Virgin Islands Self-Employed Animal Exercise Services Contract

Description

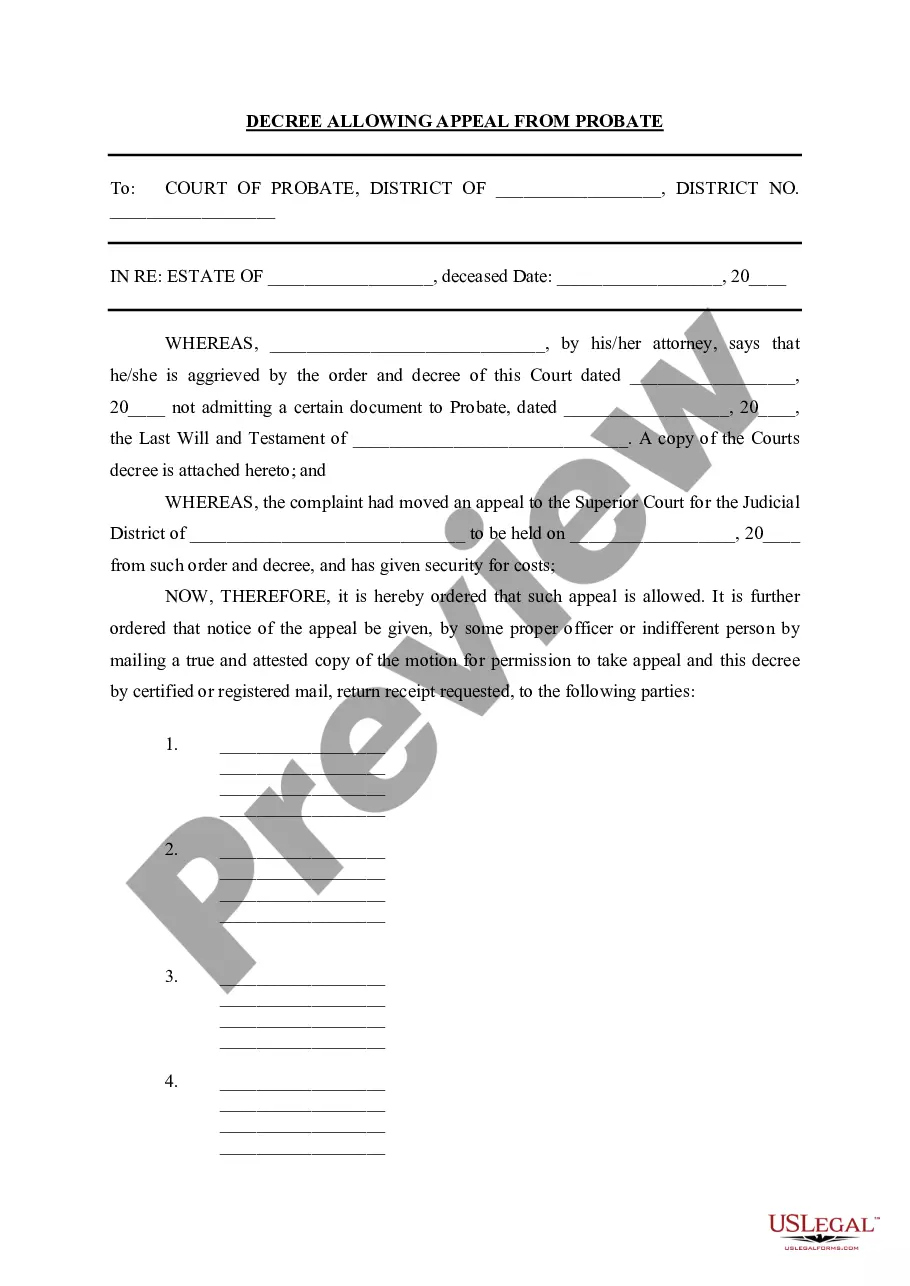

How to fill out Self-Employed Animal Exercise Services Contract?

