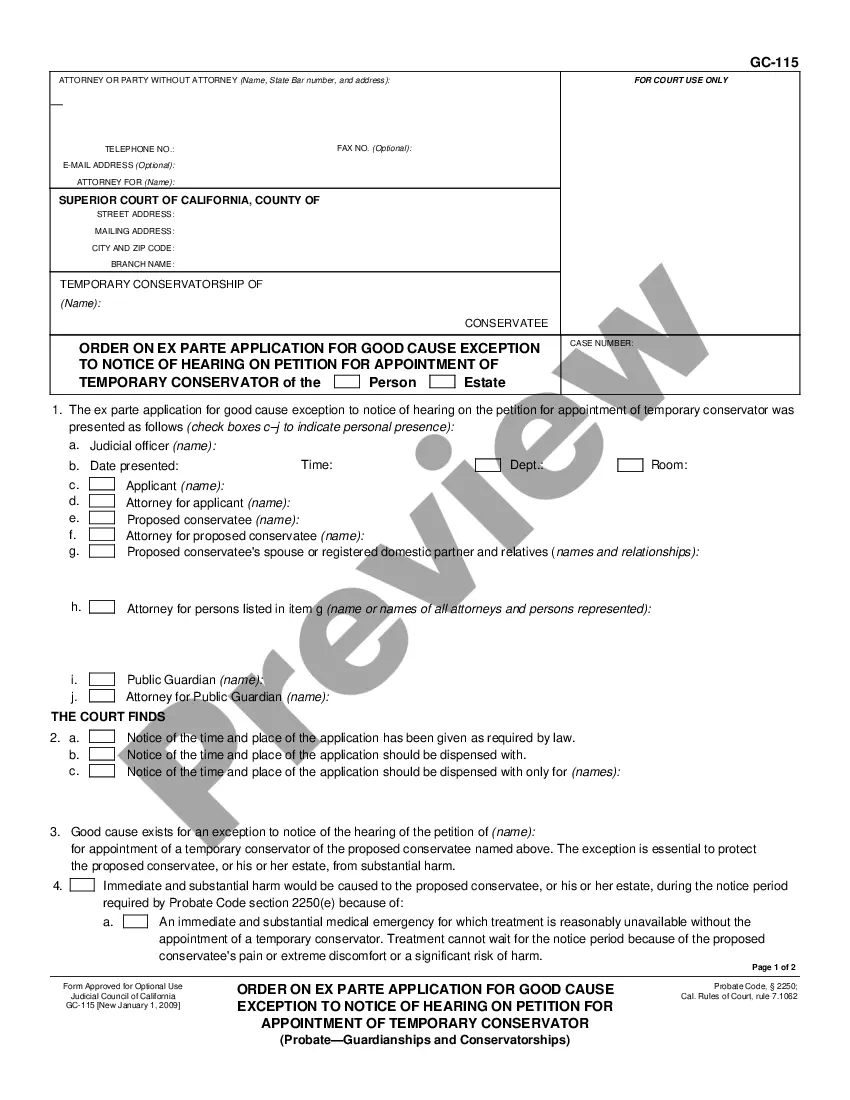

- Step 1. Make sure you have selected the shape for that appropriate area/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s content material. Do not forget to learn the information.

- Step 3. In case you are not happy together with the kind, take advantage of the Look for discipline towards the top of the screen to locate other types of the legitimate kind format.

- Step 4. Upon having located the shape you want, click on the Buy now button. Pick the prices prepare you choose and add your qualifications to sign up for the bank account.

- Step 5. Process the deal. You can utilize your bank card or PayPal bank account to complete the deal.

- Step 6. Pick the formatting of the legitimate kind and download it on your gadget.

- Step 7. Full, revise and print out or indicator the Virgin Islands Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout.

Each and every legitimate file format you purchase is your own permanently. You have acces to every single kind you saved within your acccount. Click the My Forms portion and decide on a kind to print out or download once more.

Remain competitive and download, and print out the Virgin Islands Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout with US Legal Forms. There are thousands of expert and state-specific forms you may use for the organization or individual requirements.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding Royalty Interest Example The mineral estate can be severed from the surface, beginning two separate chains of title. The mineral owner has the right to explore and develop the minerals, but the vast majority do not have the finances or knowledge to drill and operate a well.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Working Interest (WI) Value ? Since the overriding royalty interest (ORRI) is a portion of the working interest, the WI value is the major determinant of the value of overriding mineral rights. The WI owner incurs all of the costs associated with exploration and development activity.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.