Virgin Islands Masonry Services Contract - Self-Employed

Description

How to fill out Masonry Services Contract - Self-Employed?

Are you currently in a location where you require documentation for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Virgin Islands Masonry Services Contract - Self-Employed, which can be tailored to satisfy state and federal regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased from the My documents section. You can obtain another copy of the Virgin Islands Masonry Services Contract - Self-Employed anytime, if necessary. Just click on the needed form to download or print the document template. Use US Legal Forms, the most extensive selection of legal forms, to save time and avoid mistakes. The service provides expertly crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Masonry Services Contract - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

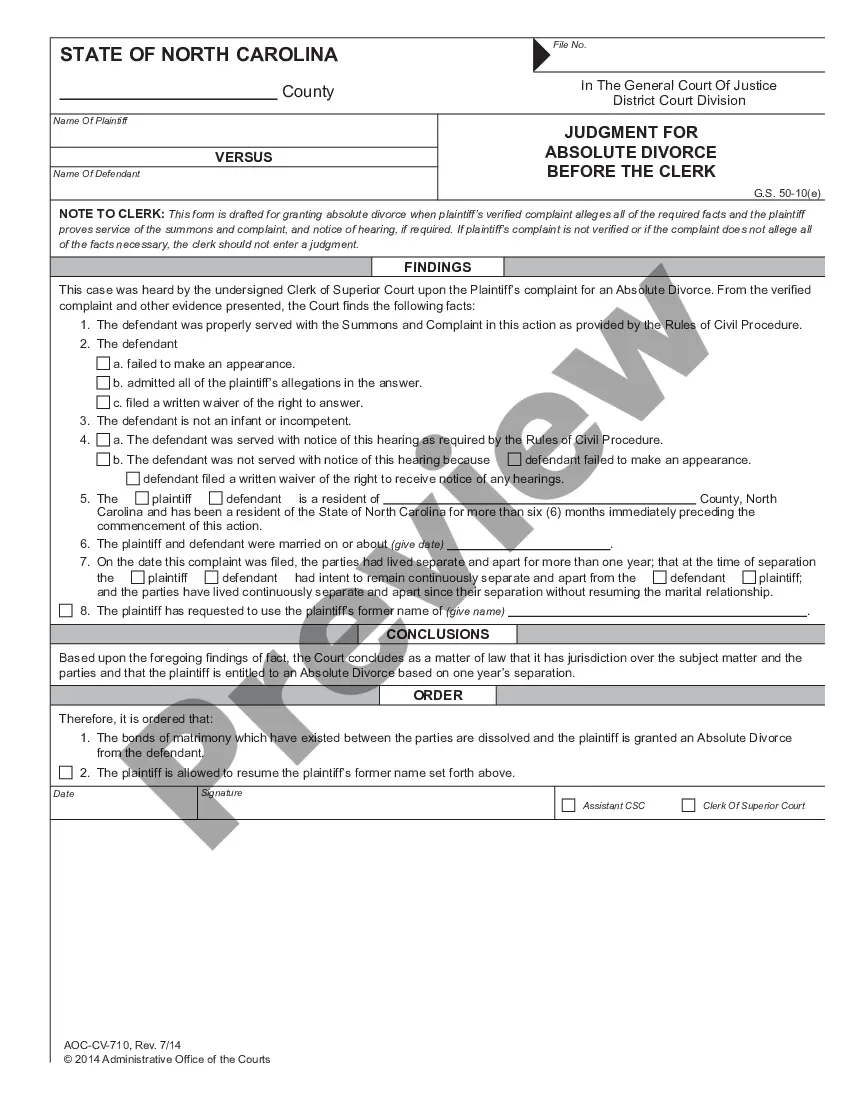

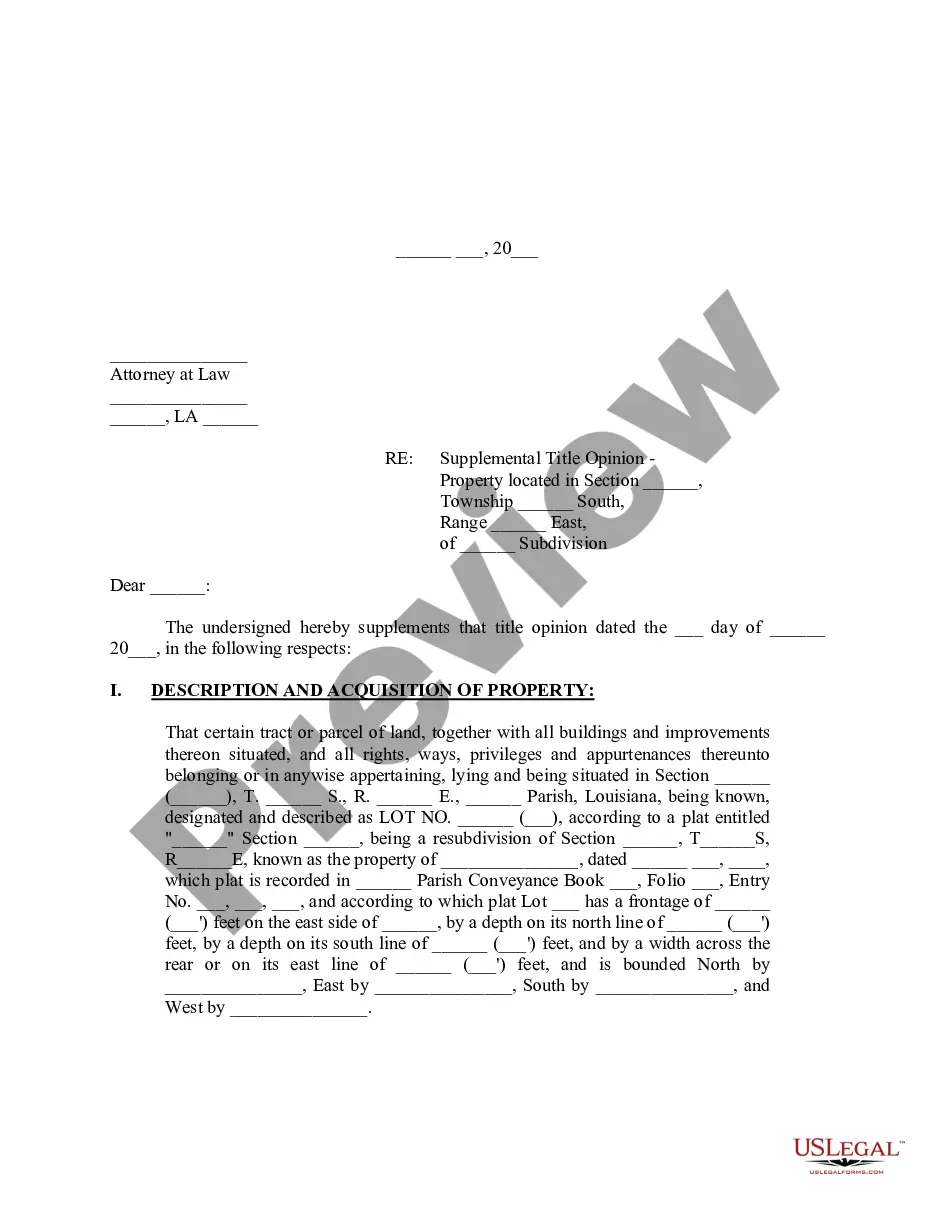

- Utilize the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs.

- Once you locate the correct form, click Buy now.

- Choose your preferred pricing plan, complete the required information to create your account, and purchase using your PayPal or credit card.

Form popularity

FAQ

Yes, the U.S. Virgin Islands has its own tax structure, which includes income tax that applies to residents and self-employed individuals. If you are operating under a Virgin Islands Masonry Services Contract - Self-Employed, it's essential to familiarize yourself with these tax obligations. While the rates can differ from those in the mainland U.S., it is crucial to comply with local guidelines to avoid penalties. For assistance with tax forms and compliance, you may consider using platforms like uslegalforms to streamline the process.