If you want to total, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's easy and convenient search to find the documents you need. A variety of templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to acquire the Virgin Islands Self-Employed Animal Exercise Services Contract in just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Download button to locate the Virgin Islands Self-Employed Animal Exercise Services Contract. You can also access forms you previously saved from the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Remember to read through the summary. Step 3. If you are unsatisfied with the form, utilize the Search bar at the top of the screen to find other types in the legal form template. Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your information to sign up for the account. Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Virgin Islands Self-Employed Animal Exercise Services Contract.

Ensure you have the correct legal documents for your needs with US Legal Forms.

Simplify your legal form acquisition process with a few simple steps.

- Every legal document template you obtain is yours forever.

- You have access to every form you saved in your account.

- Visit the My documents section and choose a form to print or download again.

- Acquire and download, and print the Virgin Islands Self-Employed Animal Exercise Services Contract with US Legal Forms.

- There are numerous professional and state-specific forms you can use for your business or personal requirements.

- Utilize the platform to fulfill your legal documentation needs.

- Take advantage of the comprehensive selection of forms available.

Form popularity

FAQ

The ESA, or Employment Standards Act, typically addresses employee rights and benefits, but does not extend coverage to independent contractors. If you operate under a Virgin Islands Self-Employed Animal Exercise Services Contract, you are generally considered an independent contractor. This means you manage your own business and are not entitled to the same protections as employees under the ESA. To ensure you understand your rights and obligations, consider using resources from uslegalforms, which can provide clarity on contracts and legal requirements.

Yes, you need a business license to operate legally in the Virgin Islands. This requirement applies to various business types, including those offering services specified in the Virgin Islands Self-Employed Animal Exercise Services Contract. Acquiring your license helps you avoid potential fines and legal issues. To simplify the process, consider using US Legal Forms for your licensing needs.

Yes, Americans can work in the British Virgin Islands, but they must obtain the appropriate work permits. This process may vary based on the job type and duration of stay. If you are considering offering services detailed in the Virgin Islands Self-Employed Animal Exercise Services Contract, ensure you meet all the legal requirements. Consulting resources like US Legal Forms can provide guidance on the necessary paperwork.

While you may begin planning your small business in the Virgin Islands without a license, you cannot legally operate without one. This applies to businesses offering services, such as those covered by the Virgin Islands Self-Employed Animal Exercise Services Contract. Therefore, it’s critical to secure your business license before engaging with clients. US Legal Forms can assist you with the necessary documentation.

A business license is generally required once you start operating your business in the Virgin Islands. This includes offering services such as those outlined in the Virgin Islands Self-Employed Animal Exercise Services Contract. It’s essential to check with local authorities to understand the specific requirements for your business type. Obtaining the right license ensures compliance and builds trust with your clients.

To open a business in the Virgin Islands, start by choosing a business structure that suits your needs. Next, register your business name and obtain the necessary permits. Additionally, consider drafting a Virgin Islands Self-Employed Animal Exercise Services Contract to outline your services and protect your interests. Platforms like US Legal Forms can provide templates to help streamline this process.

Self-Employment income means all self-employment income, including income earned from a home-based business. All net self-employment income is deducted dollar for dollar from program benefits, and is coded as 4303 Self-Employment.

You usually must pay self-employment tax if you had net earnings from self-employment of $400 or more. Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment.

The 10% rate applies to income from $1 to $10,000; the 20% rate applies to income from $10,001 to $20,000; and the 30% rate applies to all income above $20,000. Under this system, someone earning $10,000 is taxed at 10%, paying a total of $1,000. Someone earning $5,000 pays $500, and so on.

Net self-employment income is the gross income from a trade or business less allowable deductions for that trade or business. Allowable deductions are any deductions that are allowed by the Internal Revenue Service, including depreciation. Net self-employment income also includes any profit or loss in a partnership.