Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Technical Writer Agreement - Self-Employed Independent Contractor?

US Legal Forms - among the largest collections of legal documents in the United States - offers a variety of legal form templates you can download or print.

By using the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can discover the latest versions of forms like the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor in moments.

If you already possess a membership, Log In and download the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear for every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor. Each template you save in your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you require. Access the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Check the form description to confirm you've chosen the right one.

- If the form doesn’t meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, choose your preferred payment plan and provide your details to register for the account.

Form popularity

FAQ

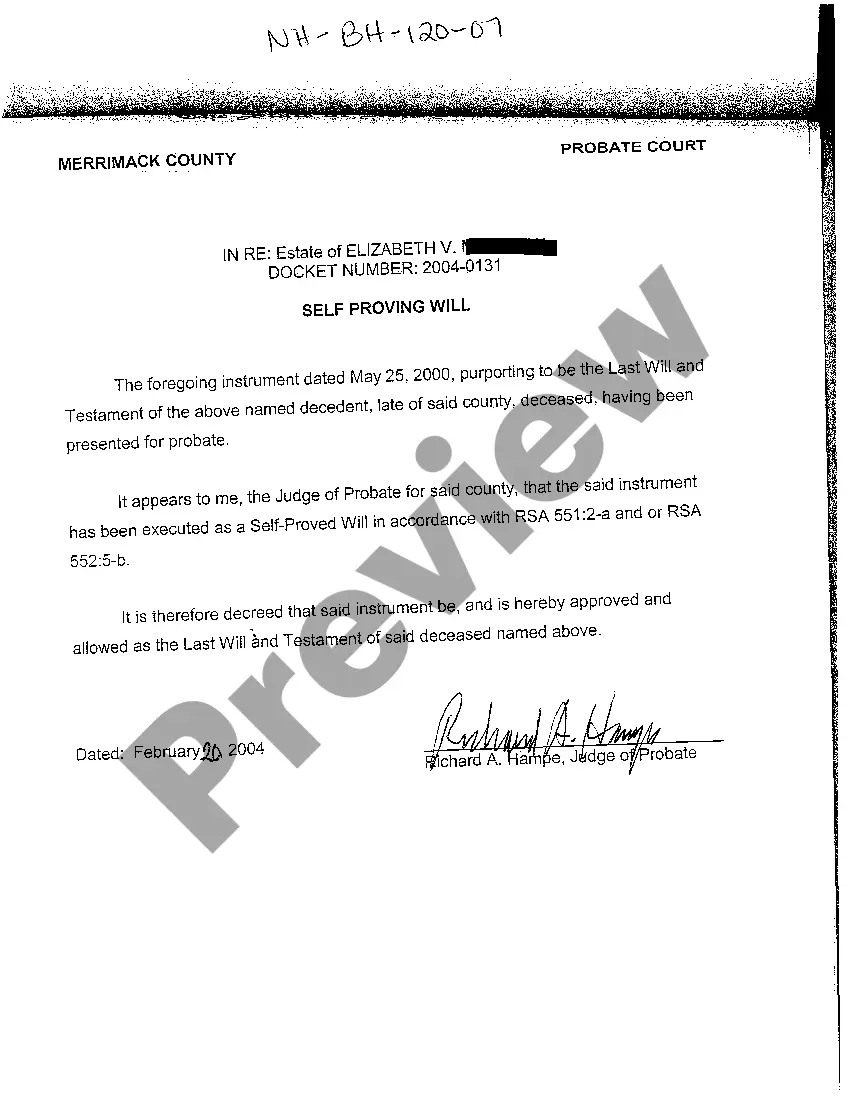

To write an independent contractor agreement, start by outlining the purpose of the agreement and identifying the parties involved. Clearly define the scope of work, compensation details, and how and when payments will be made. Remember to incorporate essential elements from the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor to ensure compliance and clarity between both parties involved.

An independent contractor typically needs to complete a W-9 form for tax purposes, along with an independent contractor agreement. Depending on the nature of the work, other forms such as invoices or specific project-related documentation may be necessary. Utilizing the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor can simplify this process, leading to more organized and compliant record-keeping.

When filling out an independent contractor agreement, start by clearly stating the involved parties and the scope of work. Include payment terms, deadlines, and any specific obligations that both parties must fulfill. It is crucial to reference the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor to align with local regulations and ensure both parties understand their rights and responsibilities.

To fill out an independent contractor form, first, gather your personal information such as your name, address, and Social Security number. Next, provide the details of your work, including the services you offer and your payment terms. Finally, ensure you review the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor for any specific clauses relevant to your situation, and then submit the form as instructed.

Writing an independent contractor agreement involves several straightforward steps. Begin by identifying the parties involved, outlining the scope of work, and detailing the compensation structure. Additionally, you'll want to include terms related to confidentiality and termination rights. For ease and clarity, consider using the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor provided by uslegalforms, which can help you create a comprehensive, legally sound document.

Whether freelance writers should form an LLC depends on their specific situation. An LLC, or Limited Liability Company, can provide personal liability protection and may offer tax benefits. However, many freelance writers start without an LLC, using the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor as their guiding framework. It's essential to weigh the benefits against the costs and complexities of maintaining a business entity.

Freelance work and independent contracting share similarities, but they are not the same. A freelancer usually operates as a self-employed individual taking on various short-term projects. In contrast, an independent contractor, such as someone using the Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor, might engage in more formal contracts with clients or companies for specific services over a more extended period. Understanding these differences is crucial for legal and tax considerations.

The $600 rule for 1099 states that payment of $600 or more to a non-employee during a tax year requires the payer to issue a 1099 form. This regulation applies to independent contractors and freelancers, making it essential to keep track of payments received. If you have a Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor, it can help you manage payments and document your earnings properly. Understanding this rule is crucial for maintaining good financial practices.

The terms self-employed and independent contractor can be used interchangeably, but they may carry different implications for your work arrangement. Self-employed often feels broader, encompassing anyone running their own business, while independent contractor specifies a type of contractual work. By utilizing a Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor, you clarify your position in professional interactions. Choose the term that best fits your business model and services.

Yes, independent contractors must file as self-employed individuals. They typically use Schedule C to report their income and expenses on their tax return. Utilizing a Virgin Islands Technical Writer Agreement - Self-Employed Independent Contractor streamlines this process, outlining your obligations and helping you maintain accurate records. Knowing how to file correctly can lead to beneficial tax outcomes.