A licensed general contractor is a professional who is authorized to oversee construction projects and ensure compliance with building codes. In the context of a Virgin Islands Masonry Services Contract - Self-Employed, hiring a licensed general contractor is crucial for ensuring quality and safety. They can facilitate project management, coordinate various trades, and ultimately help bring your vision to life.

To start an LLC in the Virgin Islands, begin by drafting an operating agreement that outlines the structure of your business. Next, file your articles of organization and ensure compliance with state requirements. By establishing your LLC properly, you can effectively manage your Virgin Islands Masonry Services Contract - Self-Employed and enjoy the advantages of limited liability.

The U.S. Virgin Islands offers several tax incentives, making it attractive for businesses, particularly those considering a Virgin Islands Masonry Services Contract - Self-Employed. Individuals and companies can benefit from lower corporate taxes and various exemptions. However, it is essential to comply with local laws and regulations to take full advantage of these benefits.

Cost plus fixed fee contract In cost plus fixed fee, the owner pays the contractor an agreed amount over and above the documented cost of work. This is a negotiated type of contract where actual and direct costs are paid for and additional fee is given for overhead and profit is normally negotiated among parties.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Whilst a contractor usually belongs to an outside organisation or is self-employed, an employee with a fixed-term contract is hired by an organisation and has all the same rights and benefits as permanent employees, they're just only employed for a specific period of time.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.