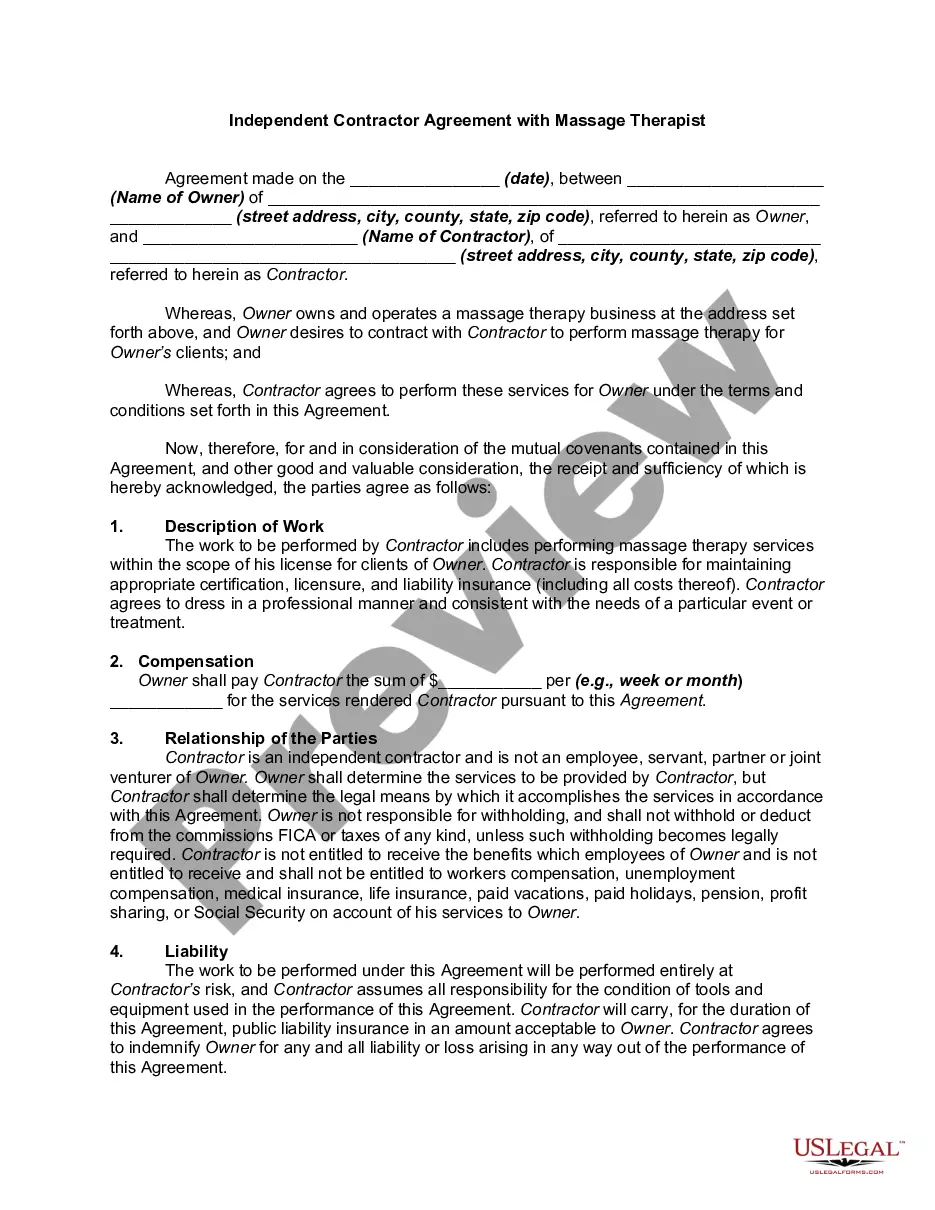

Virgin Islands Self-Employed Masseuse Services Contract

Description

How to fill out Self-Employed Masseuse Services Contract?

If you need to compile, obtain, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and convenient search function to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Virgin Islands Self-Employed Masseuse Services Contract in just a few clicks.

If you are already a US Legal Forms member, Log In to your account and click the Download button to retrieve the Virgin Islands Self-Employed Masseuse Services Contract. You can also access forms you previously saved from the My documents section of your account.

Every legal document template you download is yours forever. You have access to every form you saved in your account. Go to the My documents section and select a form to print or download again.

Be proactive and download, and print the Virgin Islands Self-Employed Masseuse Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Step 1. Verify that you have selected the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are unhappy with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your details to register for an account.

- Step 5. Complete the payment process. You can utilize your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Virgin Islands Self-Employed Masseuse Services Contract.

Form popularity

FAQ

A bona fide resident of the Virgin Islands is an individual who meets certain conditions regarding their residence and presence in the territory. To qualify, one must reside in the Virgin Islands for at least 183 days during the tax year. This status can affect your tax obligations, particularly if you are operating under a Virgin Islands Self-Employed Masseuse Services Contract. Being classified as a bona fide resident might offer certain tax benefits, making it essential to understand how residency rules apply to your situation.

Filing taxes in the Virgin Islands involves several steps, and it’s important to stay organized. First, you must gather all relevant documents, including income reports and expenses related to your Virgin Islands Self-Employed Masseuse Services Contract. You can file your taxes electronically or by mail, but consider using tax software designed for local filings to simplify the process. Consulting a local tax advisor can also help ensure accuracy and compliance.

In the US Virgin Islands, business taxes include income tax, gross receipts tax, and property tax. Understanding these taxes is crucial for anyone offering services, including those who operate under a Virgin Islands Self-Employed Masseuse Services Contract. The income tax rate varies, typically affecting self-employed individuals and small businesses. It's wise to consult with a tax professional to ensure compliance with local laws.

Massage therapy is regulated in five Canadian provinces: BC, Ontario, Newfoundland & Labrador, New Brunswick, and Prince Edward Island (PEI).

Yes, masseuses need insurance to protect them against situations such as accidental injury to clients or other third parties or damage to their property (public liability insurance) or injury to a client as a result of advice or a treatment (treatment liability insurance/professional liability).

How Much to Tip for a Private Massage. Since tips are standard protocol for massage therapists, you should assume a 20 percent tip in any massage or spa treatment situation (unless a self-employed therapist specifically tells you their rate is all-inclusive).

In late 2019, Nova Scotia announced the Act to Protect the Titles of Massage Therapists. The Act limits the use of "Massage Therapist," "Registered Massage Therapist," and similar titles to only people qualified to work as massage therapists under the rules set by the government.

On January 1, 2020, the Massage Therapist Titles Protection Act came into force in Nova Scotia. Please see the Federation of Massage Therapy Regulatory Authorities of Canada (FOMTRAC)'s news release for additional information.

You should tip the standard hospitality rate of 20%. Self-employed massage therapists who travel to your home generally charge enough to cover the cost of travel. So there's no pressure to tip more than the usual amount.

Do You Tip a Massage Therapist? Although a tip is never required, if your massage is at a spa or hotel in North America, a 20 percent tip is standard if you were pleased with the service. (The exception is all-inclusive spas that have a no-tip policy.)